- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label H.R.A.Exemption CalculatorShow All

Download Auto Calculate Income Tax for the Govt and Non-Govt Employees for the F.Y 2020-21 and A.Y 2021-22 As per New Tax Section 115BAC ( New & Old Tax Regime)

mtaxsftware.net

09:50:00

The Finance Minister mentioned in his 2020 budget speech that he had simplified the income tax stru…

HRA increased from 24,000 to 60,000 under section 80GG, With Automated All in One Excel Based Software for Govt and Private Employees for F.Y.2016-17

mtaxsftware.net

17:24:00

What is HRA? What is House Rent Allowance? House Rent Allowance or HRA is given by the employer to the …

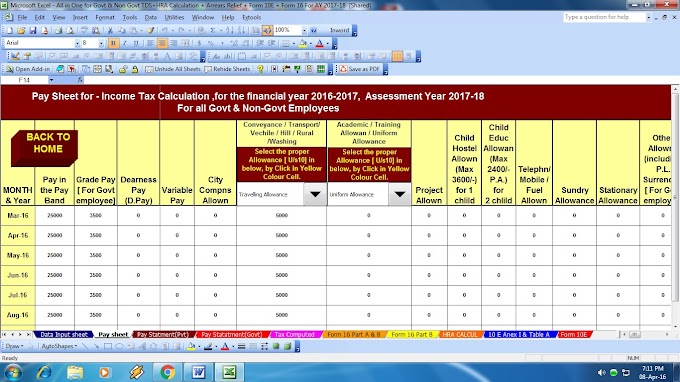

Income Tax F.Y.2016-17 – What are all the changes affecting Salaried Employees ? Plus Automated All in One TDS on Salary for Govt & Non-Govt Employees for the F.Y.2016-17

mtaxsftware.net

21:04:00

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.20…

Prepare at a time Tax Compute Sheet + Automatic H.R.A. Exemption Calculation + Automated Arrears Relief Calculation with Form 10E + Automated Form 16 Part A and B and Part B for F.Y.2016-17

mtaxsftware.net

18:56:00

The Finance Budget 2016 has to introduce or extend the Tax Deduction limits Under few Sections of the I…

All in One TDS on Salary for Govt and Non-Govt employees for F.Y.2016-17, With home loan Tax benefits – Section 24, 80EE and 80C as per Budget 2016

mtaxsftware.net

18:47:00

Download All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 & AssessmentYear 20…

Income Tax Deduction Allowances U/s 10 as per Finance Budget 2016, With Automated All in One TDS on Salary for Govt and Non-Govt employees for F.Y.2016-17

mtaxsftware.net

18:14:00

Download Automated All in One TDS On Salary for Govt and Non-Govt employees for F.Y.2016-17 & Assessmen…