- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label U/s 87AShow All

Automated Income Tax Software All in One for Govt & Non-Govt Employees for the F.Y. 2019-20

mtaxsftware.net

07:32:00

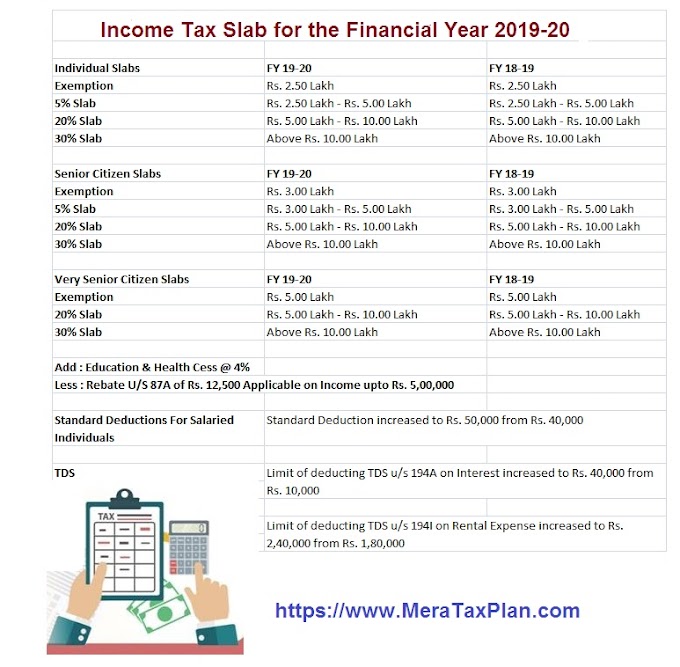

Section 87A provides an income tax rebate to a resident individual having prescribed income. This rebate …

Free Download Automated Income Tax Preparation Excel Based Software All in One for Government and Non-Goverrnment Employees for the F.Y. 2019-20, With Tax Rebate Rs. 12,500 U/s 87A for F.Y.2019-20

mtaxsftware.net

06:38:00

Section 87A provides an income tax rebate to a resident individual having prescribed income. This rebate …

Raised Income Tax Standard Deduction up to Rs. 50,000/- for the F.Y. 2019-20 in the Budget 2019,With Autamated Income Tax Form 16 for F.Y. 2019-20

mtaxsftware.net

07:45:00

In the Interim Budget presented on 1st February 2019, the Indian government has announced changes in the i…

Download Automated All in One TDS on Salary Non-Govt. Employees for the Financial Year 2019-2020 and Assessment Year 20120-2021.

mtaxsftware.net

07:02:00

As per the Finance Budget 2019, some Important Income Tax Section and Income Tax Rebate has changed. Th…

Who are not get HRA Allowances they can get House Rent Exemption U/s 80GG,with Automatic HRA Exemption Calculator

mtaxsftware.net

18:40:00

Download Automatic House Rent Exemption Calculator Under Section 80GG, an Individual can claim the de…

Under Section 80GG, an Individual can claim deduction for the rent paid even if he does not get House Rent Allowances. Not many people are aware of this deduction.

mtaxsftware.net

18:27:00

Section 80GG allows the Individuals to a deduction in respect of house rent paid by him for his own residen…

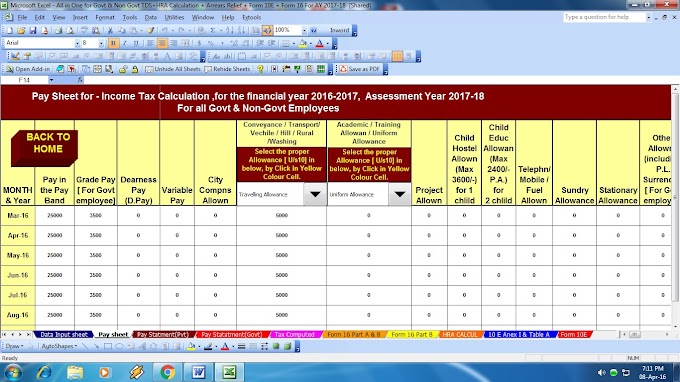

Income Tax F.Y.2016-17 – What are all the changes affecting Salaried Employees ? Plus Automated All in One TDS on Salary for Govt & Non-Govt Employees for the F.Y.2016-17

mtaxsftware.net

21:04:00

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.20…

All in One TDS on Salary for Non-Govt employees for F.Y.2016-17 ,With Tax Planning Guide for FY 2016-17

mtaxsftware.net

17:05:00

DownloadAll in One TDS on Salary for Non-Govt Employees for F.Y.2016-17 & Ass Yr 2017-18 [This Excel …

All in One TDS on Salary for Non-Govt employees for F.Y.2016-17 ,With Tax Planning Guide for FY 2016-17

mtaxsftware.net

18:16:00

DownloadAll in One TDS on Salary for Non-Govt Employees for F.Y.2016-17 & Ass Yr 2017-18 [This Excel …