- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

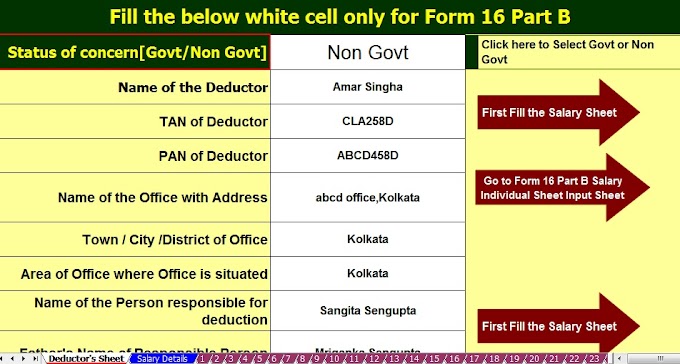

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Section 80CShow All

Investments Qualifying for deduction under section 80C as per budget 2019, With Automated 50 Employees Master of Form 16 Part B for F.Y. 2019-20

mtaxsftware.net

06:34:00

Investments Qualifying for deduction under section 80C Max Rs. 1.5 Lakh i. Provident Fund (PF) &am…

TAX BENEFITS ON PAYING RENT & TAKING HOME LOAN INTEREST, PLUS AUTOMATED ALL IN ONE TDS ON SALARY FOR GOVT & NON-GOVT EMPLOYEES FOR F.Y 2019-20

mtaxsftware.net

07:51:00

As per the latest Central Finance Budget 2019 have some changed along with the Income Tax Slab for the Finan…

Tax benefits on paying rent & taking Home Loan Interest, Plus Automated All in One TDS on Salary for Govt & Non-Govt employees for F.Y 2019-20

mtaxsftware.net

07:12:00

As per the latest Central Finance Budget 2019 have some changed along with the Income Tax Slab for the Fina…

Top Beneficial Income Tax Deductions for Salaried Individuals for F.Y. 2018-19 With Automated 100 employees Income Tax Master of Form 16 Part B for F.Y.2018-19

mtaxsftware.net

21:05:00

Salaried persons are a unit offered several tax deductions on the taxation they purchase the regular paymen…

All in One Tax Preparation Excel Utility for Non-Govt employees(Private) For F.Y 2017-18 & A.Y.2018-19

mtaxsftware.net

18:14:00

How to maximize tax benefits on a joint home loan, With Automated TDS on Salary for West Bengal Govt Employees for F.Y.2017-18

mtaxsftware.net

18:49:00

Generally all of us think that taking a loan to buy a residential property is not a good idea and so, they…

Prepare at a time 50 or 100 employees automated Income Tax Master of Form 16 Part B for F.Y.2016-17Investments Qualifying for deduction under section

mtaxsftware.net

18:20:00

1)Download and Prepare at a time 50 employees Form 16 Part B for F.Y.2016-17 [ This Excel Based Utility …

All in One TDS on Salary for Govt and Non-Govt employees for F.Y.2016-17, With home loan Tax benefits – Section 24, 80EE and 80C as per Budget 2016

mtaxsftware.net

18:47:00

Download All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.2016-17 & AssessmentYear 20…

Raised the limit of some Income Tax Section for Salaried Class in Budget 2015-16, with Automated Form 16 Part A and B for F.Y.2015-16

mtaxsftware.net

07:17:00

Download Automated Master of Form 16 Part A &B for Financial Year 2015-16 and Assessment Year 2016-…

At a Glance Income Tax Chapter VI A ( After new Finance Budget),Plus Master of Form 16 Part B for the Financial Year 2014-15

mtaxsftware.net

07:26:00

Click here to download the Automatic Master of Form 16 Part B ( This Excel Utility can prepare at a time …