- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Arrears Relief CalculatorShow All

Automated Income Tax Arrears Relief Calculator with Form 10E from the F.Y. 2000-01 to F.Y. 2019-20 ( Updated Version)

mtaxsftware.net

07:10:00

HOW TO CLAIM RELIEF WHEN SALARY IS PAID IN ARREARS OR IN ADVANCE Whereby any portion of assessee’s sa…

Automated Income Tax Arrears Relief Calculator with Form 10E from the F.Y. 2000-01 to F.Y. 2019-20 ( Updated Version)

mtaxsftware.net

06:59:00

HOW TO CLAIM RELIEF WHEN SALARY IS PAID IN ARREARS OR IN ADVANCE Whereby any portion of assessee’s sa…

Download Automated All in One TDS on Salary for Govt & Non Govt Employees for F.Y.2018-19 with Union Budget 2018: No bills required to claim Rs 40,000 standard deduction

mtaxsftware.net

20:38:00

The new measure will benefit all salaried employees and pensioners without the hassle of filing sup…

How to e-filing for upload 10E Form for Claim Relief U/s 89(1) to the Income Tax Department as XML File Format other wise Rebate will be rejected,With Automated Arrears Relief Calculator with Form 10E from F.Y.2000-01 to F.Y.2017-18

mtaxsftware.net

17:49:00

Income Tax Department has disallowed relief u/s 89(1) which was claimed by Assessee during his/her filin…

Automated All in One TDS on Salary for Govt and Non-Govt Employees for F.Y.2017-18 With Income Tax Exemptions FY 2017-18 : List of important IT Deductions for A.Y 2018-19

mtaxsftware.net

17:34:00

The income tax rate for those earning between Rs 2. 5 lakh and Rs 5 lakh has been halved to 5%. Except fo…

TWO STEPS EXCEL CALCULATOR U/S 10(13A) OF HOUSE RENT ALLOWANCE EXEMPTION,WITH ARREARS RELIEF CALCULATOR U/S 89(1) WITH FORM 10E SINCE 2000-01 TO 2017-18

mtaxsftware.net

17:57:00

Owing a home is a dream of every salary earning individual. It takes a lot of time and efforts to fulfil…

Prepare at a time Tax Compute Sheet+Arrears Relief Calculation+HRA Exemption Calculation + Form 16 Part A&B and Part B for Financial Year 2017-18

mtaxsftware.net

18:13:00

It's time for first working of any works at your office, but the Income Tax Calculation with all exem…

Download Automated All in One TDS on Salary for Govt and Non-Govt employees for F.Y. 2017-18 and A.Y.2018-19 + Income tax benefits on joint home loan

mtaxsftware.net

17:37:00

What is a joint home loan? A home loan where there is more than one borrower termed as a joint home …

At a glance all deduction under chapter VI A,With Automated All in One Income Tax Preparation Excel Based software for Govt and Non Govt employees for F.Y.2016-17

mtaxsftware.net

17:35:00

Chapter VIA List of All Deductions at a Glance As per the Finance Budget 2016, some of Income Tax Secti…

Automatic Tax compute Sheet + Arrears Calculator + Form 10E + H.R.A. Calculation + Form 16 Part A and B and Form 16 Part B for F.Y. 2016-17, with How can maximize tax saving?

mtaxsftware.net

17:22:00

Tax saving and Tax Planning are important aspects for the salaried person. As it allows you to save more m…

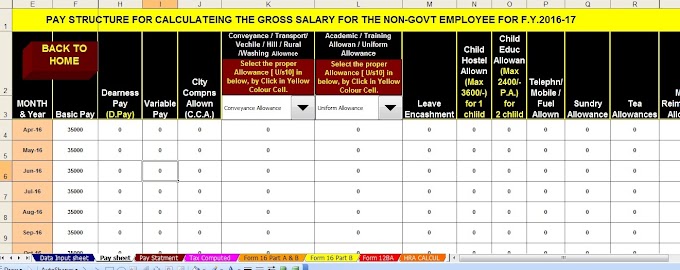

Tax saving investments to save Tax on your income, With All in One Income Tax Software in Excel for Non-Govt employees for F.Y.2016-17

mtaxsftware.net

18:03:00

Income tax is something all of us would like to reduce it to the maximum. And what better than tax saving i…