The

Finance Budget 2016 has to introduce or extend the Tax Deduction

limits Under few Sections of the Income Tax Act. For the Financial Year

2016-17 & Assessment Year 2017-18.

Let

us understand all the important sections and new introduce in respect

to ‘Income Tax Deductions 2016-17′. This list will help you in planning

your taxes.

Income Tax Deductions 2016

Section 80C

The

maximum tax exemption limit under Section 80C has been retained as Rs

1.5 Lakh only. The various investment avenues under this section are;

- PPF (Public Provident Fund)

- EPF (Employees’ Provident Fund)

- Five year Bank or Post office Tax saving Deposits

- NSC (National Savings Certificates)

- ELSS Mutual Funds (Equity Linked Savings Schemes)

- Kid’s Tuition Fees

- SCSS (Post office Senior Citizen Savings Scheme)

- Principal repayment of Home Loan

- NPS (National Pension System)

- Life Insurance Premium

- Sukanya Samriddhi Account Deposit Scheme

Download the All in One TDS on Salary for Non-Govt employees for the F.Y.2016-17 [ This Excel Utility can prepare at a time Tax Compute Sheet + Individual Salary Structure + Automatic H.R.A. Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Form 16 Part B + Form 12 BA ]

Section 80CCC (1)

Contribution to the Pension Fund by the Employee Max Rs. 1.5 Lakh.

Section 80CCD(2)

Employer’s

Contribution to the Employee’s Pension Fund Max 10% of employees Basic

salary.This deduction can be made out of 1.5 Lakh U/s 80C

80CCD(1B) :- additional exemption of Rs 50,000 u/s 80CCD (1b) will be allowed. (

To claim this deduction, the employee has to contribute to Govt

recognized Pension schemes like NPS).This Deduction can be made out of

1.5 Lakh of U/s 80C

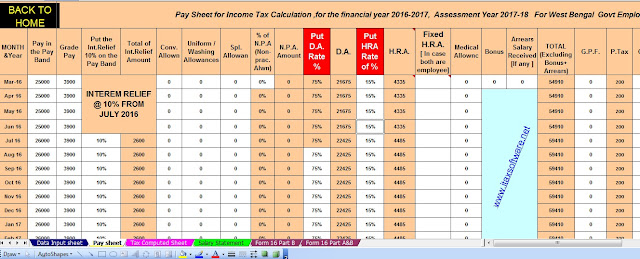

Download All in One TDS on Salary for Govt & Non Govt employees for F.Y.2016-17 and A.Y.2017-18 [This Excel utility can prepare at a time Tax Computed Sheet + Individual Salary Sheet + Automatic Arrears Relief Calculator U/s 89(1) with Form 10E + Automatic H.R.A. Calculation U/s 10(13A) + Automated Form 16 Part A&B and Form 16 Part B for F.Y.2016-17 as per the Finance Budget 2016]

Section 80D

Deduction

u/s 80D on health insurance premium will be Rs 25,000, increased from

Rs 15000. For Senior Citizens it has been increased to Rs 30,000 from

the existing Rs 20,000. For very senior citizen above the age of 80

years who are not eligible to take health insurance, the deduction is

allowed for Rs 30,000 toward medical expenditure.

Section 80DDB

An individual (less than 60 years of age) can claim up to Rs 80,000 for the treatment of specified critical ailments.

Download the Automated All in One TDS on Salary for West Bengal Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Utility can prepare at a time Tax computed sheet + Automatic H.R.A. Exemption Calculation U/s 10(13A) + Individual Salary Structure as per W.B. Govt Salary Pattern + Automated Form 16 Part A&B and Form 16 Part B]

Section 24 (B) H.B.L.Interest

You

can claim up to Rs 2 Lakh as a tax deduction on the home loan interest

payment. If your property is a let-out one then the entire interest

amount can be claimed as a tax deduction.

Section 80EE Additional H.B.L.Interest.

You can claim up to Rs 1.5 Lakh as a tax deduction on the home loan interest payment Excluding the Section 24(B).

Section 80U

You

can claim up to Rs 75,000 (increased from the existing Rs 50,000) for

spending who have up to 80% disability. It is also been Introduce to

increase the limit of deduction from Rs 1 lakh to Rs 1.25 lakh in case

of above 80% severe disability.

The

other sections are – Section 80E (tax deduction benefit on the interest

payment of an education loan), Section 80 G (Donations), Section 80GG

(when HRA is not paid by the company but you incur rental expenses) and

100% TAX DEDUCTION on contributions made to SWACHH BHARAT & CLEAN

GANGA initiatives have also been proposed.

The above ‘Income Tax Deductions 2015′ are applicable for Financial year 2015-2016 (or Assessment Year 2016-2017).

Download the All in One TDS on Salary for the Cental Govt Employees for F.Y.2016-17 & A.Y.2017-18 [This Excel Utility can prepare at a time Tax Compute Sheet + Automatic H.R.A. Exemption Calculation + Individual Salary Sheet + Individual Salary Structure as per Cental Govt. Salary Pattern + Automated Form 16 Part A&B and Form16 Part B ]

Section 80TTA:- Interest from Bank up to Rs. 10,000/- who’s taxable income less than 5 Lakh.

Section 87A :- Tax Rebate Rs.5,000/- can be availed from the F.Y.2016-17 as this Rebate was in F.Y.2015-16 Rs.2,000/-