- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Form 16Show All

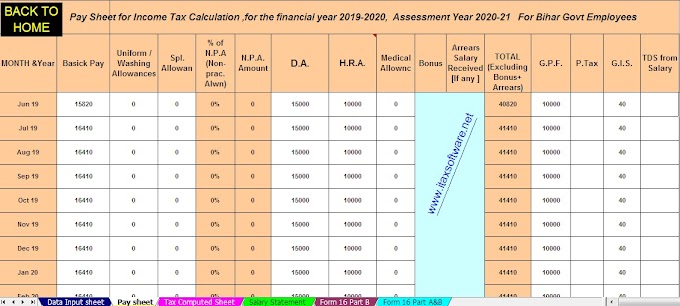

Download Automated All in One TDS on Salary for Bihar State Govt Employees for F.Y. 2019-20 With New Income Tax Section 80EEA for H.B.L. Interest up to Rs.1,50,000/- for F.Y. 2019-20

mtaxsftware.net

07:57:00

· Surcharge hiked for those earning above Rs. 2 crore; higher deduction on home l…

Download Automated All in One TDS on Salary for Non-Government Employees for F.Y. 2018-19 With Deductions on Section 80C, 80CCC & 80CCD

mtaxsftware.net

21:38:00

There are various deductions a taxpayer can claim from his total income which would bring down his taxabl…

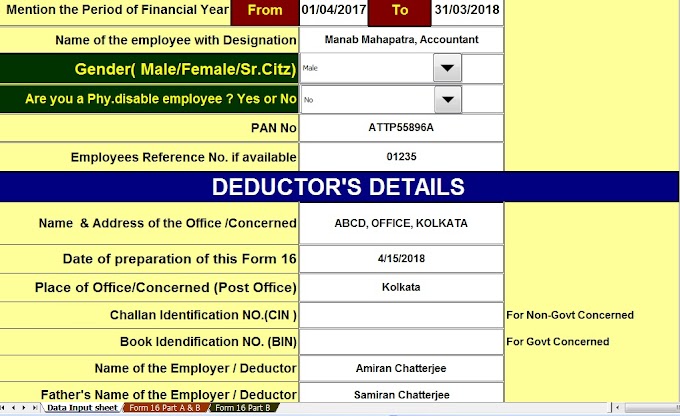

Download Automated One by One Preparation Excel Based Form 16 Part B for F.Y. 2017-18

mtaxsftware.net

21:54:00

Click here to Download Automated Excel Based Income Tax Form 16 Part B for F.Y.2017-18 [ This Excel Utility…

Prepare One by One Automated Form 16 Part B for Financial Year 2017-18 with all new amended Tax Slab and Section for F.Y.2017-18

mtaxsftware.net

17:27:00

Now this month is March 2018 is the end of the F.Y.2017-18 and Income Tax Preparation and submit the Tax St…

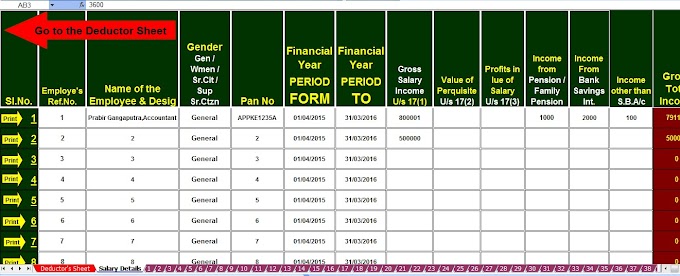

Prepare at a time 100 employees Automated Form 16 Part A and B For Financial Year 2016-17 and A.Y.2017-18

mtaxsftware.net

18:29:00

What is the requirement of Income Tax Form 16 to salaried persons? With Automated Master of Form 16 Part B for F.Y.2016-17 and A.Y.2017-18

mtaxsftware.net

18:08:00

Benefits of Form 16 TDS Certificate with Automated Form 16 Part B and Part A and B for the Financial Year 2016-17 and Assessment Year 2017-18

mtaxsftware.net

17:48:00

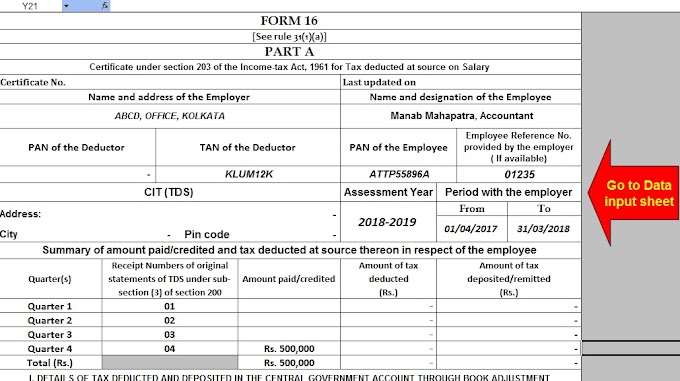

Form 16 is a TDS Certificate issued by the employer deducting the TDS while making payment to an employ…

At a Glance Income Tax Section 80 Deductions, Plus Master of 100 Employees Form 16 Part A and B for Financial Year 2016-17

mtaxsftware.net

18:32:00

Download Automated Master of Form 16 Part A&B for the Financial Year 2016-17 [ This Excel Utility can…

Download Automated Form 16 Part B and Part A and B which can prepare one by one Form 16 for the Financial Year 2016-17

mtaxsftware.net

18:18:00

The Form 16 is now have two parts, Part A and Part B. The previous Format of Form 16 have already changed …

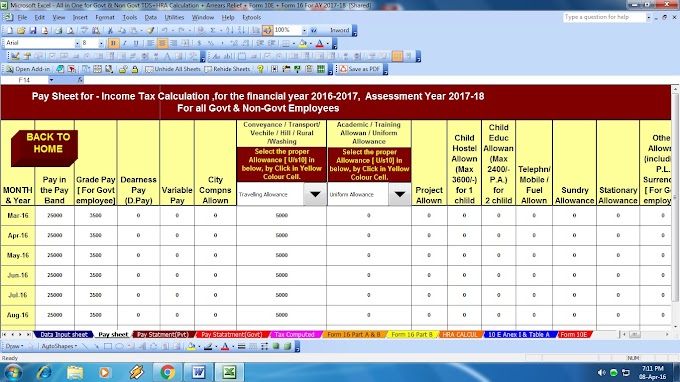

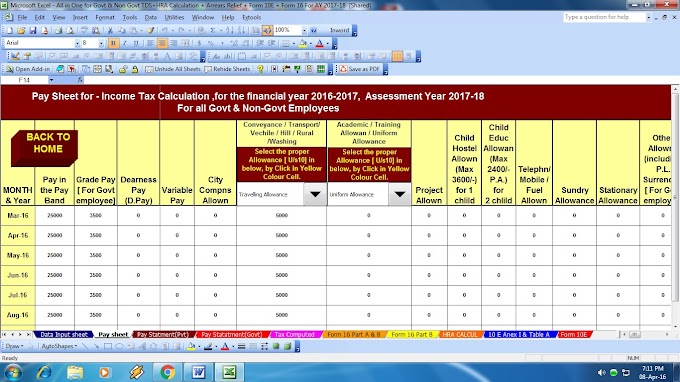

All in One TDS on Salary in Excel for the Govt and Non-Govt Employees for the Financial Year 2016-17 and Ass Y.R 2017-18

mtaxsftware.net

18:18:00

Click here to Download All in One TDS on Salary for Govt & Non-Govt Employees for the Financial Year 20…

Income Tax F.Y.2016-17 – What are all the changes affecting Salaried Employees ? Plus Automated All in One TDS on Salary for Govt & Non-Govt Employees for the F.Y.2016-17

mtaxsftware.net

21:04:00

Click here to Download the Automated All in One TDS on Salary for Govt & Non-Govt Employees for F.Y.20…