- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Form 10EShow All

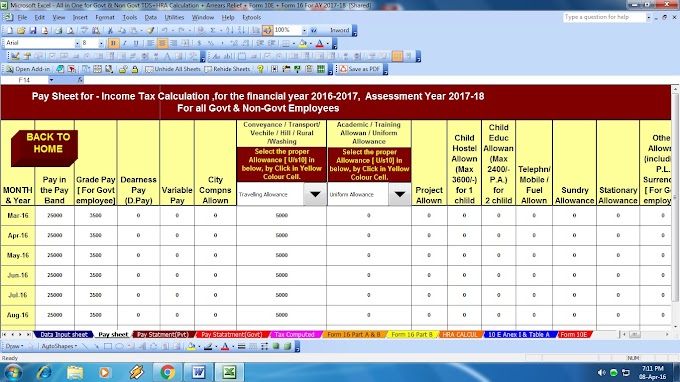

All in One TDS on Salary in Excel for the Govt and Non-Govt Employees for the Financial Year 2016-17 and Ass Y.R 2017-18

mtaxsftware.net

18:18:00

Click here to Download All in One TDS on Salary for Govt & Non-Govt Employees for the Financial Year 20…

Seventh Pay Commission Arrears Soon. How To Claim Tax Relief,With Automated Income Tax Arrears Relief Calculator with Form 10E

mtaxsftware.net

19:04:00

In Seventh Pay Commission bonanza, lakhs of central government employees will soon receive higher salaries…

Now it is Compulsory to upload 10E Form for Claim Relief U/s 89(1) to the Income Tax Department as XML File Format other wise Rebate will be rejected

mtaxsftware.net

18:07:00

Income Tax Department has disallowed relief u/s 89(1) which was claimed by Assessee during his/her filin…

The 80CCD (1) Confusion: Do you get Rs 1.5 lakh or 2 lakh deduction including Additional benefits Rs.50 thousand? As per Finance Bill 2015

mtaxsftware.net

07:43:00

There are many conflicting views and comments in various Web Site that on the budget 2015 A certain s…

Now it is Compulsory to upload Form 10E for Claim Relief U/s 89(1) to the Income Tax Department as XML File Format other wise Rebate will be rejected

mtaxsftware.net

06:32:00

Income Tax Department has disallowed relief u/s 89(1) which was claimed by Assessee during his/her filing…

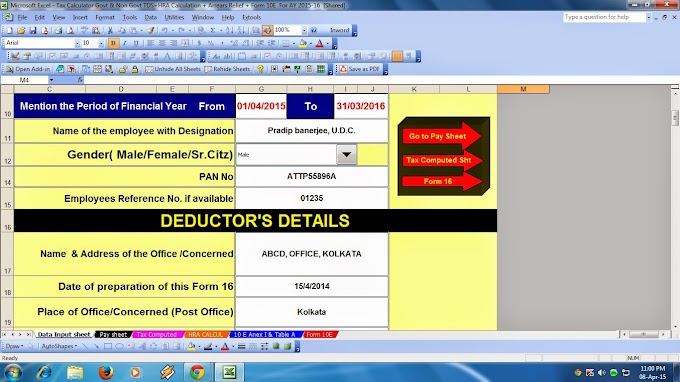

As per Budget 2015 Guess your Tax Liability for the Financial Year 2015-16 and Ass Year 2016-17 with TDS on Salary All in One for Govt and Non Govt employees for FY 2015-16

mtaxsftware.net

06:20:00

Download the All in One TDS on Salary for Govt & Non Govt employees for Financial Year 2015-16 and Ass…