- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Form 16 Part B for F.Y.2015-16Show All

You can Claim both HRA and home loan benefits , With Automated Form 16 Part A and B and Part B and HRA Exemption Calculator for F.Y.2015-16

mtaxsftware.net

18:55:00

Download Form 16 from the below link :- Form 16 Part A&B for F.Y. Download Automated Income Ta…

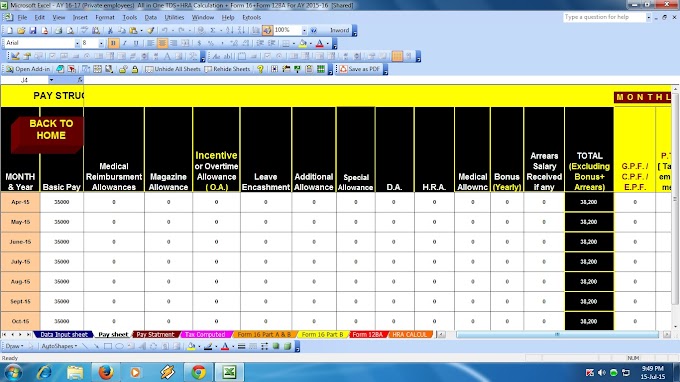

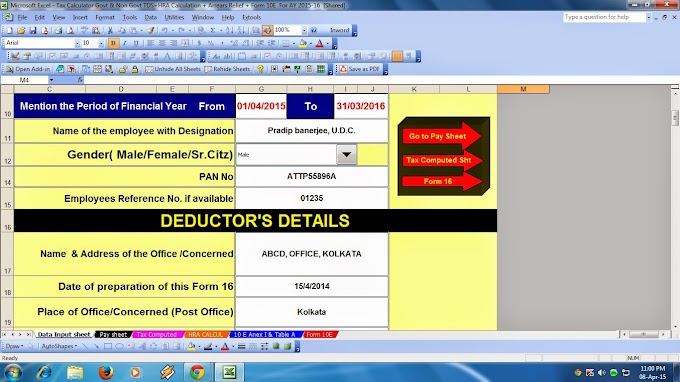

Download Private (Non-Govt) Employees Automated Income Tax Compute sheet+HRA Calculation+Form 16 Part B and Form 16 Part A&B + Form 12 BA for Financial Year 2015-16

mtaxsftware.net

06:58:00

As per the Finance Budget 2015 have some changes in the Tax Section and hike the limit of some Section …

Income Tax Deduction Under Chapter VI A- including 80C for F.Y.2015-16, with Automated Tax Preparation Excel Based Software for All State Employees for F.Y.2015-16

mtaxsftware.net

07:25:00

As per the new Finance Budget 2015-16 the some Income Tax Section limit has raised.Given below the all of …

The 80CCD (1) Confusion: Do you get Rs 1.5 lakh or 2 lakh deduction including Additional benefits Rs.50 thousand? As per Finance Bill 2015

mtaxsftware.net

07:43:00

There are many conflicting views and comments in various Web Site that on the budget 2015 A certain s…

Download TDS on Salary All in One for Govt and Non Govt employees for FY 2015-16 with latest Tax Section as per Budget 2015

mtaxsftware.net

07:38:00

Download the All in One TDS on Salary for Govt & Non Govt employees for Financial Year 2015-16 and As…

Download Automated Form 16 Part B and 24Q + 26Q all Quarters for Financial Year 2015-16 and AY 2016-17

mtaxsftware.net

07:57:00

Download Automated Form 16 Part B with 24Q and 26Q 4th All Quarters for FY 2015-16 ( Individual Salary …