- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

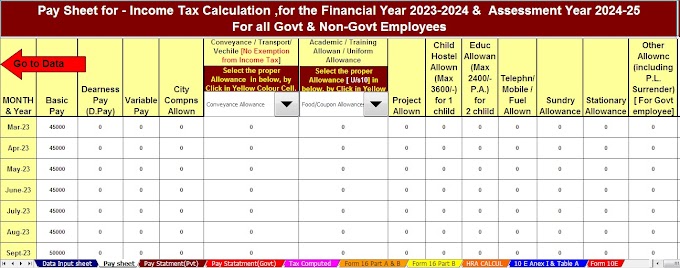

New tax regime: Update! Income tax provided excellent information on the TDS of employees. With Auto Calculate Income Tax tools in Excel as all in one for the F.Y.2023-24 and A.Y.2024-25

mtaxsftware.net

06:12:00

New tax regime: Update! Income tax provided excellent information on the TDS of employees. Note that the n…

Income tax benefits for the Senior Citizen with Auto Calculate Income Tax Preparation Software All in One in Excel for the Government & Non-Government Employees for the F.Y.2023-24 and A.Y.2024-25

mtaxsftware.net

06:55:00

Income tax benefits for Senior Citizens. Whether we like it or not, we all worry about the future and ma…

Don't take FD of any amount from any bank, take advantage of these rules and know the trick with Automatic Income Tax Software in Excel for the A.Y.2023-24 & A.Y.2024-25

mtaxsftware.net

07:01:00

Fixed deposit rate – If you are planning to take a fixed deposit ie. FD , you need to know a few things be…

All employees get a tax exemption of Rs 50 thousand U/s 16(ia) in any tax regime.| With Auto Calculate Income Tax Preparation Software in Excel All in One for the Govt and Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25 as per Budget 2023

mtaxsftware.net

06:44:00

All employees get a tax exemption of Rs 50 thousand U/s 16(ia) in any tax regime.| If you are also a tax…

Everything you need to know about Form 16 - TDS Certificate for Salary| With Auto Calculate Income Tax Form 16 Part A&B and Part B for the F.Y.2022-23 & A.Y.2023-24 in Excel

mtaxsftware.net

06:09:00

Everything you need to know about Form 16 : TDS Certificate for Salary | Employers issue Form 16 TDS certi…

Section 16 of the Income Tax Act| With Auto Calculate Income Tax Preparation Software All in One in Excel for the for the Non-Govt Employees for the F.Y.2023-24 & A.Y.2024-25

mtaxsftware.net

06:26:00

Section 16 of the Income Tax Act| Section 16 deductions help revise your taxable income to reduce your t…

How to pay less tax in F.Y. 2023-24| With Auto Calculate and Auto Preparation Excel Based Software All in One for the Govt and Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25 with Form 10E

mtaxsftware.net

06:45:00

How to pay less tax in F.Y. 2023-24| The beginning of the new tax year is a good time to reassess your fin…

Old versus new tax scheme according to relevant 2023 Budget| With automatic calculation of Income Tax Arrears Relief Calculator of U/s 89(1) with Form 10E for F.Y 2023-24 and A.Y 2024-25

mtaxsftware.net

05:58:00

Old versus new tax scheme according to relevant 2023 Budget| The Minister of Finance has announced a new …