Section 16 of the Income Tax Act| Section 16 deductions help revise your taxable income to reduce

your tax liability.

Deduction from entertainment allowance paid by your employer

Deduction at the professional rate from salary income

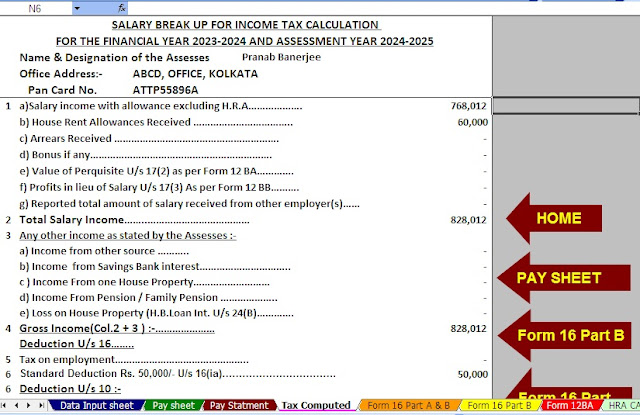

The standard deduction under Section 16(ia) – Under Section 16(ia), the standard deduction is the fixed deduction allowed from your salary income. It replaced transport allowance and medical treatment deductibles and was introduced by the Government in the Union Budget 2018. The amount of standard deduction allowed was Rs.50,000. You can deduct this amount from your wage income for taxable income.

You may also like: - Prepare at a 50 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year2023-24(This Excel Utility can prepare at a time 50

Employees Form 16 Part B)

In the 2019 interim budget, the standard deduction threshold has been raised to Rs.50,000 to provide better tax relief. Thus, from the tax year 2021-22 and subsequent years, the standard deduction is capped at Rs.50,000 until there is a change. The standard deduction will apply if you choose the new scheme slab rates as set out in Budget 2023.

The standard deduction under Section 16(ia) also applies to retirees with retirement income. Since the pension is taxable under the head – Salary Income, a standard deduction of Rs.50,000 from this pension is allowed in any financial year.

However, if the salary income is less than Rs.50,000, the normal deduction allowed is equal to the salary income. Therefore, the standard deduction is Rs.50,000 or salary income, whichever is lower. It is important to note that the ordinary tax exemption does not affect or conflict with other tax exemption provisions under the Income Tax Act. 1961.

You may also like: - Prepare at a 50 Employees Form 16 Part A&B for the Financial Year 2022-23 and Assessment Year 2023-24(This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B)

Illustration of standard deduction

calculation:

Other Taxable Deductions – Rs. 50,000

Gross salary - Rs 6,50,000

Standard deduction – Rs 50,000

Total Cost - Rs 6,00,000

Other Deductions – Rs 1,50,000

Taxable income - Rs 4,50,000

2. Deduction of entertainment allowance Under Section 16(ii) – If your employer provides entertainment allowance, it will be included in your gross pay and will be added to your wage income. However, the Section 16(ii) deduction allows you to claim the same gaming tax deduction.

And the amount you deduct depends on the nature of your project.

If you are a government servant belonging to the Central or State Government, the deduction of entertainment subsidy under Section 16(ii) is the lowest of the following:

Rs. 5,000

20% of the basic salary

A true entertainment subsidy is obtained

It’s a deduction allowed when your pay doesn’t include any other allowances, benefits, or privileges offered by your employer. Also, it treats income as an entertainment subsidy and not spending on entertainment.

You may also like: - Prepare at a 100 Employees Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24(This Excel Utility can prepare at a time 100 Employees Form 16 Part B)

2. If you are not a government employee, there is no deduction allowed on entertainment allowance related to your salary income. So if your employer gives you an entertainment allowance, it will be added to your taxable income.

Example of calculating the entertainment subsidy deduction:

Salary excluding allowances, benefits, and bonus - Rs 4,00,000

Monthly entertainment allowance – Rs 3000

Entertainment allowance for the year – Rs 36000

Deductible:

Rs. 5,000

20% of salary – Rs 80,000

Actual value – Rs 36,000

The smallest of the above items is Rs.5,000. So the allowable deduction on entertainment allowance is Rs 5,000.

3. Business tax deduction under Section 16(iii) – Business tax applies to your salary income and becomes part of your tax liability. However, Section 16(iii) of the Income Tax Act, 1961 provides for tax deduction subject to the following conditions:

You may also like: - Prepare at a 100

Employees Form 16 Part A&B for the Financial Year 2022-23 and Assessment

Year 2023-24(This Excel Utility can prepare at a

time 100 Employees Form 16 Part A&B)

If your employer pays employment taxes, it will be part of the prerequisites when calculating gross pay. You can then claim the business tax paid by your employer under Section 16(iii) of the Income Tax Act, 1961.

There is no defined limit on service tax deductions. As a result, the amount of business tax you pay will be fully deductible, regardless of the amount.

If you are liable for a penalty or business tax interest, that amount is not eligible for deduction.

Conclusion

As a responsible taxpayer, you need to be aware of the tax implications of your salary income in order to make the most of your benefits. Section of 16 of the Income Tax Act 1961 provides for customary deductions and other exemptions from gaming royalties and business taxes. However, certain factors must be considered in particular in determining the applicability of a specific tax rule.

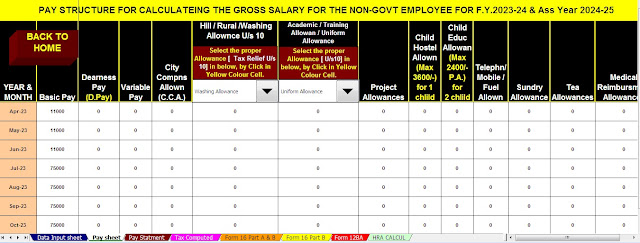

The Main Feature of this Excel Utility is:-

+This Excel Utility can prepare at a time Tax Computed sheet

+ Auto Calculate H.R.A. Exemption U/s 10(13A)

+ Inbuilt Salary Structure as per the Non-Govt Employee's

Salary Structure

+ Auto Calculate Form 12 BA

+ Automated Form 16 Part A&B and Form 16 Part B)

0 Comments