How to pay less tax in F.Y. 2023-24| The beginning of the new tax year is a good time to reassess your

finances and also explore possible changes that can help you save taxes and maximize your wealth.

The growing season is about to begin. While a higher salary is always good news, it comes with the

backlash of higher taxes. In some cases, the increase may lead the individual to a higher tax slab. For

example, if a person with an income of Rs 10 lakhs gets a 20% raise, his tax rate changes from 20% to

30%. Rs.2 lahks up.

To optimize the tax, you must reorganize income and investments so that all available tax deductions and exemptions are used up to the maximum limits allowed. The following steps may help:

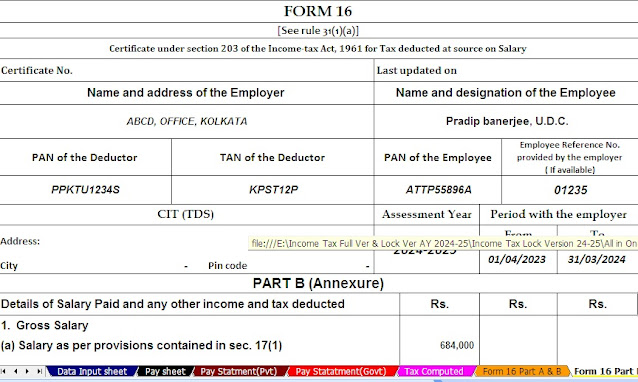

You may also like- Master of Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24[This Excel Utility can prepare at a time 50 Employees

Form 16 Part B]

Many companies allow their employees to make changes to the CTC at the beginning of the fiscal year. If your company gives you that option, restructure your salary to include more tax-efficient bonuses. This includes reimbursement for phone and internet bills, gas and travel expenses, food stamps, and newspaper bills. After the implementation of GST, the car rental option has lost its appeal, but the driver's salary, gasoline, insurance, and maintenance are still beneficial.

For the past two years, Holiday Travel Assistance (LTA) has not been able to be used very efficiently due to Covid travel restrictions. Your family travel fare is eligible for tax exemption as part of the CTC. Please note that the LTA is expected to be integrated into the CTC at the beginning of the year. You cannot opt out later in the year or claim it when filing the ITR.

You may also like- Master of Form 16 Part B for the Financial Year 2022-23 and Assessment Year 2023-24[This Excel Utility can prepare at a time 100 Employees

Form 16 Part B]

Opt for NPS contribution

This benefit is offered by many companies to their employees and is a diamond in the rough. Up to 10% of the base salary placed in the NPS is exempt from tax under Sec. 80CCD(2). However, only 10% of employees who received this benefit opted for it, despite the fact that it can significantly reduce the tax. NPS outperforms mutual funds in terms of cost and outperforms other retirement savings options (such as Provident Funds, PPFs, and insurance plans) in terms of ret.

The NPS can help save more tax if the taxpayer invests in the scheme on their own. Under Section 80CCD(1b), there is an additional deduction of Rs 50,000 for NPS contributions. This is in addition to the deduction of Rs.1.5 lakh allowed under Section 80C.

Start

investments with tax savings

There is a saying that what is well started is only half done. For the same reason, don't wait until the last few months of the tax year to make your tax-saving investments. If you plan to invest in an ELSS fund, start the SIP in April. Starting in April will allow you to spread your risk over time instead of putting up a lump sum at the end of the year. Even if you intend to go with a risk-free fixed-income option such as PPF, invest as soon as possible.

Feature of this Excel Utility:-

1) This Excel

utility prepares and calculates your income tax as per the New Section 115 BAC

(New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as a New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2023-24 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2023-24

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2023-24

0 Comments