NPS is a good saving and tax benefit. National Pension System (NPS) A good savings tool with stable returns and tax benefits

The National Pension System (NPS) is not yet very popular with individual evaluators as people are not familiar with the benefits of the NPS. It is one of the best ways to save, stable returns and tax benefits.

It is undeniable that old-age pensions are an advantage when income falls. It is relevant that the pension is no longer available for state and semi-government employees who entered service after a particular cut-off date. Private sector employees never got the benefit of a regular pension after retirement.

With the introduction of the NPS (National Pension System), all individuals can plan their retirement by choosing this Voluntary Retirement Savings Plan.

NPS is a platform sponsored by the Indian government with an initiative to provide retirement opportunities for all Indians. At the beginning of 2004, it was exclusively for public employees, but since 2009 it has been open to all private individuals.

Contributions made under NPS are credited to a mutual pension fund, which is invested in shares, debt securities and government bonds by authorized fund managers according to the guidelines established by the PFRDA (Regulatory and Development Authority of Pension Funds ). The investment made increases. and returns deposited in the pension fund.

Any Indian citizen, resident or non-resident, between the ages of 18 and 60, can contribute to the NPS. After reaching the age of 60, the existing subscriber will not be able to contribute further to NPS accounts.

However, he has a chance to quit NPS even before he reaches the age of 60. In the event of the subscriber's death, there will be a mandatory exit. The accumulated wealth depends on the contributions paid and the income generated by the investments made by this fund.

So contribution + investment growth - commission = accumulated retirement money. Investing in NPS is independent of your contribution to any retirement fund and you can contribute to NPS as well as EPF / PF.

Download & Prepare at a time 50 Employees Automated Income Tax Form 16 Part A&B for the F.Y.2021-22

Each individual subscriber is issued a Permanent Retirement Account Number (PRAN) card which consists of a unique 12-digit number. Two sub accounts are provided in the NPS account: levels I and II.

The tier one account is a no-withdrawal retirement account that can only be withdrawn after meeting the NPS exit conditions. However, the Tier II account is a voluntary savings structure available as an add-on to any

Level 1 Account Holder. Subscribers will be free to withdraw their savings from this Level II account whenever they wish. The government does not make any contributions to the subscriber's NPS account. A subscriber must make a minimum annual contribution of Rs 6000 / - for his Tier, I account in a financial year, otherwise, his account will be blocked. There are several Pension Fund Managers (PFMs) who manage the underwriting fund at the choice of the underwriter.

Income tax exemption is available for NPS investments where an additional deduction of Rs 50,000 can be claimed for the National Pension System (NPS) contribution under section 80CCD (1B) of the National Pension System. income tax. Aside from this Rs. 1.50.000 / - Exemption under section 80C of the Income Tax Act.

Download & Prepare at a time 100 Employees Automated Income Tax Form 16 Part A&B for the F.Y.2021-22

The Finance Act 2020 introduced a new income tax regime where taxpayers have the option to choose a tax bracket with lower income tax rates. However, in order to opt for the new income tax table, the taxpayer must avoid the income tax benefits under section 80C, section 80CCD (1) and various other deductions and exemptions. However, the exemption for contribution to the national pension system under section 80CCD (2) is available even if they have opted for the new income tax regime.

Therefore, investing in NPS is beneficial in all respects and young people should contribute to the NPS for future regular returns and exemption from current income tax.

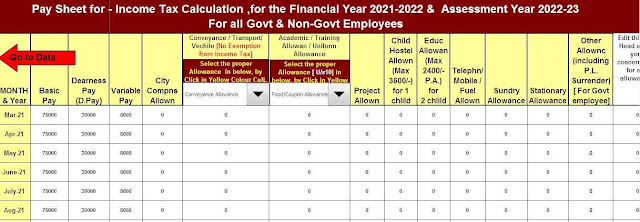

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

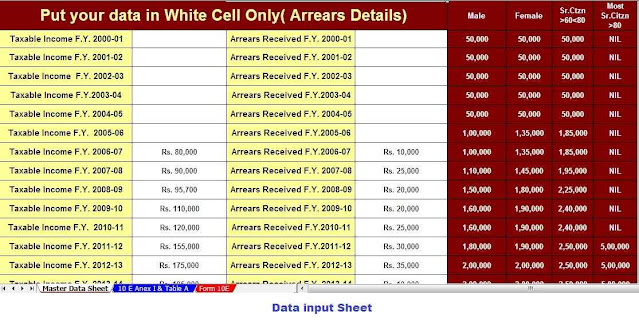

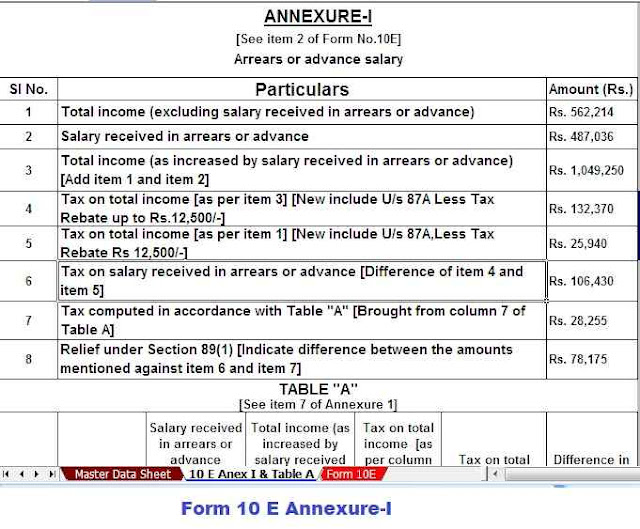

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

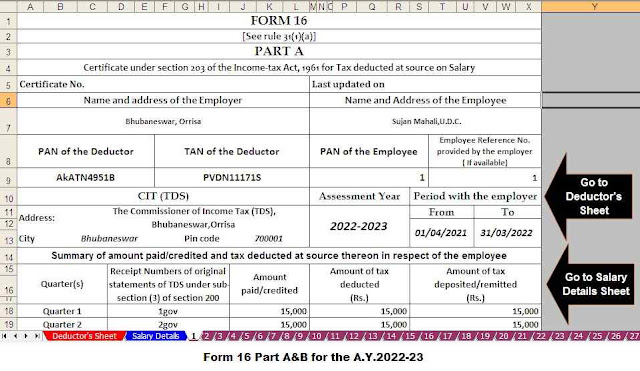

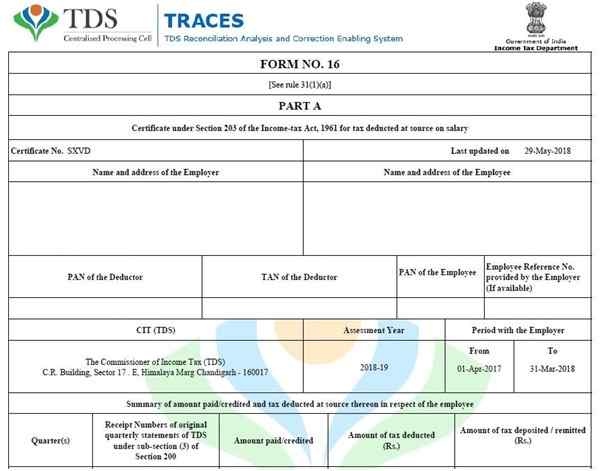

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments