Zero Income Tax on Rs 10 lakhs Individual Income- See How? It is well known that the income tax on income of Rs. 10 lakh in a personal situation will attract Rs. 1.17.000 / -. But, if you plan well, you don't have to pay any income tax on your personal income of Rs 10 lakh.

In order to promote savings and provide tax relief, the government has enacted several exemptions under various chapters for the benefit of individual evaluators. However, the basic exemption limit under the Income Tax Act is only Rs. 2.5 lakh but availing various exemptions available, a single valuer can pay zero tax up to an income of Rs 10 lakh and thus save his hard earned money. Otherwise, with the help of these deductions and exemptions, their tax can be reduced to a large extent.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2021

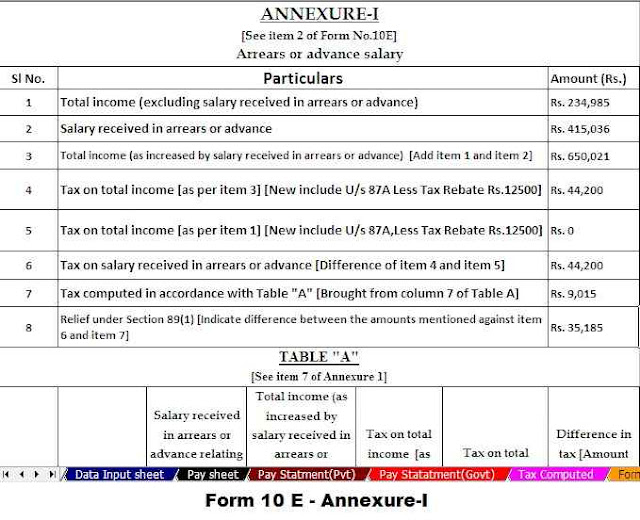

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

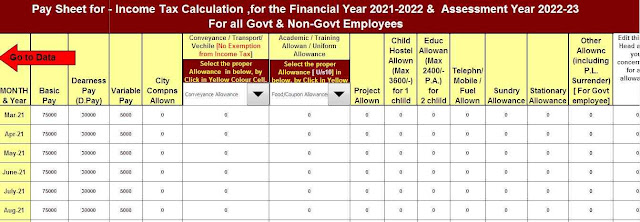

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

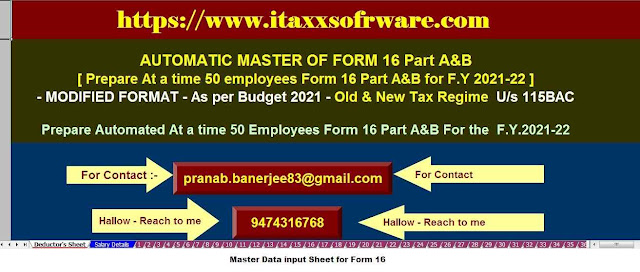

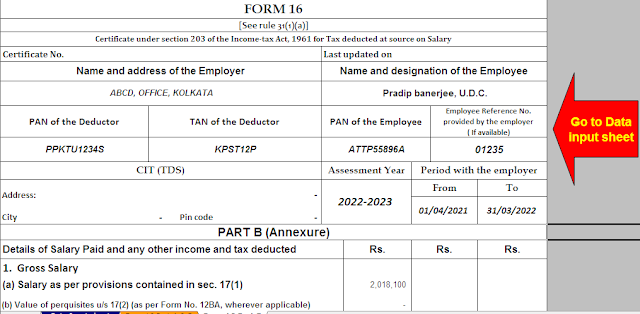

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula

The art of saving on income tax is not very difficult but a basic understanding of income tax is essential. Let's see what exemptions can be used to reduce an individual's tax liability.

1. If you are a salaried individual, you can take advantage of the standard deduction of Rs. 50,000 / - under section 16 (ia) of the Income Tax Act.

2. Any person can apply for exemption under section 80C of the Income Tax Act subject to a maximum of Rs 1.50,000 by contributing to EPF, PPF, ELSS, NSC etc. or paying the LIC premium of himself or his spouse or children // Can claim Rs. The payment of the registration fee of two children is also exempted in this section. Contribution to the PPF is beneficial in two respects. First, interest on the PPF is completely exempt from income tax under section 10 (11) of the Income Tax Act. Secondly, the amount deposited on the PPF account cannot be seized by any authority / court.

3. An additional exemption of Rs 50,000 may be requested for National Pension System (NPS) contribution under Section 80CCD (1B) of the Income Tax Act.

4 2 lakh from his taxable income.

5. The discount of Rs 25,000 can be used to pay the health insurance premium for health insurance of self, spouse and children under section 80D of the Income Tax Act. However, if a person pays for their elderly parents' health insurance, they are eligible for an additional exemption of Rs 50,000.

6. A person can apply for a preventive health check deduction of up to Rs.5,000 per financial year under section 80D. This preventive health check deduction is covered within the limit of 80D above Rs 25,000 for individuals and Rs 50,000 for seniors.

7. Another exemption under section 80DDB of the Income Tax Act may be used for medical treatment of certain specific illnesses that you have used for yourself or for employees. Employees can be spouses, parents or siblings. The exemption is allowable for medical expenses of Rs. 40,000 / - per year. However, in regards to a dependent senior's medical bills, this exemption is Rs. 1.00.000 / -. This exemption is in addition to the exemption under section 80D of the Income Tax Act.

8. Exemption under 80G of the Income Tax Act may be claimed for donations to organizations registered under Section 80G of the Income Tax Act. Section 80G of the Income Tax Act, 1961 provides for the deduction of income tax to a valuer, who makes donations to charitable organizations. This deduction varies by receiving organization, which means that you can take advantage of a deduction of 50% or 100% of the amount donated, with or without restrictions.

Therefore, the valuer should manage his financial affairs and make investments in such a way that his taxable income is less than Rs 5 lakh so that there is no incidence of the income tax provided for in section 87A of the Income Tax Act. .

.

0 Comments