Automatic Income Tax Preparation Software All in One in Excel for the F.Y.2021-22

Understanding 80D

To address rising medical and hospitalization costs, insurance companies offer a number of health plans. To encourage more citizens to insure properly, the Income Tax Act provides various tax exemptions for medical insurance under section 80D. Having adequate medical insurance is essential for a stress-free life. It provides financial assistance in times of medical emergency. Medical insurance that provides adequate coverage will help you protect yourself from financial crisis during a medical emergency such as a serious illness or serious accident.

What is Section 80D?

If your insurance portfolio is to be considered consolidated, adequate medical coverage is essential. If the cost of your insurance premium is too high for you to bear, you need to find out how to manage the medical expenses when you are hospitalized. Hospitalization can be a huge headache for anyone. The government also encourages you to take benefits of medical coverage. In the Income Tax Act, Section 80D deduction is a tax deduction based on the health insurance premium you pay.

You may also, like- Automatic Income Tax Preparation Excel Based Software All in One for the Non-Govt Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per all the Non-Govt Concern’s Salary Structure + Auto calculate income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automatic Prepare Income Tax Form 16 Part A&B and Part B + Automatic Income Tax Form 12 BA]

A health insurance policy that has a single premium

Section 80D of the 2018 Budget introduced a new provision for a tax deduction for a single premium health insurance policy. Suppose a taxpayer pays a single amount in a year for a plan whose validity is more than one year. The exact fraction that will be applied is calculated by dividing the amount of one month paid as a premium by the number of years of the policy. However, it is subject to an upper limit of Rs 25,000 and Rs 50,000 depending on the case.

Scenario | Premium paid | Deduction under Section 80D | ||

Individual + parents below 60 years | 25,000 | 25,000 | 50,000 | |

Individual and family below 60 years but senior citizen parents | 25,000 | 50,000 | 75,000 | |

individual and parents above 60 years | 50,000 | 50,000 | 1,00,000 | |

Members of Hindu Undivided Family | 25,000 | 25,000 | 25,000 | |

Non-resident individual | 25,000 | 25,000 | 25,000 |

Payment for the medical insurance you have chosen should be made through online banking, debit card, credit card, demand draft, check and other similar methods. If the premium instalment is made using cash, no tax exemption will be available under section 80D. However, the preventive health tests you pay in cash are still eligible for tax deduction under section 80D.

How do you get Section 80D deduction?

If you are a salaried person who wants to get an 80D tax deduction, then you need to submit policy documents along with a premium payment slip to your employer.

This will allow you to get your health insurance section 80D income tax return. Merchants can file their tax returns online. One of the most frequently asked questions regarding Section 80D deduction is: Is a person eligible for tax deduction when the employer pays medical insurance to the employee for which he deducts salary? The answer can be given in the following ways: Whenever individuals pay for insurance themselves, even after providing medical insurance to the employer and his family, 80D is eligible for a tax deduction.

Conclusion

We hope this detailed article answers all your questions regarding Section 80D discounts. It is necessary to Medical insurance is a must for each and every person. It provides a wealth of security and stability.

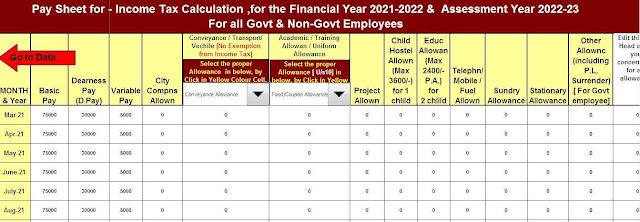

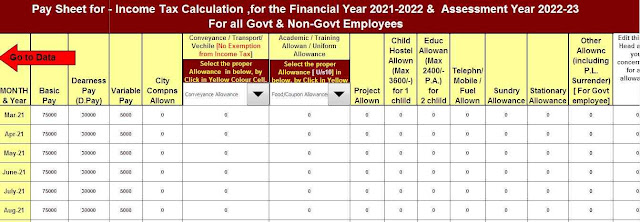

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments