- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

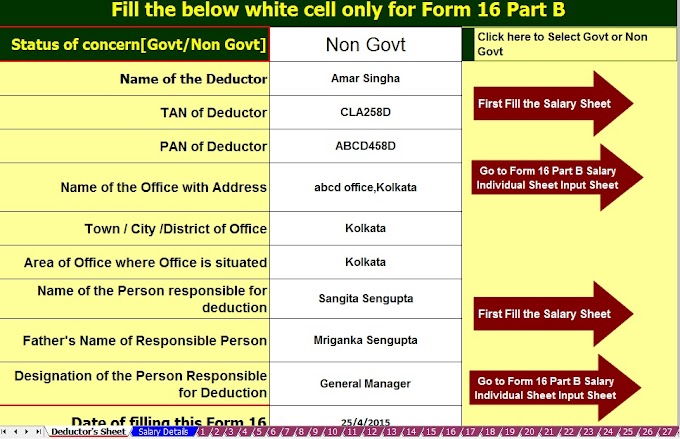

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Income TaxShow All

All about Income Tax Salary Certificate Form 16 for Salaried persons for F.Y.2016-17 with Automatic Form 16 for F.Y.2016-17

mtaxsftware.net

18:37:00

Automated Master of Form 16 Part B for F.Y.217-18 and A.Y.2018-19 with Best Tax Saving Options Other Than 80C for F.Y.2017-18

mtaxsftware.net

18:32:00

New amended Automated Pan Card Application Form 49A (Amended Format) in Excel

mtaxsftware.net

19:03:00

What is the requirement of Income Tax Form 16 to salaried persons? With Automated Master of Form 16 Part B for F.Y.2016-17 and A.Y.2017-18

mtaxsftware.net

18:08:00

Prepare One by One Automated Form 16 Part A and B and Part B for Financial Year 2016-17

mtaxsftware.net

18:20:00

Automated Income Tax Master of Form 16 Part A and B for F.Y.2016-17 + Additional Deduction of Housing Loan Interest under Section 80EE for F.Y.2016-17

mtaxsftware.net

18:19:00

Prepare at a time 50 employees Form 16 Part B for F.Y.2016-17 and A.Y.2017-18 ( Master of Form 16)

mtaxsftware.net

18:15:00

Download the Automated Master of Form 16 Part B for prepare at a time 50 Employees Form 16 Part B for Finan…

You Must Know About Tax Form 16, Plus Automated Master of Form 16 Part B for Financial Year 2016-17 and Ass Year 2017-18

mtaxsftware.net

18:25:00

In this fast moving world, young individuals switch job more often with an aim to get a better opportunity …

Mandatory to Download the Form 16 Part A from TRACES PORTAL, Plus Automatic Form 16 Part B for Financial Year 2016-17

mtaxsftware.net

17:08:00

Government notifies mandatory v erification of Pa r t A of Form N o . 16 (employer certificate) for Fi…

Download all Type of Income Tax Form 16 For Fin Yr 2016-17 and Ass Yr 2017-18

mtaxsftware.net

18:50:00

Now in this time to prepare the Income Tax Form 16 which will be given to the employee and which will be pr…

Tax Planning Tips for A.Y. 2018-19,Plus Automated Income Tax Preparation Excel Based Software all in One TDS on Salary for F.Y.2017-18

mtaxsftware.net

18:09:00

Tax planning has always been the test of efficiency for people along with being a test of their cunningne…

Gratuity Exemption from Income Tax U/s 10(10) + Arrears Relief Calculator U/s 89(1) with Form 10E

mtaxsftware.net

17:18:00

If Gratuity is received by any employee while in employment then it is fully taxable in the hands of an emp…

Leave salary exemption U/s 10(10AA) in Income Tax + Automatic Master of Form 16 Part A and B for F.Y.2016-17 and Ass Year 2017-18

mtaxsftware.net

19:10:00

If Leave salary encasement is received by any employee while in employment then it is fully taxable in th…