- Home-icon

- Form 10 E

- Form 16

- Tax Software

- _Govt & Private employees

- _Non-Govt Employees

- H.R.A.

- Arr.Relf 89(1)

- Tax Software

- _Private Employees

- _Govt & Private Employees

- Form 16 Part B

- _Master of Form 16 Part B

- _Master of Form 16 Part A&B

- _Master of Form 16 Part A&B

- _One by One Form 16

- _Arrs.Relf.Calculator

- Contact Us

Showing posts with the label Automated Income Tax Form 16 for A.Y. 2018-19Show All

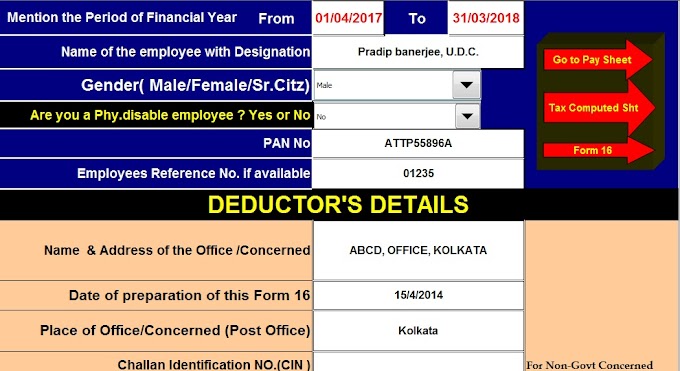

Download Automated One by One Preparation Form 16 Part A& B and Part B for F.Y.2017-18

mtaxsftware.net

18:44:00

Where are few employees with any concern, they can use this One by One Preparation Excel Based Form 16 Part…

Automated Form 16 Part A and B and Part B for F.Y. 2017-18 With Income Tax Exemption From Under Chapter VI-A for the F.Y. 2017-18 [Amended by the Finance Budget 2017]

mtaxsftware.net

18:11:00

DEDUCTIONS FROM GROSS TOTAL INCOME (CHAPTER VI-A) UPDATED AS ON APRIL 1, 2017

Download & Prepare at a time 100 employees Excel Based Form 16 Part A&B for F.Y.2017-18

mtaxsftware.net

17:16:00

Click here to Download & Prepare at a time 100 employees Excel Based Form 16 Part A&B for F.Y.2017-…

Income Tax Section 288A and 288B (Round Off) of Income Tax payable/Refundable as per the Income Tax Act 1961, With Automated Master of Form 16 for F.Y.2017-18 and A.Y.2018-19

mtaxsftware.net

18:18:00

As per the Income Tax Section 288 A and 288 B which is clearly mentioned in the Income Tax Act 1961 and …

Prepare at a time 100 employees Form 16 Part A&B for the Financial Year 2017-18 & Assessment Year 2018-19 with New Income Tax Slab Rate for F.Y.2017-18

mtaxsftware.net

17:47:00

Some of the Govt and Non-Govt Concerned yet not prepared the Salary Certificate Form 16 and they have yet …

Exemptions from Chapter VI-A as per Finance Budget 2017-18, Plus Automated Master of Form 16 Part A & B for F.Y.2017-18 and A.Y.2018-19

mtaxsftware.net

17:57:00

1) DEDUCTION IN RESPECT OF INVESTMENTS IN SPECIFIED ASSETS (SECTION 80C)

Automated All in One TDS on Salary for Assam State Employees for F.Y.2017-18

mtaxsftware.net

19:04:00

Click here to Download the Automated All in One TDS on Salary for only the Assam State Govt Employees for t…

DOWNLOAD INCOME TAX TDS ON SALARY AUTOMATED ALL IN ONE FOR NON-GOVT EMPLOYEES FOR F.Y. 2017-18

mtaxsftware.net

18:35:00

Download the Automatic Income Tax Preparation Excel Based Software for only Non-Govt employees for the Fin…

Auto fill Income Tax All in One TDS on Salary for Government & Private Employees for F.Y.2017-18

mtaxsftware.net

18:32:00

Auto fill Income Tax All in One Income Tax Preparation Excel Based Software for the Financial Year 2017-18…

Exemptions from Chapter VI-A as per Finance Budget 2017-18, Plus Automated Master of Form 16 Part A and B for F.Y.2017-18 and A.Y.2018-19

mtaxsftware.net

18:43:00

1) DEDUCTION IN RESPECT OF INVESTMENTS IN SPECIFIED ASSETS (SECTION 80C) Section 80C provides fo…

Automated All in One TDS on Salary for Govt. and Non-Govt Employees for F.Y.2017-18 and A.Y.2018-19, Plus Income Tax Benefits on Joint Home Loan ?

mtaxsftware.net

18:21:00

Download Automated All in One Income Tax Preparation Excel Based Software for Govt & Non-Govt employees…

Income Tax Exemption to the salaried person as per the Finance Budget 2017-18 as given below along with the Automated All in One TDS on Salary for Non-Govt employees for the F.Y.2017-18 and A.Y.2018-19

mtaxsftware.net

17:43:00

Download Automated Income Tax Preparation Excel Based All in One TDS on Salary for Only Non-Govt Employees …

![Automated Form 16 Part A and B and Part B for F.Y. 2017-18 With Income Tax Exemption From Under Chapter VI-A for the F.Y. 2017-18 [Amended by the Finance Budget 2017]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhWxt90PSZReUM58R51KgI0AHZifi165RD_yt0E-3EUReu6mDG3EKczqrt9T2WtF5i2D0gZ4qSzS_rSGA1LSkdfGmSc2p2WQ5DdB3aORaLyQyWdhuA9CpPszxb9hlXRSk9ijhyg8n3xX7G_/w680/One+by+One+Form+16+Page+1.jpg)