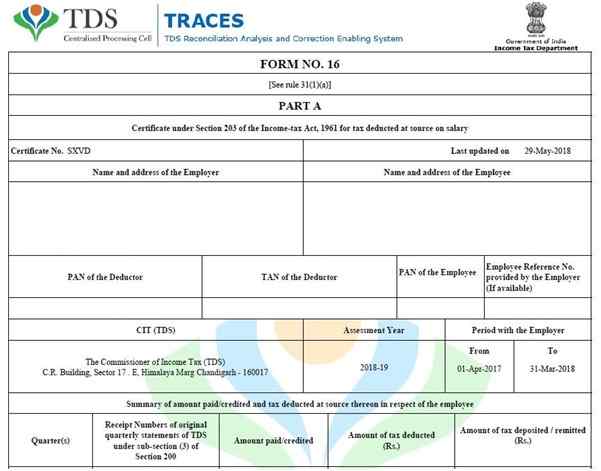

What is Form 16 for Income Tax? Form 16 is nothing more than a certificate issued by your

an organization providing information about the salary you received during the financial year and the

amount of TDS withheld from your salary.

In the event that the income from your annual salary exceeds the original withholding tax limit; then, your employer is required to deduct TDS from your salary and pay it to the Government of India. Employers provide 16 forms to their employees as proof of filing a tax return. If your annual income is below the discount limit, no TDS is deducted from your paycheck.

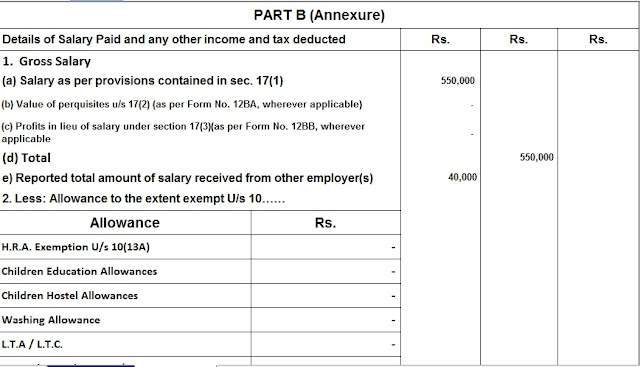

Form 16 Part B is issued annually by the employer containing information on other income, exemption benefits, arrears in wages, taxes payable, etc., which is usually before June 15 of the following year. This immediately follows the tax year in which the tax is withheld. You don't have to worry if you lose 16 forms, you can get duplicates issued by your employer without any recruitment problems

The essential elements of Form16 Part A are listed below:

Employer information such as billing account number (TAN), name, fixed account number (PAN), tax exemption, etc.

All information related to tax payment such as amount, invoice number, money order number, check number, etc.

Tax is withheld as per Section191A.

Recognition of the total amount of tax paid by the employer.

• Extra information such as wages, total salary, net salary, parks, deductions etc.

• TDS receipt provided.

If you work with only one employer in a financial year, that employer will post Form 16 for the full fiscal year. If you change jobs and work for more than one company in a financial year, Form 16 will be issued to all employers individually during their period of employment.

0 Comments