New G.P.F / EPF / VPF Income Tax Rules You Should Know | New Pension Fund Income Tax Rule: The CBDT has notified entities to maintain two separate PF accounts. One of the accounts will be for taxable contributions and the other for non-taxable contributions starting April 1, 2021.

• New income tax rules for the GPF: following the pension fund rationalization announced in the 2021 budget, the Central Board of Direct Taxes (CBDT) introduced rule 9D of the income tax rules, 1962

New Income Tax Rules for the GPF: Since the start of the new fiscal year 2022-23, the various income tax rules announced in the 2022 Union Budget have come into effect. Therefore, it is important for the taxpayer to be aware of the new changes in the income tax rule that have now been applied. One of them is the taxation of contributions to the Reserve Fund (PF) exceeding Rs 2.50 lakh. Following the pension fund rationalization announced in the 2021 budget, the Central Board of Direct Taxes (CBDT) inserted Rule 9D of the 1962 Income Tax Rules in Exercise 22. Under this rule, each EPFO subscriber will have two PFs. / EPF, while the second account contributions to the PF exceed the threshold.

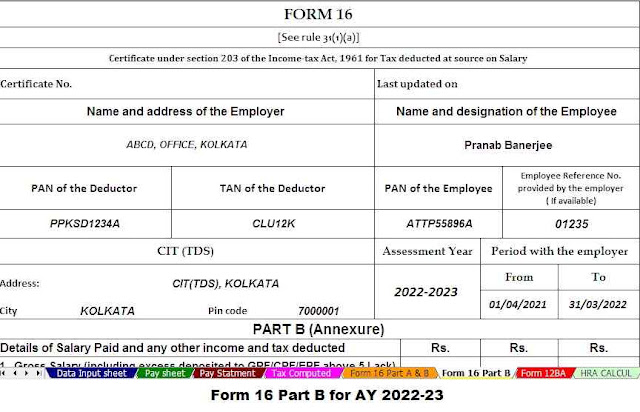

Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

Speaking of new income tax rules for the GPF or General Pension Fund; A SEBI-registered tax and investment expert said: “In the 2021 budget, the union finance minister announced a streamlining of the pension fund by taxing interest from the pension fund earned on a contribution of Rs 2.50 lakh in one year.

To ensure the implementation of this announcement and the regular calculation of interest on PF earned by an EPFO subscriber, the CBDT introduced Rule 9 of the Income Tax Rules of 1962 in the fiscal year 2021-22.

Under this rule, each EPFO subscriber will have two EPF or PF accounts where a PF contribution of more than Rs 2.50 lakh for one financial year will be deposited in the second PF or EPF account.

Thus, interest earned on an EPF/PF-1 account will be exempt from any taxation, while interest earned on a PF/EPF-2 account will be taxed.” from the new financial year, the system of two accounts began to be applied. EPF or PF. However, the classification of taxable and non-taxable PF accounts will come into effect on April 1, 2021.

Download and Prepare at a time 50 Employees Form16 Part B for the F.Y.2021-22

Explain the new income tax rules for the GPF; “The CBDT has advised that organizations must maintain two separate accounts in the PF. One of the accounts will be for taxable contributions and the other for non-taxable contributions starting April 1, 2021. Interest accrued on contributions deposited in a taxable account with the EPF will be taxed."

On how the new income tax rules for pension fund contributions will work, “Interest earned from an employee's contribution to a pension fund account will be taxable if the contribution in the financial year exceeds 2.5 lakh. If there is, if the employer does not contribute to the pension fund account, the threshold will be 5 lakh rupees per year.”

For example, EPFO salaried subscriber contributes Rs 1.5 lakh to EPF accounts and Rs 1.5 lakh to VPF accounts during the 2021-22 fiscal year. The initial balance of the PF account on April 1, 2021, is 20 lakhs. The total contribution to the pension fund account in the fiscal year 2021-22 is Rs 3 million. The contribution of Rs 2.5 million EPF will then be credited to a tax-free account and Rs 50,000 will be credited to a taxable account. The balance of the non-taxable account on March 31, 2022, will be Rs 22.5 lakh (the initial balance on April 1, 2021, is tax-free) and the taxable account is Rs 50,000. The 8.5% interest rate applicable to the 2021-22 fiscal year on £50,000 would therefore be taxable in the hands of the EPFO subscriber.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments