Finance Bill, 2022 | Latest Income Tax Table F | Y 2022-2023 (A | Y 2023-24) - Budget Review 22 | Income Tax Rule Changes and the Latest Income Tax Chart There are two main things most people

look for in a budget | Details in the income tax plate F|Y 2022-23 (A|Y 2023-24). Union budget 22 and

what are the main changes in income tax from employees |

Tax-free work from home and standard deduction increases are among Nirmala Sitharaman's 2022 wage class expectations for the union budget.

The 2022 budget is just around the corner. Increasing the standard deduction, income tax credit, and child education funded tax relief are some of the wage class expectations in Nirmala Sitharaman's 2022 Union Budget. Some of the points and expectations are listed below.

Tax-free work-from-home allowance for employees

Due to the high collection of direct taxes this tax year, there may be an opportunity to increase tax deduction limits. For example, the standard deduction available for those with wages could be increased and currently stands at Rs 50,000.

Increase in the standard deduction, income tax relief for savings for children's education

For employees and retirees, the standard deduction is the allowable deduction from gross earnings. This deduction reduces a person's taxable income in the form of wages and also reduces his or her tax burden.

After being abolished in the fiscal year 2005–2006, the standard deduction for salaried taxpayers was reintroduced from the fiscal year 2018–19 at Rs 40,000. Ultimately, the contribution ceiling was increased to Rs 50,000 from the 2019-20 financial year.

“Given the fixed costs of inflation over the years and the ongoing living costs of salaried workers, the amount of the deduction is relatively small. Since the outbreak of the Covid-19 epidemic, household spending has been negatively affected by rising medical bills and work from home, such as buying furniture, energy and the Internet.

Therefore, the current standard deduction ceiling of Rs 50,000 should be raised to at least Rs 75,000. In addition, taxpayers who elect the additional sectarian regime under section 115BAC of the Income Tax Act of 1961 are eligible for the standard deduction.

The need to deduct savings for higher education for children

Saving money for a child's college education is an important financial goal for everyone, and most people set aside a certain percentage of their salary towards it.

Alternatively, the deduction for education expenses (including tuition fees) may be deducted from the section 80C deduction and may be treated as a separate deduction. In short, such an increase in the standard deductions and additional deductions for education spending will bring large savings for future purposes, as well as provide incentives for individuals through tax savings.

Tax exemption provisions

(A) Income tax rate;

(B) Tax incentives;

(C) Eliminate problems faced by taxpayers;

(ii) Tax guarantee measures;

(E) Expand and deepen the scope of taxation;

(F) Revenue collection provisions;

(G) Improve the efficiency of tax administration;

(H) Prevent the misuse of taxes; As well as

Feature of this Excel Utility:-

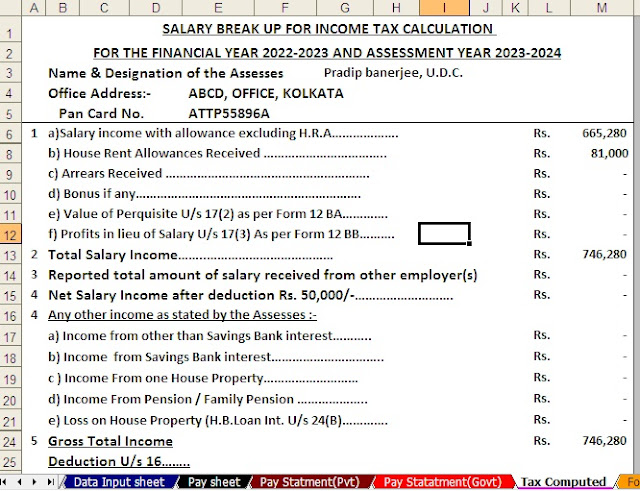

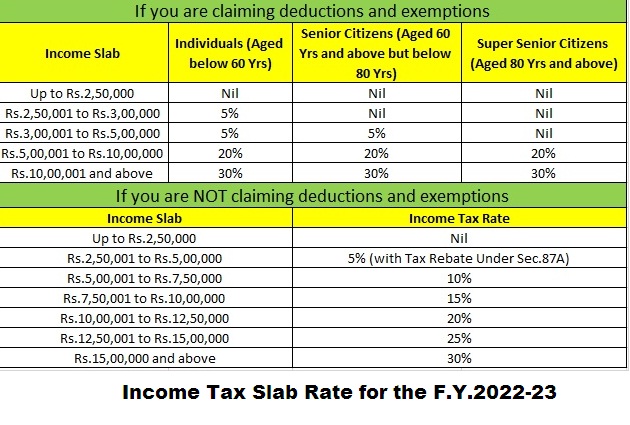

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

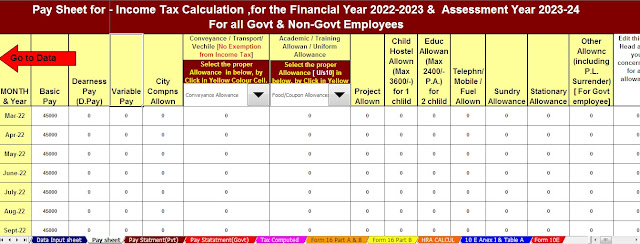

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

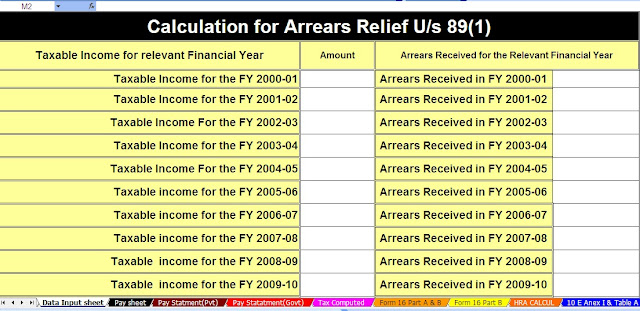

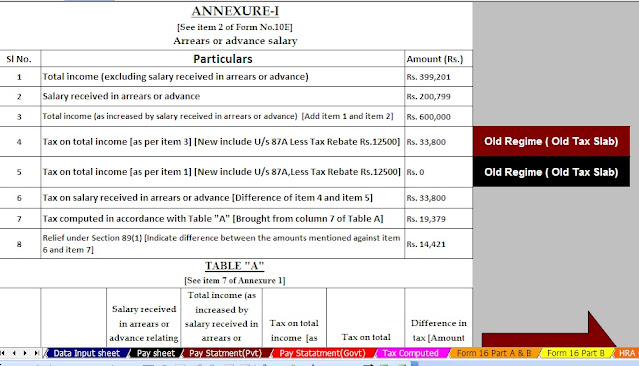

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments