U/s 89 (1) Income Tax Exemption Calculator with Form 10E |How can income tax arrears be exempted from wage arrears from the previous tax year? If we really assume you might be nervous about the tax consequences of the equivalent. Would it be okay for me to have to pay taxes on the total taxable amount? Shouldn't something be said about the previous year's tax checks etc? For taxpayers with such demands in mind, here's all you need to know.

For now, I recently found out that income tax is determined by the taxpayer's total income for a specific year. Income can be a salary, an annual family stipend, or various sources of income.

However, there may be circumstances where you have received family benefits in arrears or your salary has come close during the current cash year. It may happen that a taxpayer gets a hint of her preferred status or salary early or late in any money-related year, accumulating her total income similarly as taxes payable increase. In such a case, an application can be filed and the inspection body may allow the taxpayer to be exempted.

In summary, the Income Tax Law ensures that there is value in the irregularity rates of the Income Tax, in this way, when no indication of income is related to the current year, the exemption is abandoned with the objective of that the taxable income does not increase.

To ensure that it does not interfere with the completion of additional taxes, the Income Tax Office grants you Relief U/s 89 (1). In the event that you have earned any annual salary or part of the previous year, you will not be taxed on the total amount of the current year. Basically, it prevented you from paying additional taxes by thinking about the path in which the partial delays occurred.

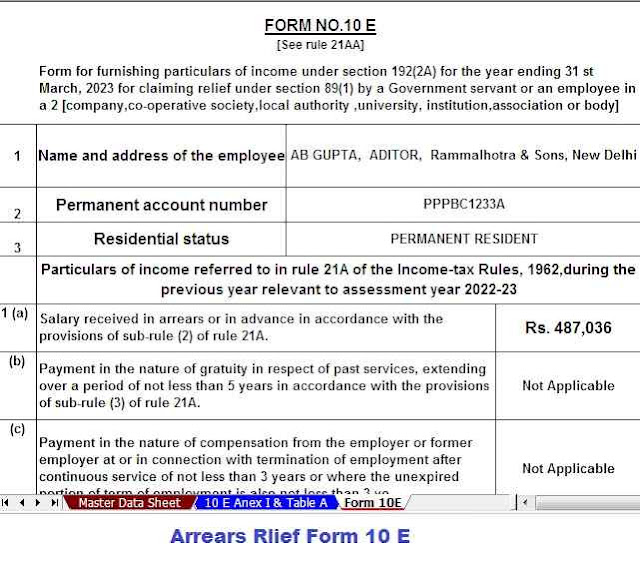

To take advantage of the provisions set forth in Section 89(1), you must file a Form 10E. Form 10E will be the most obvious request. The exact details of Form 10E, about how to file the amount, and why are listed below.

What is relief under section 89(1)?

Specifically when the taxpayer obtains:

1. Back wages or

2. Salary advance or

3. Arrears in family pensions

At this point, this amount is taxable in the cash year in which it was acquired.

In any case, the exemption is granted pursuant to section 89(1) to reduce additional tax inconveniences due to the deferral in obtaining such income.

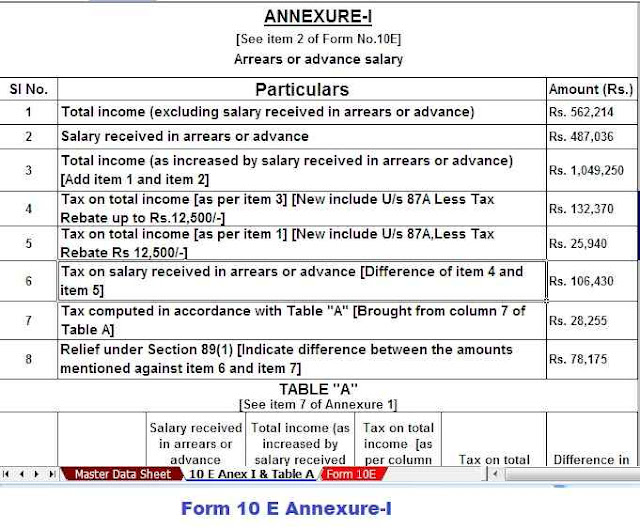

How is the exemption under Section 89(1) calculated?

The following is the best approach for calculating the exemption under Section 89(1) of the Income Tax Act of 1961:

1. Calculate the tax to be paid on the total income by reviewing the arrears of the year in which they were accrued.

2. Calculate the tax to be paid on the total income regardless of the delay in the year in which they were accrued.

3. Calculation of the separation between some points in the measure of (1) and (2).

4. Tax to be paid on the total taxable income for the year to which the arrears refer, including arrears.

5. Calculate the separation between some points of the range (4) and (5).

6. The amount of the exemption is the amount of abundance (3) more than (6). No exemption will be allowed if quantity (6) is greater than the quantity in (3).

What is Form 10E?

To secure exemption under Section 89(1) for back wages earned, Form 10E is expected to be filed with the Department of Income Taxes. If the Form 10E is not filed and the exemption is granted, then the taxpayer is on track to receive a warning from the Income Tax Office for not filing the Form 10E.

0 Comments