Why is Form 16 required? Salary Certificate Form 16 is a most important document because:

• It shown as proof that the government has received the tax deducted from your employer.

• Assist in the process of filing your tax return with the Income Tax Office.

• Many banks and financial institutions require Form 16 to check the person's solvency when applying for a loan.

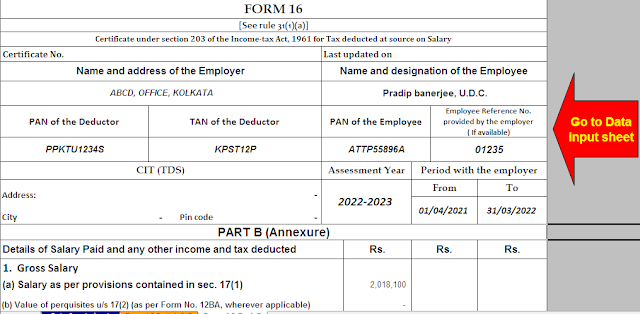

Download Automatic Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel utility prepare one by one Form 16 Part A&B and Part B for F.Y.2021-22]

What is Form 16?

Form 16 is a salary certificate supply to salaried persons by their deductor when deducting the tax from the employee's salary. Put simply, it is an acknowledgment that your tax deduction has been filed with the Income Tax Office.

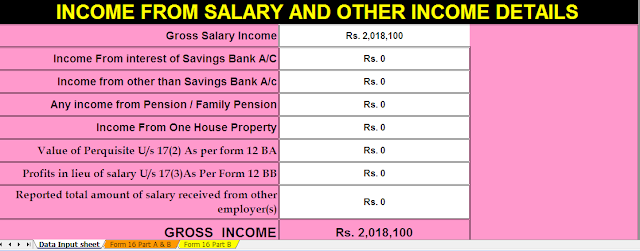

Salary Certificate Form 16 is a most valuable document that is issued under the provisions of the Income Tax Act, 1961. Form 16 details the amount of withholding tax (TDS) on salary from your employer along with the breakdown of salary for the financial year. In short, it can be said that Form 16 is a TDS test certificate deduced and filed by your employer.

Download Automatic Income Tax Form 16 Part B for the F.Y.2021-22[This Excel utility prepare at a time 50 employees Form 16 Part B for F.Y.2021-22]

Who issues form 16?

The Income Tax Act instructs an employer holding a TAN number and deducting employee salary tax to issue Form 16. Whether your tax is not deducted, your employer may refuse to issue form 16.

Download Automatic Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel utility prepare at a time 50 employees Form 16 Part A&B for F.Y.2021-22]

When should form 16 be issued?

It must be released by June 15 of the year for which it is released. For example, F.Y. 2017-18, the deadline for issuing Form 16 was June 15, 2018. If an employer delays or fails to issue Form 16 by the specified date, they are required to pay a fine of Rs 100 per day until on that date. The default continues.

Download Automatic Income Tax Form 16 Part B for the F.Y.2021-22[This Excel utility prepare at a time 100 employees Form 16 Part B for F.Y.2021-22]

0 Comments