Deductions U/s 10|As per the Income Tax Act, 1961, each tax payers Indian citizen who's Income above a certain limit of income is liable to pay tax. So, with each financial year falling, taxpayers look for ways to reduce their tax liability.

To reduce the burden on taxpayers, to encourage them to save, invest and pay taxes, the law lists some incomes as exemptions.

Benefits U/s 10 of the Income-tax Act

Salaried Persons are given many benefits in addition to regular income. too many of these deductions are allowed part of the total income, whereas some of them are allowed for exemption under section 10.

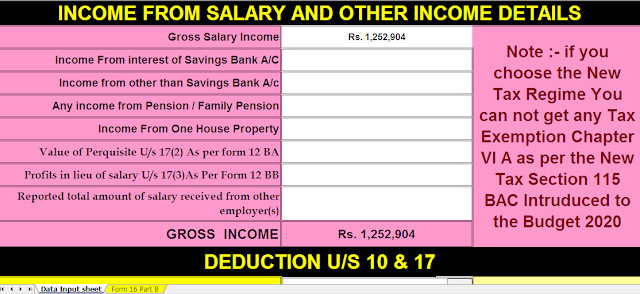

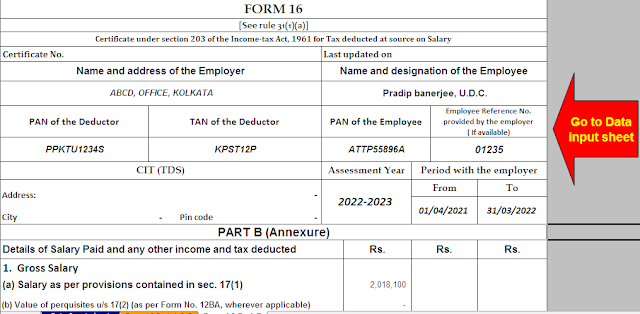

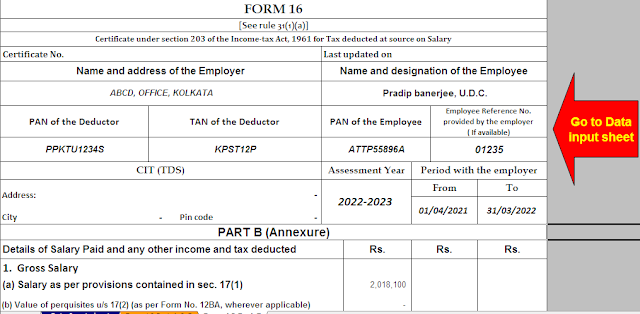

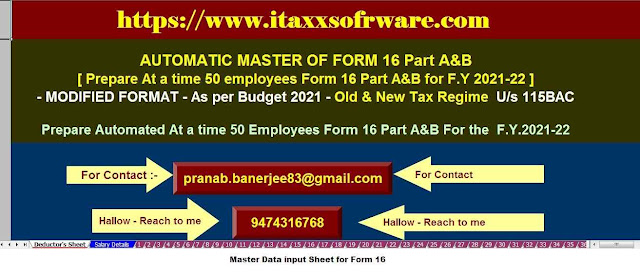

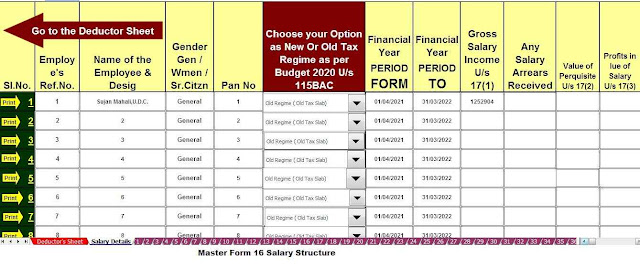

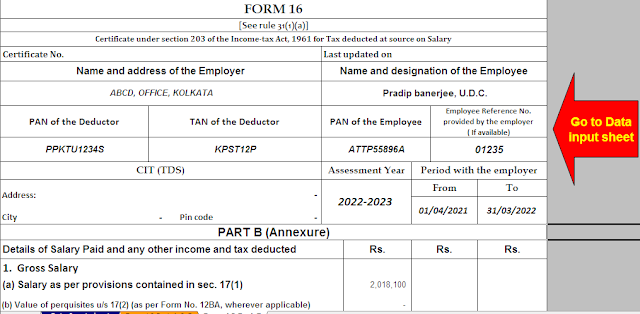

You may also, like- Automated Income Tax Form 16 Part B for the F.Y.2021-22[This Excel Utility can prepare One by One Form 16 Part B as per Old and New Tax Regime U/s 115 BAC]

1. Special allowance under section 10 (14):

Some allowances are classified as special discounts under section 10 and no tax is levied. Exceptions are subject to the allowable amount or the actual amount used for the specific purpose, whichever is less.

2. Daily Allowance: This includes daily compensation to cover expenses incurred during an official tour or relocation / transfer to a new place of work.

3. Travel Allowance: It is paid to the employees to cover their travel expenses during official visit or job transfer.

4. Assistant Allowance: This concession is given for the fee of an assistant appointed to assist in the discharge of government duties.

5. Uniform Allowance: In case it is required to wear uniform in line of office duty, allowance is given to cover the cost of purchase and maintenance of uniform.

6. Transport Allowance: This grant is given to cover the cost of official travel. It does not reimburse the cost of traveling from home to work.

You may also, like- Automated Income Tax Master of Form 16 Part B for theF.Y.2021-22 for 50 Employees[This Excel Utility can prepare at a time 50 Employees Form 16 Part Part B as per Old and New Tax Regime U/s 115 BAC]

7. Another allowance under section 10 (14) (ii):

Exemption of allowances under sub-section (14) (ii) of section 10 of the Income-tax Act

Climate allowance: This includes compensation for working at high altitudes or in hilly areas.

Up to Rs.800 / - for Himachal Pradesh, Uttar Pradesh, Jammu & Kashmir & North Eastern Hills.

Discount up to Rs 7,000 per month for Siachen.

Discount up to Rs. 300 for other high altitude places.

• Tribal Area Allowance: Rs.200 / - for those working in pre-classified tribal, scheduled or agency areas like Karnataka, West Bengal, Madhya Pradesh, Assam, Orissa, Tamil Nadu, Bihar, Uttar Pradesh and Tripura.

Border Area Allowance: Under Rule2BB of Section 10 (14) (ii), allowances ranging from Rs.200 to Rs.1,300 per month are given to Armed Forces personnel working in border areas, remote areas or any troubled area. .

Compensatory Field Allowance: Grant of Rs.2,600 / month is acceptable under section 10 (14) (ii), if a person is allowed to perform duties in unusual areas like Nagaland, Jammu and Kashmir, Himachal Pradesh, Uttar Pradesh. Being given. ,

• Child Education Fund: Under this section 10 (14) (ii) up to a maximum of 2 children are given a rebate of Rs.100 / - on allowance. 300 / month / hostel allowance can also be claimed for a child up to two children.

Anti-Terrorism Allowance: 3,900 / month This grant is directed to the persons employed in the Armed Forces for the purpose of Section 10 (14) (ii).

ীপ Island Fee Allowance: Exemption under Section 10 (14) (ii) of Rs.9600

Another allowances under sub-section (14) (ii) of section 10 of the Income-tax Act include:

800 per month for underground miners.

Rupees for workers in highly active sectors. 4,200 / month.

1,000 1,000 / month for staff in certain changed area areas.

Physically handicapped employees will get Rs. 1,600 / month.

• Transportation allowance Rs. 1,600 / month.

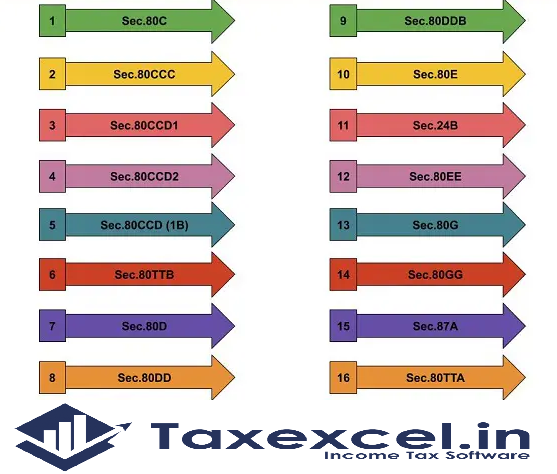

In addition to the above section, you will get Rs. You can save up to 46,800 under section 80C of the Income Tax Act. Term insurance is one of the most effective ways to save tax under this category. So choose a term policy now.

Download Automated Income Tax Master of Form 16 Part B for the F.Y.2021-22 for 100 Employees [This Excel Utility can prepare at a time 100 Employees Form 16 Part Part B as per Old and New Tax Regime U/s 115 BAC]

0 Comments