Leave Travel concession or exemption, Under Section 10 (5) and Rule 2B

General provisions. In some cases, the employer may provide vacation leave or assistance to his employee to go on vacation anywhere in

Family vacation travel discounts include: employee's wife; the employee's child (minor or principal, dependent or independent, married or single); And if the employee's parents, brothers and sisters depend on him.

Download One by One Preparation Form 16 Part B in Excel fort he Financial Year 2021-22[This excel Utility can prepare one by one Income Tax Form 16 Part B]

No waiver is allowed for the third or subsequent children born after 1 October 1998. This rule does not apply to multiple births.

Discount amount

Discounts will be at least among the following:

A) the actual cost of carrying out the trip; or

B) The prescribed amount as indicated below

1) If the journey is by plane, the maximum discount is equal to the convenient fare charged by a national carrier for the shortest route to the destination.

2) If the trip is made by any means of transport other than by plane

If a non-travel holiday travel discount is available, the full amount received by the employee will be taxable. The above discount is only acceptable for travel expenses. The cost of boarding, accommodation, travel from accommodation to train station / airport / bus stop and other expenses during the journey will not be eligible for discounts.

The Assessor can request a discount on any two trips in the 4-year block. If the assessor does not take advantage of the discount on holiday travel in a given block, a maximum of one trip can be anticipated and this advance must be made within the first year of the following block. Such onward travel will not be taken into account when determining the round trip tax deduction for the next block.

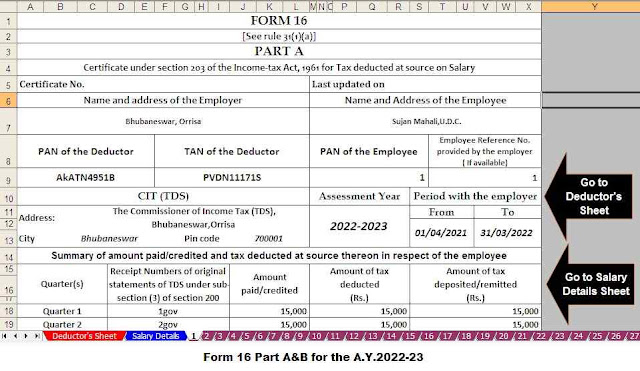

Download One by One Preparation Form 16 Part A&B in Excel for the Financial Year 2021-22[This excel Utility can prepare one by one Income Tax Form 16 Part A&B]

0 Comments