Before you can file a tax return, you must have Form 16 - if you are an employee of a company, or Form 16A - if you have income from a source other than your salary. Form 16 Part B and Form Part 16 A are tax deducted at source (TDS) certificates used by income earners when filing tax returns. Both the forms were issued under section 203 of the Income-tax Act, 1961. In addition to being important documents for tax compliance, they also serve as proof of TDS.

If no TDS is deducted, there is no need to issue the form 16

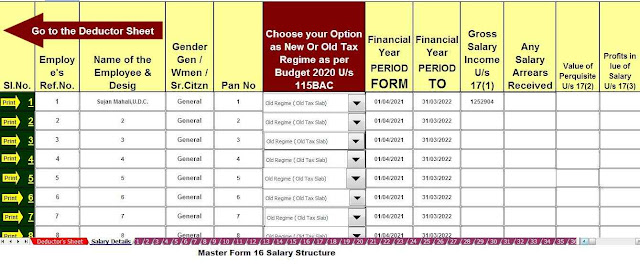

Download Automatic Income Tax Form 16 Part A&B for the Financial Year 2021-22 [This Excel Utility can prepare at a time 50 Employees]

What is Form 16?

Form 16 is a Salary TDS Certificate, which is issued annually to salaried employees. Section 203 of the Income Tax Act, 1961 has made it mandatory for employers to issue Form 16 to their employees, showing TDS of their total income. This serves as proof to employees that their tax has been deducted at source.

If the income you earn is above the discount limit. 2.50,000, then according to the Income Tax Act, your employer will have to deduct TDS from your salary and submit it to the government. If you change jobs within a year, you will be issued multiple Form 16s (depending on the company you worked for).

What is included in Module 16?

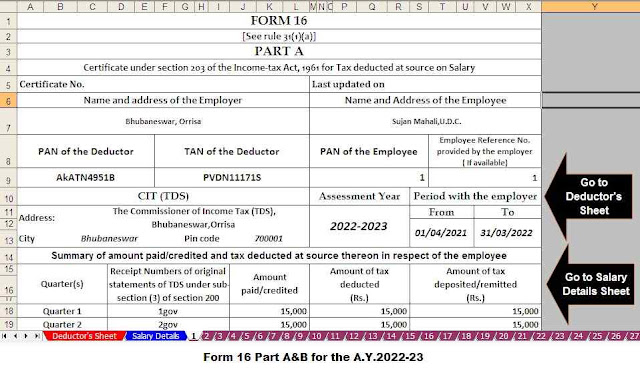

Part A of Form 16 contains basic details of the employer and the employee. This will include, among other things, a unique TDS certificate number, the employer's PAN and TAN, the employee's PAN and the employment period with the employer. Form 16 will also contain details of payments made to the employee and deductions at source year.

Part B of Form 16 contains the elements of your salary and the deductions you have requested. Some of the items you will see in Part B of Form 16 are income under "Salary", Chapter VI-A (Sections 80C, 80CCC, 80CCCD), Total Income, Taxes and Taxes on Total Income.

Download Automatic Income Tax Form 16 Part B for the Financial Year 2021-22 [This Excel Utility can prepare at a time 50 Employees]

0 Comments