Significant changes in income tax which will be effective from 1st April 2021 The new financial year

is going to start from 1st April The government has planned some major changes for this financial year

(2021). In the 2021 budget, Finance Minister Nirmala Sitharaman did not provide any relief to the

middle class and paid the class in terms of income tax. But those who are over 65 years of age are

exempted from filing income tax returns this time.

Note this, this has been already decided to take major action against those who do not file income tax returns. All these changes will be effective from 1 April 2021

If any taxpayers do not file an income tax return (ITR) from 1st April, the interest rate on TDS on bank deposits will be doubled. This means that if a person does not come to the income tax outgo slab and file an ITR, the rate of TDS on him will be doubled.

You may also, like- Automatic Income Tax Preparation Excel Based Software All in One for the

The changes in income tax will be effective from 1st April 2021

1. Pre-filled ITR form. A major change in ITR forms is expected as per Budget 2021 (Pre-filed ITR). The pre-filled ITR forms will contain information on capital gains, dividend income, interest from bank/post office, etc. on the listed securities. Previously pre-filed ITR forms were available to salaried employees where income was reflected on the basis of Form 16, but now the scope has expanded.

2. Interest tax on PF interest earned from the last fund of the payer is exempt from income tax. However, Budget 2021 proposes that the interest on employee contributions to the Provident Fund be Rs. 2.5 lakh should be taxable.

3. Punishment for not linking Aadhaar and PAN. The date fixed for linking Aadhaar and income tax PAN is 31st March 2021. In the case of non-linking, your PAN card will be activated In the case of non-linking, you may be fined. Rupees Ten Thousand under Section 272B of the Income Tax Act. Link the pan to the reservoir

4. Income Tax Return (ITR) High TDS / TCS Rate for Non-Filers A new paragraph 206AB (ITR) has been inserted in the Income Tax Act as a special provision for an upper rate of TDS to non-filers of income tax returns. The proposed rate for non-filers is higher among the following: 5% Double the rate or double the effective rate mentioned in the relevant provisions of the law. Similarly, a new section 206CCA has been inserted in the Income Tax Act as a special provision for Income Tax Return (ITR) for TDS for non-filers. Arranging high rates. The recommended rate for non-filers is higher than the following: 5% double the rate specified in the relevant provisions of the law.

5. Billing under LTC Cash Voucher Scheme To get tax benefits under LTC Cash Voucher Scheme, make sure that your employer has submitted the required bills in a proper format including GST amount and seller's GST number (Employer paid on or after March 31, 2021). The scheme is being offered earlier. According to the scheme, an employee has to spend three times the amount considered as LTA rent on goods and services attracting 12% or more GST.

6 There is no tax filing for citizens over 75 years of age who are over 75 years of age and whose pension income and interest on fixed deposits come to the same bank and who have only interest income, do not have to file an income tax return. The bank will deduct the income tax he has to pay and submit it to the government.

Relief for super senior citizens

Can this Rule apply to super senior citizens? In this regard, Pankaj Mathpal (Managing Director of Optima Money Managers) said that from April 1, 2021, senior citizens above 75 years of age will not have to file ITR. This exemption is given to senior citizens who are dependent on pension or fixed deposit interest.

Income tax law came to the country 160 years ago. In 1860, James Wilson, a British officer, presented the first budget. Added to this is the income tax law. In the first budget of the country, income tax exemption was given to the annual income earners up to Rs. 200. The Income Tax Act of 1961 is still in force in the country. It is corrected from time to time.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

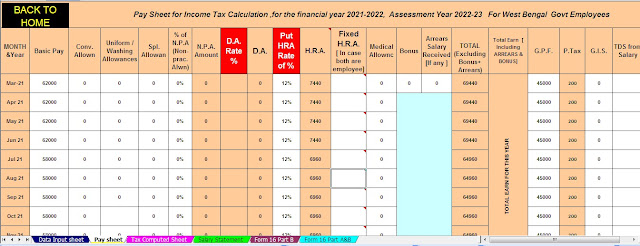

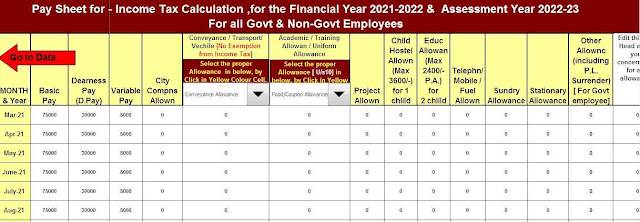

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

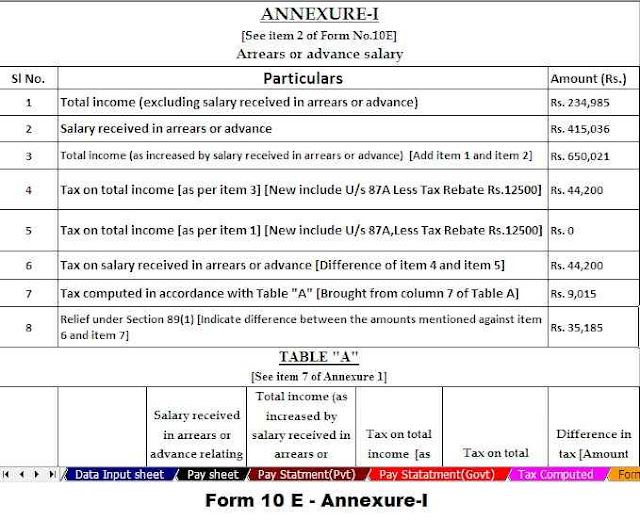

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments