How to save tax through NPS| With Automatic Income Tax Preparation Excel Based Software All in

One for the West Bengal Govt Employees for the F.Y.2021-22

How to save tax by NPS investing an additional Rs 50, 000,.Investment in the National Pension System (NPS) is a hot topic of discussion from the perspective of tax protection for individual taxpayers considering various changes in the Income Tax Act in recent years. The NPS Tier 1 account provides tax benefits to the employer as well as the employee / self-employed person for their contribution to the NPS.

The tax benefits at the contribution stage are summarized below:

A person who has deposited any amount in his NPS account in a financial year can claim a rebate from his total income which is limited to 10% of the basic salary of salaried persons and 20% of the total income of self-employed persons. . This discount is for contributions made directly or in person by the employer.

Section 80CCE specifies the total amount of exemption permitted under sections 80C and 80 CCD (1) of the Income-tax Act., However, deposit in Section 80C baskets (EPF, PPF contributions, etc.),80CCD (1) also.

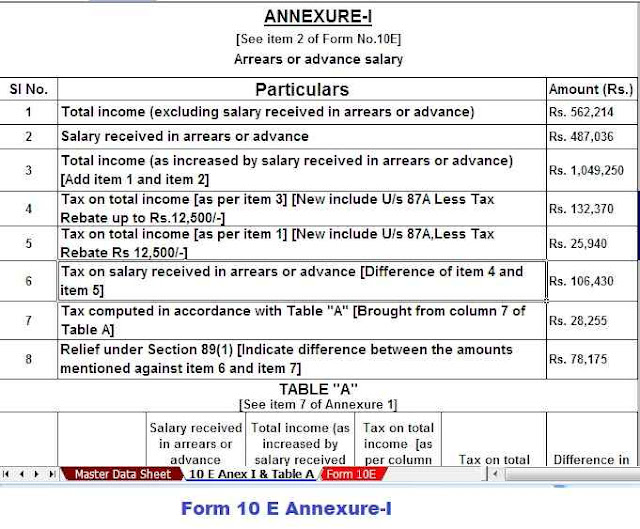

You may also, like-Automatic Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10 E from the F.Y.2000-01 to F.Y.2021-22

Recently, U/s 80CCE permitted a person to an exemption up to Rs 1.5 lakh from the gross income if this Rs 1.5 lakh is invested in a specific way (including NPS). Certain expenditures are also eligible for exemption under the limit of Rs 1.5 lakh U/s 80CCE.

The maximum amount that can be deposited in NPS to claim deduction under section 80CCD (1) does not exceed 10% of a person's basic salary. After that, if 10% of the basic salary is below Rs. 1.5 lakhs, say Rs 1.40. deposit such as P.F., Tax-Saving F.D etc. Rs. 50,000 / - can be deposited in NPS in addition to Rs. 90,000 mentioned under 80CCD (1b). This rebate of Rs.50,000/-

Additional discount on NPS

To encourage investment in NPS, Section 80CCD (1B) of the Income-tax Act allows an additional rebate of Rs 1.5 lakh and above Rs 50,000 available under Section 80CCE.

Thus, where the individual taxpayer has exceeded the limit of Rs. 50,000 under Section 80CCD (1B) can be used to claim an additional rebate.

Employer's contribution

Employer's Contributions to the NPS account it is going to 80CCD(2)of an employee are governed by Section 17 (1) (viii) of the Income Tax Act applicable).

In Conclusion, Section 1 ((2) (vii) of the Finance Act, 2020 has been amended

Further, under section 17 (2) (viia), any interest, dividends, etc. earned by the employer on contributions above Rs. 7.5 lakhs and above will be taxable. The provision states that annual contributions will be calculated "in the prescribed manner" due to additional contributions. However, calculation guidelines are still pending.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount in to the in-words without any Excel Formula

0 Comments