What is Section 80TTA? Section 80TTA of the Income Tax Act gives a discount to interest income.

Limits are accessible for certain constraints and limitations. In this article, we have covered everything

identified with guaranteeing tax exemption because of interest procured

Tax exemption on interest income

Where a taxpayer's total income remembers any income through interest for the deposit, that income is without tax. The taxpayer should be a different taxpayer, an individual from the Hindu Unified Family or a Hindu Unified Family.

The way of acquiring interest should be a deposit with an investment account:

A financial organization where the Financial Guideline Act, 1949 (10 of 1949) applies

A co-usable society that carries on the financial business. A co-usable land contract bank or a co-employable land advancement bank

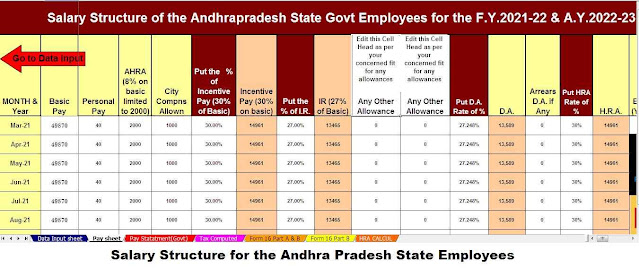

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure as per Andhra Pradesh State Employees Salary Pattern + Automatic Calculate H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B]

A mailing station under the Indian Postal Office Act, 1898

The assessor can guarantee tax exemption while working out his total income

Tax exemption on the interest income from time deposit isn't accessible. A period deposit is a deposit that is payable with a fixed interest rate upon the expiry of a specific timeframe. Subsequently, the exemption can't be given in the accompanying cases:

Interest from fixed deposits

Interest from repeating deposits

No other time deposit

The measure of exemption under Section 80TTA of the Income Tax Act

The most extreme rebate permitted under 8TTA is Rs 10,000 for one monetary year.

In the event that the total interest is under Rs.10,000, the genuine interest is limited.

In the event that the total interest is more than Rs 10,000, just Rs 10,000 is permitted as tax exemption

The appraiser should consider its total interest from all investment funds financial balances.

Qualification to make claims under 80TTA

Cutting endorsed under 80TTA

The accompanying taxpayers can guarantee derivations under Section 80TTA of the Income Tax Act:

Private Taxpayer or Hindu Unified Family (HUF)

Indian inhabitants

Non-Inhabitant Indians (NRIs) who own NRO Investment accounts

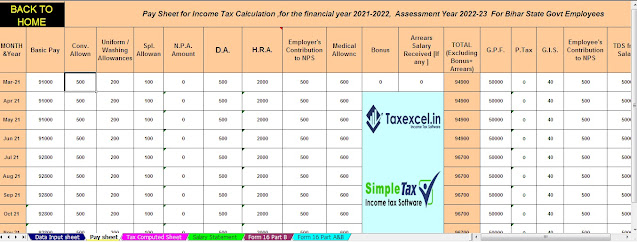

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure as per Bihar State Employees Salary Pattern + Automatic Calculate H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B]

An element with investment account in an association like a bank, mail centre or co-employable society

80TTA markdown

The accompanying sorts of taxpayers are not qualified for this rebate:

Interest income emerges from any deposit in a bank account. The record is in the interest of or for the benefit of:

A firm, or

A relationship of people, or

A collection of people

Then, at that point, no exemption will be given to any accomplice of the firm or any individual from the affiliation or any person of the association. No markdown can be given against the interest income of these taxpayers while computing the total income.

Essentially, a firm, AOP or BOI can't guarantee interest limits. Also, the accomplice or part accepts its income from these organizations, AOP or BOI. In this way, they can't guarantee a cut

Besides, even senior residents can't guarantee a waiver under the 80TTA. They can guarantee tax benefits inside 80TTB.

How to guarantee Section 80 TTA derivation while recording an income tax return?

You should first add interest 'income from one more source as interest income. You will then, at that point, need to guarantee tax benefits under Section 80TTA under 80 Exemptions.

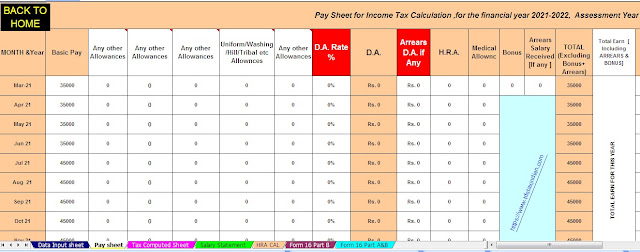

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure as per Jharkhand State Employees Salary Pattern + Automatic Calculate H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B]

Section 80TTB:-

Where a taxpayer's total income remembers any income through interest for the deposit, that income is without tax. The taxpayer should be an occupant of

Ways of procuring interest on deposits:

A financial organization where the Financial Guideline Act, 1949 (10 of 1949) applies

A co-usable society that carries on the financial business. A co-usable land contract bank or a co-employable land advancement bank

A mailing station under the Indian Postal Office Act, 1898

The assessor can guarantee tax exemption while working out his total income

The greatest passable rebate of 8TTB for a monetary year is Rs.

On the off chance that the total interest is not as much as Rs 50,000, the genuine interest is limited.

Section 80TTB

Individual taxpayers and Hindu Unified Family (HUF) endorsed uniquely for residents over 60 years old enough

Interest procured on deposits with a bank account Interest acquired as it were: - Deposits with a bank account - Fixed Deposit, Term Deposit or Repeating Deposit

As far as possible under section 80TTA is Rs.10,000 per annum

On the off chance that the total interest is more than Rs 50,000, just Rs 50,000 is permitted as tax exemption

The distinction between Section 80TTA and 80 TTB

Section 80TTB

Individual taxpayers and Hindu Unified Family (HUF) supported uniquely for residents over 60 years old enough

Interest acquired on deposits with a bank account Interest procured as it were: - Deposits with an investment account - Fixed Deposit, Term Deposit or Repeating Deposit

As far as possible under section 80TTA is Rs.10,000 per annum

Download Automated Income Tax Preparation Excel Based Software All in One for the Assam State Employees for the F.Y.2021-22 as per Budget 2021[This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Structure as per Assam State Employees Salary Pattern + Automatic Calculate H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Revised Form 16 Part A&B and Part B]

0 Comments