Income Tax Calculator All in One for the Government and Non-Government Employees

for the F.Y 2021-22 Excel Download (A.Y 2022-23). Unfortunately, there is little

change in the 2021 budget in terms of income tax slabs, income tax rates and

deductions. The government is as silent and realistic as possible about income tax.

As far as salaried employees and professionals are concerned, the 2021 budget was not very exciting, except for the benefit of additional housing interest under the affordable housing scheme for affordable housing and it has been extended to 311 March 2022 at U / S80 EEA.

Therefore, the income tax slab, rate and other deduction benefits for the old tax system are almost the same for F.Y 2020-21 and F.Y 2021-22 respectively.

Income Tax Calculator F.Y 2021-22 you must know which tax system is more beneficial for you. Since there was no major income tax-related change in Budget 2021, it is more or less the same as in F.Y 2020-21.

You may also, like- Automated Income TaxCalculator All in One for the Andhra Pradesh State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your tax computed sheet + Individual Salary Structure as per the Andhra Pradesh State Employees salary patter + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

Therefore, it is very important for a taxpayer to know the basic differences between the old vs. the new tax system.

The basic differences between the two existing tax systems are as follows

The old tax system is the new tax system

It encourages investment in tax savings instruments. This discourages investment in tax savings instruments.

Existing income tax is deductible. Existing large cuts are not allowed.

Standard deduction and professional tax are deducted from the income (maximum Rs. 52,400). Approved without any deduction for the standard deduction and occupational tax.

The facility of paying interest on housing is allowed. Paying interest on housing interest is not allowed.

Only 3 tax slabs such as 5%, 20% and 30% are applicable. Applicable 6 tax slabs such as 5%, 10%, 15%, 20%, 25% and 30%.

The 5% tax rate is largely ineffective. For every Rs 2.5 lakh, the tax slab is changed by 5%.

For income up to Rs 5 lakh, a tax exemption of Rs 12,500 is given.

Allowed to cut under chapter VI-A. There is no right to claim an exemption for choosing the new tax regime U/s 115 BAC

This tax system is more beneficial for income up to Rs 15 lakh. This tax system is more beneficial for income above Rs 15 lakh.

You may also, like- Automated Income Tax Calculator All in One for the Assam State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your tax computed sheet + Individual Salary Structure as per the Assam State Employees salary patter + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

New Tax System Limitations F.Y 2021-22:

According to section 115BAC, a taxpayer who chooses a new income tax system is not eligible to claim the following income tax deductions:

Exemption from Travel Allowances Under Section 10 (5)

H.R.A. allowances exemption U / S Section 10 (13A);

Allowances for the income of minors included in Article 10 (32);

Standard deduction at U / S 16, entertainment allowance and occupational tax;

Reduce the Income Tax under chapter VI-A such as 80C to 80 CCD(1) and 80U To 80 EEA

Income Tax Calculator A.Y 2022-23 Before using the Excel tool, first look at the Income Tax Slabs for F.Y 2021-22 and A.Y 2022-23:

You may also, like- Automated Income Tax Calculator All in One for the Bihar State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your tax computed sheet + Individual Salary Structure as per the Bihar State Employees salary patter + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

Income tax slab for F.Y.2021-22

Calculating income tax sometimes becomes a difficult task. Also, choose a tax system that raises questions in your mind.

This excel-based calculator is a combination of both old and new tax systems. You don't have to do anything extra. Just give details of all your income and deductions and this calculator will automatically calculate your final tax liability under both regimes.

Key Features of Excel's Old and New Income Tax Calculators AY 2022-23 as follows

It is a combined calculator for calculating your tax liability under the old and new tax systems;

You cannot use this tool to calculate your long-term capital gains tax;

Just put your details in the white cell, and don’t try to move other unused cells to maintain the sanctity of the calculator;

Excel Income Tax Calculator A.Y 2022-23 for the old and new tax regime

The 2021 budget is the most frustrating for salaried workers. No slabs have been changed, no additional tax benefits. The benefits of U / S 80EEA for new home buyers has been extended for one more year.

You may also, like- Automated Income Tax Calculator All in One for the Jharkhand State Employees for the F.Y.2021-22[This Excel Utility can prepare at a time your tax computed sheet + Individual Salary Structure as per the Andhra Jharkhand State Employees salary patter + Automated H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

Therefore, from the above comparison, it is quite clear that the new tax system is only beneficial when your total income is more than Rs 15 lakh and you do not pay any interest on a housing loan n U / S 24.

Which tax system is old or new for you?

As can be seen from the comparison table above, the old tax system for annual income up to Rs 15 lakh is more beneficial considering the complete 80C exemption and deduction of Rs 80,000.

But if you pay Rs 1 lakh as interest on housing, the situation will change. If no HBL interest is paid, for each income level, as shown above, the old tax system will be the absolute winner.

Thus, it can be said that the interest paid on a housing loan plays an important role in determining which tax system is most suitable for you.

Therefore, if you pay any interest on your housing, you are advised to opt for the old tax system, as it will ensure that your total tax expense is reduced by at least somewhat.

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

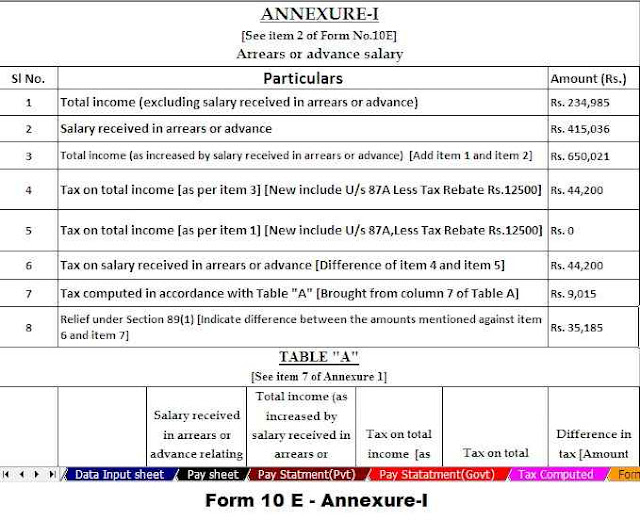

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount into the in-words without any Excel Formula

0 Comments