What are the benefits and who can claim the benefits of U/s 80U? Section 80U of the Income Tax Act, 1961 provides for a tax deduction for persons with disabilities. as per order to claim a tax exemption U/s 80 U, a person must be certified as a person with a disability by the appropriate medical authority.

Who is a disabled person?

Under the Persons with Disabilities (Equal Opportunity, Protection of Rights and Full Participation) Act, 1955, persons with any of the following diseases, including the following 60% disability, will be considered disabled:

Blindness

• Low vision

Leprosy (cure)

• Hearing impairment

Locomotor disability

• Mental retardation

• Mental illness

Autism

Cerebral palsy

Disability law also provides a definition of severe disability that refers to a condition where the disability is 80% or more. A person with multiple disabilities will also be considered seriously disabled.

Exemption limit under section 80U

Disabilities: If a person suffers from at least 80% disability, he can claim a tax exemption of up to Rs.75,000 on taxable income U/s 80U.

Severely Disabled Person: If a person is suffering from severe disability i.e. 80% disability (from one or more illnesses) he can claim tax exemption up to Rs. 1.25 lakh under section 80U.

Disability reduction limit under section 80U

General Disability Rs. 75,000

Severe disability Rs. 1.25 lakhs

You may also, like- Automated Income Tax preparation Software All in One in Excel for the Assam State Employees for the F.Y.2021-22

Necessary proof for required to get this tax benefits U/s 80U

Only Medically disability Certificate will be required and no other documents are required, Issued by the medical authority, However, in the case of illnesses such as autism and cerebral palsy, Form 10-IA must be supplemented.

What constitutes a medical authority?

The following medical authorities are eligible to issue a medical certificate:

A Civil Surgeon or Chief Medical Officer (CMO) of a Civil Government Hospital

A neurologist with MD in Neurology

A pediatric neurologist in paediatrics

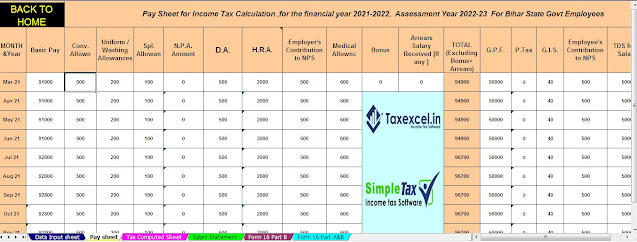

You may also, like- Automated Income Tax preparation Software All in One in Excel for the Bihar State Employees for the F.Y.2021-22

What if my disability certificate expires this year?

Expires Disability Assessment Certificate, you can not claim a tax deduction U/s 80U

Have any difference between Section 80DD and Section 80U?

Although both the departments pay income tax deductions on the basis of disability, the beneficiaries under the respective department are different. Under section 80U, persons with disabilities can claim tax deductions only for themselves. Under section 80DD, dependent family members of persons with disabilities can claim tax exemption. Here, dependent family members include wife, children, parents, siblings of the disabled person.

How to claim an exemption under section 80U?

The person claiming the deduction must provide a copy of the certificate issued by the medical authority in the prescribed form along with the ITR. Since there is virtually no need to attach any document to the ITR, it is advisable to keep the document in hand.

Please note that the medical certificate must be certified to suffer a disability. With the prescribed form 10-IA

So, it only means that if you are taking cuts under this section, keep a certificate with you which you can take from an authorized medical practitioner.

Also, it is advisable to keep medical prescriptions and medical records safe if the Income Tax Department asks about the same in the future.

The medical certificate should contain details of the disability of the taxpayer victim.

Disability certificates have a certain validity. If the certificate expires in a financial year, deductions can be claimed for that financial year using that expired certificate. However, from the next financial year, a new certificate will have to be adopted in the following year to claim deduction under section 80U.

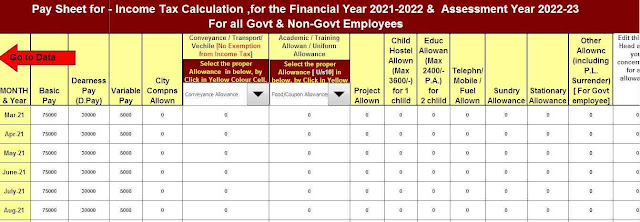

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure as per Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Calculate House Rent Exemption U/s 10(13A)

6) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

7) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments