Download Auto-Fill Income Tax Preparation Software in Excel for the F.Y.2021-22 as per Budget

2021. This Software is simple and user-friendly income tax Software for salaried people. This software

will work for both the old and new tax slab Regime that was published in 2020. You can calculate your

tax liability and determine taxable investment options and the appropriate tax system for F.Y 2021-22.

Software is created using Microsoft Excel. Simple code of Visual Basic & Excel formulas and functions are used to create this software. This Excel-based income tax Software All in One, let's get acquainted with the latest income tax slab for the current financial year 2021-22 and the income tax changes in the 2021 budget.

You may also, like- Auto-Fill Income Tax Software All in One for the Non-Government Employees for theF.Y.2021-22[This Excel Utility can

prepare at a time Tax Computed Sheet as per new and old tax slab + Automated

Income Tax Form 12 BA + Automated

Calculate Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated

Form 16 Part A&B and Form 16 Part B as per Budget 2021]

The income tax slab and income tax rate will remain the same for F.Y 2021-22 (A.Y 2022-23). The change in the budget is that only citizens over the age of 75 are exempted from filing income tax returns if they have income from pensions and interest. No major changes have been made to the income tax rules. Income tax slab for the fiscal year 2021-22.

Income Tax Slab 1 - High Tax Rate

If you choose the New Tax Regime then you can not avail of the exemption under Section 80C including Exemption for under Chapter VI A Except for NPS and 80CCD(2)

However, there are some discounts that you can still claim using the new tax system and they are like below.

Monetization at retirement

Trim compensation

VRS facility

• EPFO: Employer's Contribution

• NPS lift facility

• Education Scholarship

Salaried persons can choose any tax slab new or old. They can change between the old Tax Regime and the new tax Regime. If an individual or HUF has business income, the option of switching between tax slabs is not allowed.

You may also, like- Auto-Fill Income Tax Software All in One for the Andhra Pradesh State Government Employees for the F.Y.2021-22[This Excel Utility can

prepare at a time Tax Computed Sheet as per new and old tax slab + Automated

Calculate Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated

Form 16 Part A&B and Form 16 Part B as per Budget 2021]

This Income Tax Software in Excel F.Y 2021-22 (A.Y 2022-23) from the link given below and easily calculates your income tax liability. This calculator has two parts. Both are given on separate pages.

Episode 1 - Calculate taxes according to higher tax rates

The first sheet contains a calculator for high tax rates, where deductions and discounts are allowed.

To calculate your income tax liability according to the higher tax rate, you need to provide input like your total income, discount amount. In addition to this, you need to provide information about the investments you have made under different sections. The sheet has inputs for different sections like 80C, 80D, 80CCD etc.

After filling in this detail you have to go to the bottom section where you have to select the applicable tax slab by selecting male/female, senior citizen and very senior citizen options.

You may also, like- Auto -Fill Income Tax Software All in One for the Assam State Government Employees for the F.Y.2021-22[This Excel Utility can prepare at a time Tax Computed Sheet

as per new and old tax slab + Automated Calculate Income Tax House

Rent Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and

Form 16 Part B as per Budget 2021]

You will immediately see your tax liability on tax liability including the cess section.

Part 2 - Calculate tax according to the lower tax rate

The second sheet has a new calculator to reduce the tax rate according to the new tax system, where deductions are not allowed.

To calculate your income tax liability according to the new tax rate slab, you only need to provide a single input to your total income.

This Excel Based Software will automatically calculate the tax liability and display it in the tax liability including the cess field.

Feature

of this Excel Utility

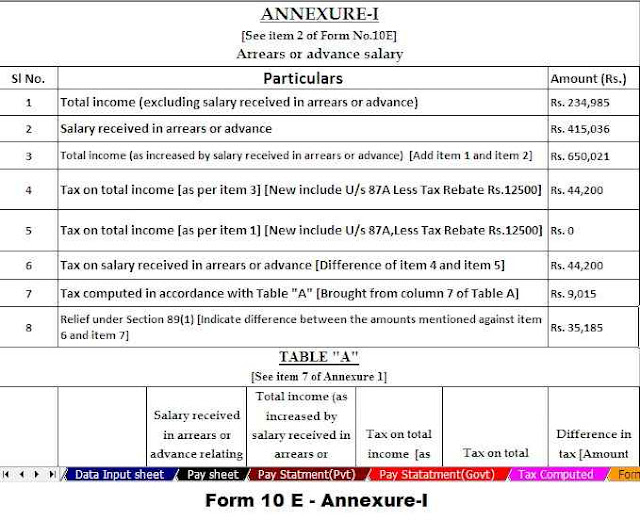

@ Income

Tax Arrears Relief calculation U/s 89(1) with Form 10 E for the F.Y.2021-22

@ This

Excel Utility can prepare at a time Tax Computed Sheet as per new and old tax

slab

@ Individual

Salary Structure as per Govt & Private Employees Salary Pattern

@ Automated

89(1) with Form 10E for F.Y.2021-22

@

Automated Calculate Income Tax House Rent Exemption Calculation U/s 10(13A)

@

Automated Form 16 Part A&B and Form 16 Part B as per Budget 2021]

0 Comments