Tax benefits to the salaried persons as per Budget 2021| Here is the list of Tax benefit deductions

available to Hindu Undivided Family (HUF) assessee in Income tax act on various Investments /

Payments / Incomes in Income tax return for F.Y 2020-21 A.Y 2021-22

Section 24(b) – Deduction from Income from House Property on interest paid on housing loan & housing improvement loan.

In the case of self-occupied property, the upper limit for deduction of interest paid on housing loans is Rs.2 lakh. However, this deduction is not available for a person opting for New Tax Regime.

You may also, like- Automated Income TaxPreparation of Excel Based Software All in One for the Non-Govt. Employees for the F.Y.2021-22 as per Budget 2021

Interest on loan u/s 24(b) allowable are tabulated below

Nature of Property | When the loan was taken | Purpose of loan | Allowable (Maximum limit) |

On or after 1/04/1999 | Construction or purchase of house property | Rs 2,00,000 | |

On or after 1/04/1999 | For Repairs of house property | Rs 30,000 | |

Before 1/04/1999 | Construction or purchase of house property | Rs 30,000 | |

Before 1/04/1999 | For Repairs of house property | Rs 30,000 | |

Let Out | Any time | Construction or purchase of house property | Actual value without any limit |

The amount of tax exemption specified under VIA in the chapter on income tax law

These exemptions will not allow any taxpayer to opt for the new tax regime U/s 115 BCA exemptions, except for the grant exemption U/s 80 CCD (2) which will be applicable for the new tax regime.

1. 80 C, 80 CC, 80 D (1) The combined discount limit is Rs.1,50,000

80C: Life Insurance Premium, Provident Fund, Subscription for Fixed Equity Shares, Tuition Fee, National Savings Certificate, Housing Loan.

2. Health insurance premium for any member for preventive health checks included above this limit and Rs. 250 for preventive health check-up (Rs. 50,000 if any person is a senior citizen)

2a. 80D discount for medical expenses for a senior citizen, Rs. 50,000 discount if no premium of health insurance coverage is paid for a member

80 DDB discount for payment of Rs. 4.04,000 for treatment of HUF member (Rs. 1, 00,000 if senior citizen)

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the West Bengal State Govt Employees for the F.Y.2021-22 as per Budget 2021

5. 80G Grants per grant to certain funds, charities, etc.

Grants are eligible for discounts under the following categories without any limit

Note: No concession will be allowed in case of grant in cash payment of Rs. 2000 / - under this section.

80. 60GGA discount for grants for scientific research or rural development grants.

Research associations or universities,

College or other institution for scientific research Sociology

Or statistical research associations or institutions for rural development

Conservation of natural resources or forest conservation

PSU or

Local authority or an association or

An institution approved by the National Committee to manage any eligible project

Forest Rural Development National Urban Poverty Alleviation Fund Notified as set up by Central Government and fund as notified by Central Government

Note: No concession will be allowed in case of cash grants of more than Rs.2000 / - under this section or if the total gross income includes profit / business / occupation.

80 TTA discount on interest on deposits in bank accounts of non-senior citizens

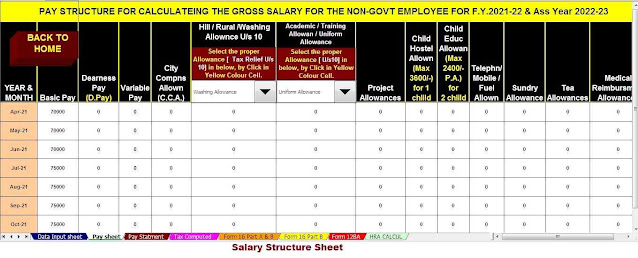

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

7) Automated Income Tax House Rent Exemption Calculation U/s 10(13A)

0 Comments