Is a joint home Loan can get an advantage? The girl who owns the dream house is on the bucket list.

But with a fixed salary and rising inflation, it seems like a distant dream. Purchase a house should be

one of the momentous events of your life.

Thanks to a great home loan project, the dream no longer seems to be enough. If you are willing to purchase a house you can get the money and pay through EMI every month. It's just like saving the opposite.

The bottom line, however, is that home loans are usually high-value and long-term, which ensures that banks work hard before giving loans, leaving a lot of people on screen.

You may also like- Automated Income TaxPreparation Excel Based Software All in One for the Andhra Pradesh State Employees for F.Y.2021-22 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per Andhra Pradesh State Employees Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10 (13 A) + Automated Income Tax Form 16 Part A&B and Part B for F.Y.2021-22]

Well, then what is the solution?

Try a shared home.

Here's what you need to know about mutual home loans:

What is a joint home?

A joint house building loan is when 2 Family members are jointly applying for a loan for a single property. When 2 people jointly apply for a home loan, they agree to collectively take on the responsibility of repaying the loan.

For example, if you and your wife are planning to buy a new home, you can both jointly apply for a joint venture for your dream home and pay the same together.

Some banks insist that the co-owner should also be the co-owner of the property. However, this requirement differs from bank to bank because some banks allow joint home loans even if the co-owner or co-owner is not co-owner of the property.

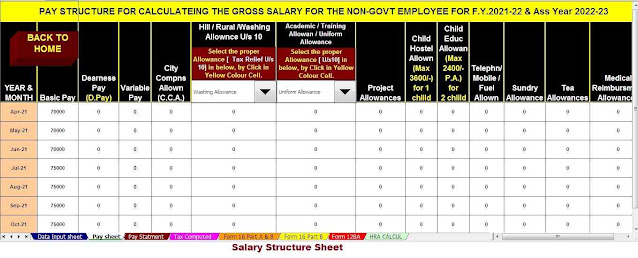

You may also like- Automated Income TaxPreparation Excel Based Software All in One for the Non-Govt (Private) Employees for F.Y.2021-22 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as Non-Govt Concern’s Salary Pattern + Automated Income Tax Form 12 BA+ Automated H.R.A. Exemption Calculation U/s 10 (13 A) + Automated Income Tax Form 16 Part A&B and Part B for F.Y.2021-22]

Why a joint home?

A joint home provides a solution to the limitations imposed by an individual home.

Let's take a look at its benefits.

Attractive interest rates

Most home loans provide discounted rates to female beneficiaries. So, if one of the applicants in the joint application is a woman, you can get faster processing:

Since two or more people are applying for the same loan, the guarantee of repayment increases. Even if a person defaults or is no longer available for payment, another person can do so.

Thus, joint home loans are processed faster than individual home loan applications.

Flexible Payment In joint home loans, since there are two or more people who will repay the loan, banks usually offer flexible repayment options.

You may also like- Automated Income TaxPreparation Excel Based Software All in One for the Jharkhand State Employees for F.Y.2021-22 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per Jharkhand State Employees Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10 (13 A) + Automated Income Tax Form 16 Part A&B and Part B for F.Y.2021-22]

Tax benefits

The IT Act also allows discounts on the principal amount and the amount of interest. Payment of principal is allowed under section 80C as exemption and payment of interest is allowed as deduction under section 80EE and U/s 24 B. Thus, by applying for a joint home loan, both applicants will be able to take advantage of the discounts in their respective tax calculations, which will result in more savings.

So, considering the various benefits of joint home loans, it is recommended that you choose a joint home loan if you are planning to buy a home.

Download Automated Income Tax Preparation Excel Based Software All in One for the Bihar State Employees for F.Y.2021-22 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Structure as per Bihar State Employees Salary Pattern + Automated H.R.A. Exemption Calculation U/s 10 (13 A) + Automated Income Tax Form 16 Part A&B and Part B for F.Y.2021-22]

0 Comments