Tax benefits of New and Old Tax Regime as per Budget 2023| According to the actual Tax Slab on

your total income found under the old or new tax system, each salaried employee will be subject to tax.

Payroll employees must file income tax returns at the beginning of the 2023-2024 tax year because,

after various deductions, income tax is calculated based on various tax brackets. As a result, tax

planning must begin with the start of a new tax year. Under the new tax system, new income tax slabs

and rates are proposed in the Finance Law of 2023.

The two major announcements made in the 2023-2024 Union Budget were that the Ministry of Finance increased the tax exemption limit under the new tax regime from Rs 2.5 lakh to Rs 3 lakh and that a standard deduction of Rs 50,000 was introduced. Under the new tax. the regime, which was previously available only under the old tax system. However, these changes will take effect from next year, that is, in AY 2024-25. Do salaried people know that they can reduce the effective tax rate to zero if they receive a gross salary of Rs. 10 lakhs per fiscal year? We will find out with our experts.

Each salaried employee will be taxed at marginal slab rates on his or her total income (i.e., gross income minus eligible deductions). Thus, for a salaried taxpayer, his wage income will form a majority component; You will be asked to take into account any other income, such as interest income from banks, rental income, etc. for the purposes of calculating his taxes. Salaried people with no other major source of income must cope not only with rising inflation but also with the rising cost of living.

Therefore, for better tax planning, employees should make efficient use of the deductions and exemptions available under the IT Act. So, any taxpayers with a gross salary of Rupees Ten lakhs can entitle the following deductions generally claimed under the old tax system to reduce the effective tax rate to zero:

1. Standard discount of Rs. 50,000 under Section 16(ia) of the Information Technology Act.

2. Deduction under Section 80C of the Information Technology Act up to Rs. 1,50,000 in payments made to Life Insurance premiums, Provident Fund, National Provident Certificate, Housing Loan Administrator, etc.

3. Deduction under Section 80CCD (1B) of the Information Technology Act of Rs. 50,000 contributions to the National Pension Regime notified by the Central Government

4. Deduction under Section 80d of the Information Technology Act of Rs. 25,000 (Rs. 50,000 in the case of seniors) for payments of health insurance premiums.

5. Deduction under section 24 (b) of the IT Act in respect of interest on the Mortgage Loan up to Rs. 2,00,000 Pa while repayment of the principal component of the loan can be claimed as a deduction of u/80c as mentioned above.

If the taxable income of the taxpayer is less than Rs. 5,00,000, such taxpayer will be eligible to claim a deduction under Section 87A of the IT Act up to Rs. 12500/-

In addition to the above, salaried taxpayers can also take advantage of the 10 exemptions for housing rental subsidies, travel permits, vacation pay, etc. based on the components of your salary specified in your CTC. The limits for these deductions are usually calculated based on certain salary components, such as base salary, benefit allowance, etc.

Note that a salaried person who opts for the proposed new tax regime has an income of Rs. 700,000 after a standard deduction U/s 10(1) of Rs 50,000) and would have zero tax liability.

Note: Each salaried individual will have the option to choose between the old and the new tax system for the 2023-24 tax year, and it has been announced that the proposed new tax system will be the "default" tax system.

Although you were not in the limelight, even the old tax system allows you to claim the following deductions and reduce your tax liability to zero if your income is up to Rs. 10 lakhs

• Standard discount of Rs. 50,000/-

• PT (Professional Tax) - Rs. 2500/-

• Deduction below 80C - Rs. 1,50,000/-

• Interest on H.B.Loan - Rs. 2,00,000/-

• Additional NPS - Rs. 50,000/-

• Deduction for Mediclam below 80 Years - Rs. 50,000/-

By using the maximum cap under such deductions, you can reduce your net taxable income to Rs. 5 lakhs and thus also reduces the tax amount to zero under the old tax regime.

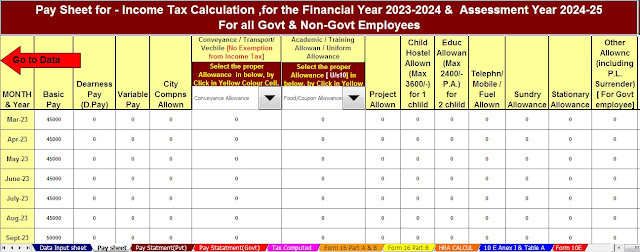

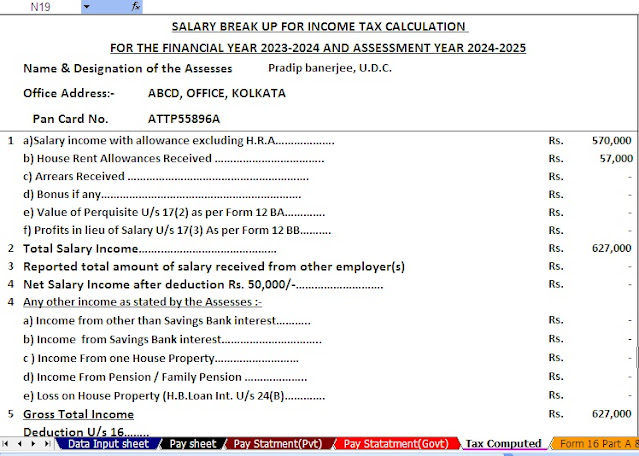

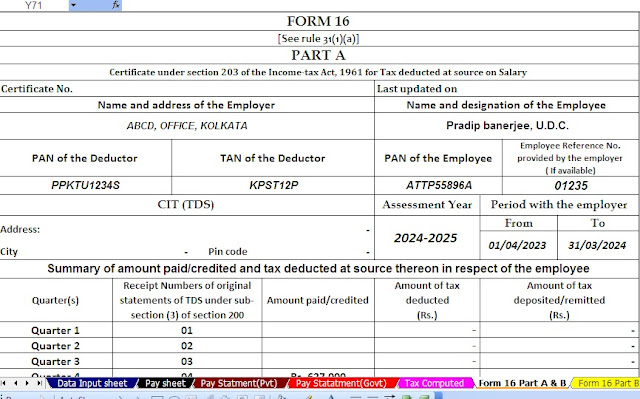

This Excel Utility can prepare at a time your Tax computed Sheet

+ Auto Calculate H.R.A. Exemption U/s 10(13A)

+ Auto Calculate Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E

+ Automatic

Income Tax Form 16 Part A&B and Part B for the F.Y.2023-24

0 Comments