Exemption from House for Rent U/s10(13A)| Often, people have to move to another city to work. In

such cases, they may pay rent for their stay. Organizations often compensate employees for this cost by

paying them to rent instead of their basic salary. This is usually part of the salary structure. However,

an HRA qualifies for income tax exemption and can be a great way to reduce your taxable income.

1. What is HRA or Housing Rent Allowance?

House Rent Allowances is the amount paid by an employer to an employee in compensation for the rent paid to occupy the workplace. Although a deduction is allowed for house rent allowance under Section 10(13A) of the Income Tax Act, CRT may be taxed in whole or in part. The calculation of HRA deduction depends on your salary, the HRA you have earned, the actual rent you pay, and where you work and live. Self-employed individuals can even claim HRA tax benefits.

2. HRA calculation method

The HRA calculation is based on several factors, including your salary, the HRA you get from your employer, the actual rent you pay, and whether you live in a metro or non-metro city. However, when calculating the CRT tax, the exemption rate will be the lower of the following:

HRA paid by your employer

Actual rent paid for accommodation less 10% of basic salary

50% of basic pay plus D.A. if you

live in a metro city (Mumbai,

To calculate house rent allowance or HRA policy is to calculate the above three factors and claim the lowest one as HRA deduction under Section 10(13A) of the ITA.

The HRA exclusion under Section 10(13A) of the ITA has the following benefits:

The main advantage of an HRA refund is that it reduces your taxable income.

You can claim an HRA deduction in your income tax file even if you live with your parents, as long as you show proof of rent payment.

Download Automated Income Tax House Rent Exemption Calculator U/s 10(13A)in Excel

4. Important Points to Remember While Applying for HRA Deduction

Any HRA paid to you cannot be claimed as an exemption. Only the lesser of the annual rent actually payable less 10% of basic salary, HRA paid by the employer and 40%/50% of salary depending on where you live can be claimed.

You can claim HRA deduction even if you live with your parents, as long as you show proof of rent payment, such as rent receipts or bank transfers. However, your parents will need to show this as income when filing their returns.

Rent paid by a spouse does not qualify for HRA deduction.

If the annual rent paid exceeds Rs 1,00,000, the PAN of the landlord will have to apply for an HRA exemption. If they do not have PAN, a signed document is required.

5. How to claim a deduction if you don't get HRA

Self-employed and salaried individuals who are not eligible for the HRA cannot claim a house rent allowance deduction under Section 10(13A) of the ITA. However, they can avail of rent exemption under Section 80GG of the Income Tax Act.

Under section 80GG, an individual can claim a minimum of the following in lieu of the house rent he or she pays:

5,000 per month ie. 60,000 per annum

25% of gross turnover

Actual rent paid minus 10% of gross income

In understanding the difference between what is HRA and the deduction claimed under section 80GG, here are some points to keep in mind:

The deduction under section 80GG is available only to those who do not receive HRA.

This includes members of Hindu Undivided Families, self-employed persons, and salaried individuals who do not receive HRA from their employer.

The maximum deduction allowed under section 80GG is Rs 60,000.

You cannot claim a deduction under both Section 10(13A) and Section 80GG

According to section 10(13A), an individual, spouse or minor child cannot own property in the city of residence to claim the benefit.

Individuals wishing to apply for this exclusion will need to submit a Form 10-BA showing that they meet all of the conditions listed above.

6. Documents Required to Apply for HRA Tax Exemption

To claim an HRA tax exemption, an individual will have to submit certain documentary proofs.

This includes rent receipts showing the rental income used to calculate the HRA deduction or a rental agreement with a specified equivalent rental rate.

Additionally, if the rent exceeds Rs 1,00,000/- per annum, then a copy of the landlord's PAN card or a declaration form signed by them is required. For rent paid to family members or parents, the same proof will be required to calculate HRA tax.

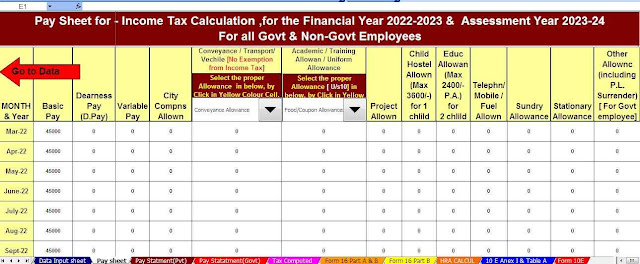

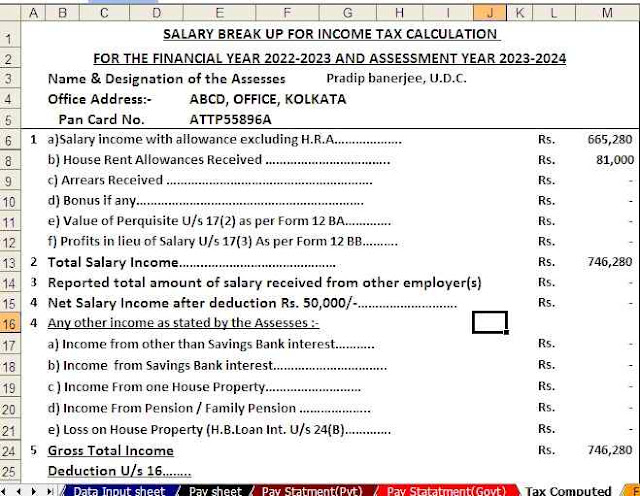

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section

115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

employees Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments