Download Automated Income Tax Preparation Software in Excel | Calculation of income tax for

employees of a private company in 2022: The annual CTC of a person working in a private company

consists of several components. These include LTA, HRA, pension fund contributions and tips,

entertainment reimbursements, phone bills, transportation, books and periodicals, and more. While the

names of CTC components may vary from company to company, the applicable tax rules remain the

same. For proper tax planning, it is important to understand the tax implications of the various

components of the CTC.

Here we look at how Tips, Reserve Fund, Rental Housing Allowance (HRA), LTA and Refunds are taxed.

Some components of wages are fully taxable and some are completely exempt. Some components are partially exempt from income tax.

Income Tax at HRA

HRA is an important part of the CTC, providing tax credits to workers who live in rented housing. The HRA is taxable if the employee does not live off the rent.

Subject to Section 10(13A), a minimum of the following may be exempt from tax:

(i) Actual amount received

(ii) 50% of salary if you reside in metropolitan areas (ie Mumbai,

(iii) Rent above 10% of wages

Income tax refund

Companies provide various subsidies for transportation, books and periodicals, entertainment, telephone and internet, etc.

Under section 10(14) of the Income Tax Law, subsidies given to employees are tax-deductible if such expenses are actually incurred.

The transport discount is released in the amount of the costs incurred.

Telephone/mobile and internet reimbursements are also exempt from regulation 3(7)(ix) of the Income Tax Law.

Reimbursement for books and periodicals may be claimed as an exemption under Section 10(14).

The entertainment allowance is fully taxable in the case of private employees. However, this may be claimed as an exemption if hospitality expenses are incurred for the company's business purposes.

To receive tax credits for reimbursement, employees must pay initial expense invoices.

Pension fund income tax

Contributions to the Reserve Fund are deductible under section 80C of the Income Tax Act.

Income tax on tips

Bonus earned while working is fully taxable. You can take advantage of the tip tax credit when you retire if your employer is covered by the Tips Act. Under section 10(10) of the Income Tax Law, at least the following persons are exempt:

one. Actual amount received

B. 20 thousand reais

h. 15 days' salary based on the last salary withheld for each full year of service or part of it exceeding 6 months

For the calculation of remuneration, salary means base salary + charity allowance.

If the employer is not subject to the Free Payments Act, at least one of the following exceptions:

one. Actual amount received

B. RJU CAN'T. 20 00 000

h. Half of the monthly salary for each full year of service. (i.e. ½ * average wage in the afternoon.

Income tax under LTA

The following conditions must be met in order to apply for a travel allowance tax exemption:

One. The actual trip is carried out by the taxpayer

B. Only domestic trips are counted

h. The exemption is granted to the employee alone or together with the family, including the employee's spouse, children, dependent parents, and siblings. However, the exemption does not apply to more than 2 children born after October 1, 1998.

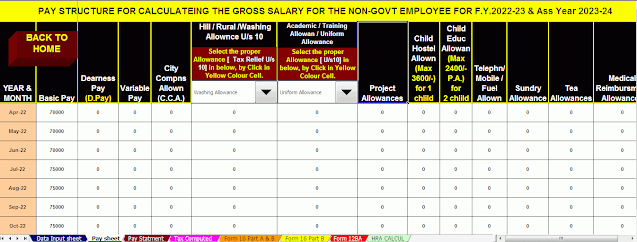

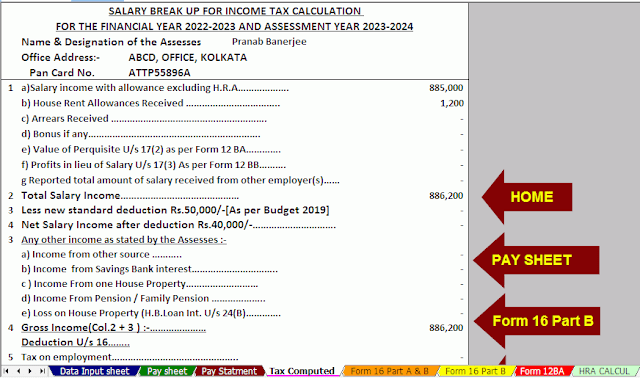

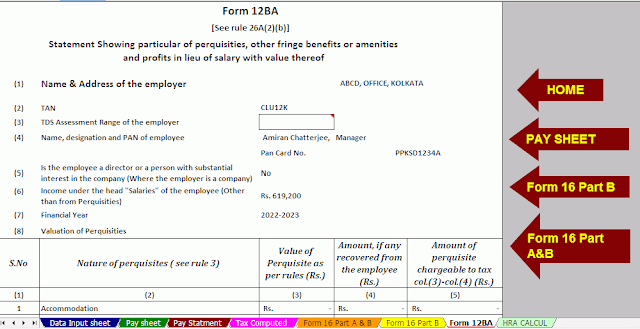

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

3) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4) Individual Salary Structure as per the Private Concern’s Salary Pattern

5) Individual Salary Sheet

6) Individual Tax Computed Sheet

6) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

7) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments