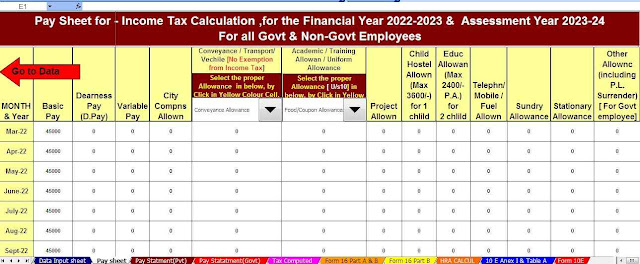

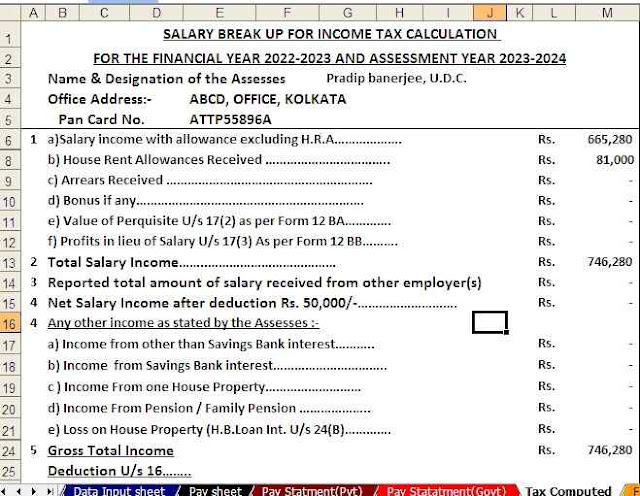

The article contains a program for automatic adjustment of income tax in Excel. This Excel utility can

prepare times for Govt and Private employees in various formats for the tax year 2022-23 (tax year

22-23), i.e. income tax estimate for the year 2023-24. Income tax calculation software is useful for

employees in the government and private sector.

“Let all be subject to the governing authorities, for there is no other authority but that which God has established. Give to each his due: if you owe tribute, pay tribute; if tribute, pay tribute; if you respect, respect." if honor, honor.

I wish you a life without financial stress and competent tax planning! Good luck and God bless you.

A common question employees ask is: what factors should be considered when preparing a financial and financial plan?

Tax-related financial planning is important for employees as they invest their limited and hard-earned resources to save on taxes and increase their wealth. There are a few simple things to keep in mind when preparing a detailed tax plan.

How much to invest in tax-saving for the F.Y.2022-23?

Review your current liabilities, such as Employee Provident Fund contributions, tuition payments, premiums paid on life insurance policies, mortgage payments, etc., that qualify for tax investment under section 80C. There is no need to invest in suitable tax-saving tools if the total payments in the list above are more than 1.5 lac per year, or if you only need to invest in tax-saving options to the extent that remains after accounting for all over. - Said payments. So, to keep things very simple and straightforward, don't spend too much to save on taxes. The rest of the money you have can be invested in a growth/wealth fund other than a tax savings fund, give the following ideas.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments