Tips to save on taxes|

1. Rent paid but HRA not received:

You typically receive an HRA as part of your paycheck and treat the HRA as a primary tax-saving plan while you file taxes. However, there may also be a situation where it is not part of the employee's salary. In such a situation, the standard HRA deduction cannot be claimed and the taxpayer will not be able to claim benefits even if they are paying rent. Also, in such cases, the taxpayer must claim a tax benefit under Section 80GG.

To provide taxpayer benefits even when they did not receive an HRA, Section 80GG was introduced. Under this section, a taxpayer can claim a rent deduction even if they have not received an HRA. As per the following conditions:

That the individual is self-employed or receives a salary.

The HRA was not received at any time during the year for which the Section 80GG deduction was claimed.

You may also like- One by One Preparation Form 16 Part A&B and Part B for the F.Y.2021-22

You, your spouse, or the HUF of which you are a member do not own any accommodation where you currently reside.

To claim the deduction under Section 80GG, you must file a 10BA form for the rent payment. Less of the following will be considered a deduction under this section:

Rupee.5000 per month.

25% of total income (excluding long-term capital gains and short-term capital gains under Section 111A and income under Section 115A or 115D and deductions under 80°C at 80 units).

Real income is less than 10% of income

2. Interest paid on the mortgage loan

To claim the interest component of a home loan as a tax deduction, you must meet the following conditions:

You must obtain a loan to buy or build a house.

The construction of the house must be completed within 5 years after the end of the financial year in which the loan was taken.

The interest component paid as part of the loan can be claimed as a deduction under section 24 up to Rs. 2 lakhs This applies in the case of self-occupied properties. In the case of rental property, there is no maximum limit for claiming interest.

In the event that interest is paid on a mortgage loan obtained during the pre-construction period, the pre-construction interest paid may be claimed as a deduction. The discount is available in five equal instalments beginning with the year the property was purchased or construction was completed. However, the maximum is Rs. 2 lakhs

You may also like- One by One Preparation Form 16 Part B for the F.Y.2021-22

3- Bank Savings Account Benefits:

The Income Tax Act of 1961 provides for deductions in respect of interest earned on bank savings accounts. Undivided Hindu individuals and families can claim a tax deduction under Section 80TTA on interest earned. This deduction applies to non-senior taxpayers. In the case of the elderly, article 80 TTB applies.

The maximum limit u/s 80TTA is Rs. 10,000. Limit Rs. 10,000 is applied to the total interest earned on the savings bank account held by the resident. No interest above and above Rs. 10,000 is taxed under the heading “Income from other sources”. The tax rate will correspond to the applicable tax bracket. For example, the total interest Amit earned from his savings bank account was Rs. 15,000. But allowed under Section 80TTA will be Rs. 10,000/-

On April 1, 2018, Section 80TTB for the elderly appeared. Under the 80TB section, seniors can claim discounts of up to Rs. 50,000 or a specified amount of gross gross receipts.

4- Medical expenses for disabled dependents:

Under the provisions of Section 80DD, a taxpayer can claim a deduction if they are caring for disabled dependents. This tax benefit will help reduce the tax liability of a person caring for a disabled person in their dependent family.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

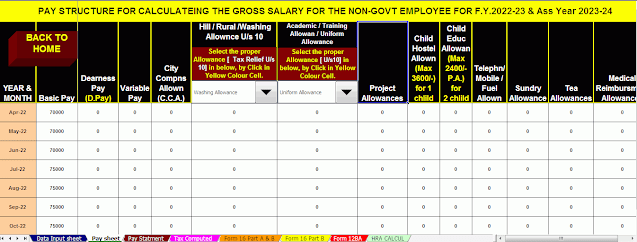

3) This Excel Utility has a unique Salary Structure for Government and Non-Government employees Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23 (Update Version)

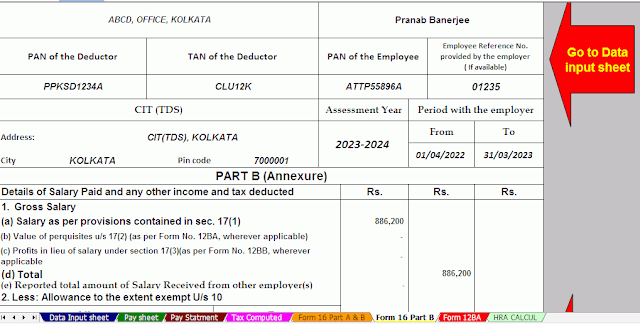

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23

0 Comments