Obligatory presentation of the personal income tax return | If you are not sure if you are required to file

an income tax return, this article will help you clarify it.

Cases in which the presentation of the personal income tax return is mandatory

1. The gross income before any deduction is allowed under Section 80C to 80U exceeds Rs. 2.5 lakhs in the fiscal year 2021-22. However, for seniors, over 60 years of age but under 80, the limit is Rs 3 lakhs and for seniors, i.e. people over 80 years of age is Rs 3 lakhs. 5 lakhs.

2. For a business or enterprise, the return must be filed regardless of whether the business or enterprise made a profit or a loss in the previous year.

3. In order to carry the loss.

4. To claim an income tax refund.

5. If a resident person has an asset or a financial interest in an entity located outside of

6. Whether the resident has the authority to log into a foreign account.

7. If you receive a receipt, you will have income from property held in trust for charitable or religious purposes, a political party, a research association, a news agency, an educational or medical institution, a hospital, a debt fund of infrastructure, or any authority, body or trust.

8. If a foreign company obtains the benefits of a treaty in a transaction in

8. If a foreign company obtains the benefits of a treaty in a transaction in

9. The following persons other than a business or corporation are required to file a return:

Depositing an amount or total amounts in excess of one crore into one or more checking accounts with a banking company or cooperative bank; either

incur expenses in an amount or total sums exceeding two lakh rupees for himself or for any other person to travel to a foreign country; either

Charges may be incurred in total amount(s) exceeding one lakh rupees for electricity consumption.

10. Also in accordance with notification No. 37/2022 on April 21, 2022, the following persons are required to file their income tax returns-

If your total sales, turnover or total receipts, as the case may be, in the business exceeds Rs. 60 lakh during the previous year; either

If your total income in the profession exceeds Rs. 10 lakh during the previous year; either

If the total tax deducted at source and tax collected at source during the previous year, in the case of one person, is Rs. 25,000 or more, however, in the case of a person 60 years of age or above the maximum limit of Rs. 25,000 rupees to Rs. 50000 or

The deposit in one or more bank savings accounts of a person, in total, is Rs 50 lakh or more during the previous year

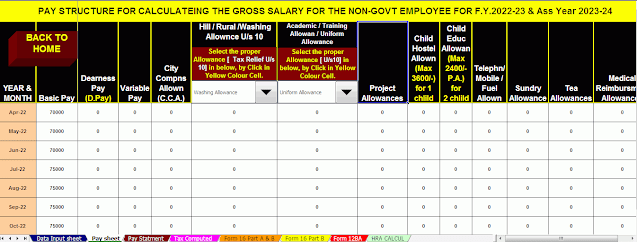

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

0 Comments