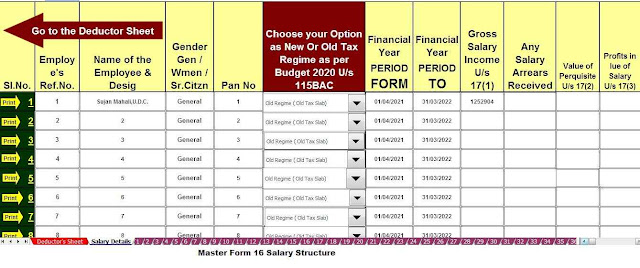

Download and generate Form 16 Part B and Form 16 Part A and Part B for the fiscal year 2021-22

Form 16 components

Form 16 is one of the most important forms for employees; it contains all the information on wages paid and withholding taxes.

Form 16 is divided into 2 parts, both equally important, which are listed below:

Part A Form 16

Part A of Form 16 provides a summary of the taxes collected by an employer on the pay of an employee on his behalf and paid to the government. This is a guarantee certificate signed by the employer, certifying that he has already filed the TDS deducted from the employee's salary.

Details to be completed on Form 16, Part A

Part A of Form 16 contains the following data, which must be completed:

Personal Information: The personal information of the employee and employer, including the employer's name, address, permanent account number (PAN) and TAN (TAN is the number assigned to the account responsible for deducting and collecting taxes). This data helps the IT department track money movements from employee and employer accounts.

Year of assessment: Indicates the year of assessment, or more simply the year in which the taxpayer is required to submit the tax return. For example, for the income generated between April 2020 and March 2021, the valuation year would be 2021-2022.

Time Period: The length of time the employee worked for the employer in a given fiscal year.

Summary of wages paid

Tax filing date with the government

Summary of the tax that has been deducted and also filed with the Income Tax Department

This part of Form 16 is generated through the Department's Income Tax Track Portal. In addition to the above, it also provides the BSR code of the bank from which payments are made, challan numbers and other specific data for further use.

Part A must be signed manually or digitally by the detractor.

Part B of Form16

Part B of Form 16 covers declarations of wages paid, any other income disclosed by the employee to the employer, and things like the amount of tax paid and tax payable. In this part of Form16, the above information is presented in a comprehensive and streamlined manner, showing the income earned by the worker, with various benefits and allowances applicable in a specific format as indicated.

Details to be completed in part B

Part B of Form 16 contains the following information, which must be completed:

Total salary: The salary structure is further broken down into various components such as house rent, travel allowance, vacation receipts, tips, etc.

Exceptions: All applicable exceptions allowed under section 10 of the Income Tax Act of 1961 are listed in this part of the form.

Gross Income: This is the sum of the regular salary plus any other income generated or received by the worker through various means such as housing and rent.

Details of other sources of income must be provided by the employee to their employer when submitting the investment confirmation.

Miscellaneous Paycheck Deductions: Miscellaneous paycheck deductions under section 80C / 80CCC / 80CCD, including contributions to instruments or schemes such as Public Provident Fund (PPF), life insurance, mutual funds, pensions, college tuition, deductions tax for children. for a total amount up to Rs 1,5 lakh.

Net Taxable Wage: Various tax deductions are added together in Chapter IV-A and then subtracted from gross income to calculate net taxable income.

Tuition and additional fees, if applicable

Section 87 Discount if and when applicable

Section 89 discount, if any

The total income tax payable on an employee

Tax deduction and tax balance payable or refundable, as applicable

0 Comments