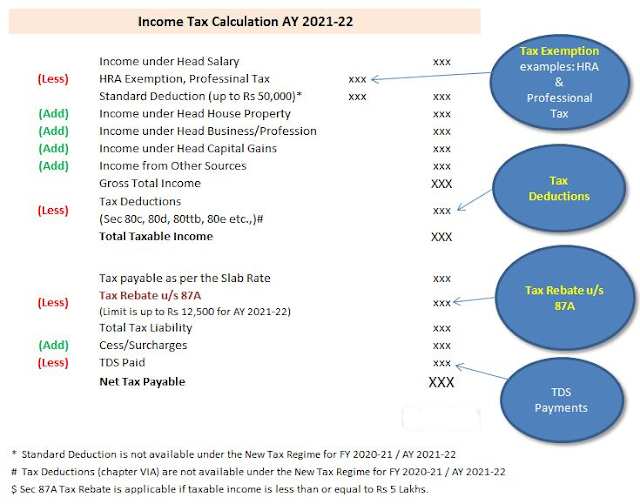

Standard Deduction U/s 16(ia) | Section 16 of the Income Tax Act 1961 provides for a

deduction from income charged to tax under the heading “salaries”. Provides deductions for

the standard deduction, leisure allowance, and occupational tax. Through this deduction, a

salaried taxpayer can reduce his or her taxable salary income.

Moreover, with recent modifications to the standard deduction, the interest of this section has been extended to a higher amount. Moreover, there is no hassle in submitting bills for travel and medical treatment which makes it easy to claim them.

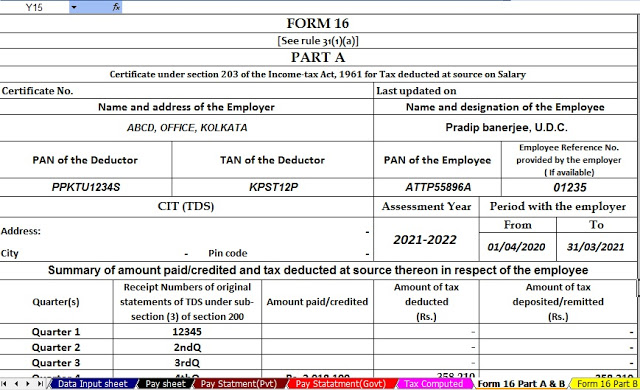

Download and Preparation One by One Form 16 Part A&B and Part B for the Financial Year 2021-22

In this article, we'll cover each of the deductions in Section 16 along with account-specific illustrations.

U/s 16 (IA) Salary Deduction of Rs. 50,000/-

The standard deduction is allowed under Section 16(ia) of the Income Tax Act. Replace the standard deduction for transportation allowance of Rs 19,200 and medical reimbursement for Rs 15,000. In Budget - Presented by Finance Minister Jaitley for 2018.

Budget - 2018 provided for a standard deduction of Rs 40,000 in lieu of transport allowance and medical reimbursement. This deduction of Rs 40,000 does not require the taxpayer to provide any invoice or proof of expenses. It provides for a fixed discount of Rs 40,000.

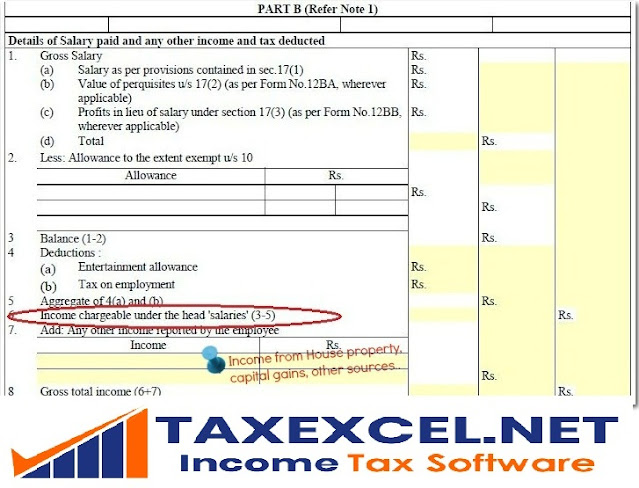

Download and Preparation One by One Form 16 Part B for the Financial Year 2021-22

Later in the 2019 Provisional Budget, the discount amount of Rs 40,000 was increased to Rs 50,000. Hence, the discount for F.Y 2018-2019 was Rs 40,000 and from FY 2019-20 the discount would be Rs 50,000.

The standard discount is also available for retirees. A clarification has been issued by the Central Bank of

The deduction amount available under Section 16 for the standard deduction is:

Salary received

Or

50,000 rupees

Whichever is less?

Download and Preparation at a time 50 Employees Form 16 Part B for the Financial Year 2021-22

Details F.Y2018-19 F.Y2019-20

(Rs.) From F.Y2019-20 From F.Y2020-21 (Rs.)

Base salary + design allowance 800,000 800,000

Other taxable benefits 100,000 100,000

Gross wages 900,000

Standard deduction 40000

Total income 860,000

Other deductions 200000

Taxable income 660000

Income tax 44500

Income Tax Savings - 2000

Remember that the standard deduction is not related to the u/s 80C deduction or any other part of the VIA chapter.

Interpretation of the Standard Deduction Calculation

Section 16(ii) Entertainment allowance

Entertainment allowance is first included in wage income and then deducted based on several criteria. The allowance must be an allowance specifically provided by the employer to the taxpayer as an entertainment allowance.

Entertainment allowance for government employees

The minimum deduction for central government and state employees is:

20% of the basic salary

5000 rupees

Amount Provided as Entertainment Allowance in Fiscal Year

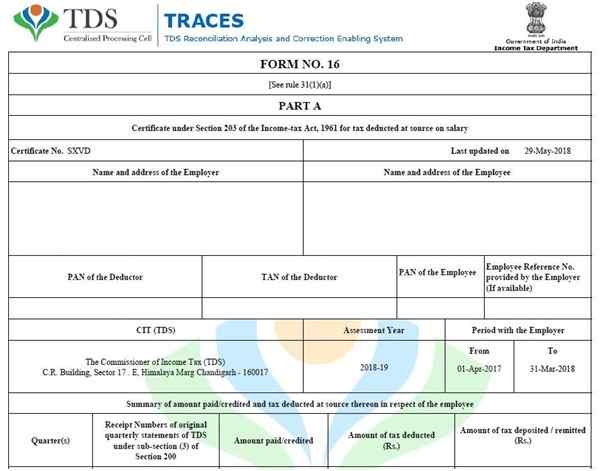

Download and Preparation at a time 50 Employees Form 16 Part A&B for the Financial Year 2021-22

To qualify for relief, the taxpayer must ensure that the following details are met:

Salary must not include any allowances, employer benefits, or other benefits received. Essentially, wages should be the gross amount received, excluding any other benefits.

Ignore the actual amount spent on entertainment benefits received from the employer.

Entertainment allowance for a non-government employee

The hospitality deduction is not available to non-government employees. Only employees of the central or state government are eligible for the deduction. In addition, employees of local governments and public corporations are not entitled to the deduction.

Demonstration of calculating the entertainment allowance deduction

Size Details

Salary (excluding other allowances, benefits and privileges) 120000

Entertainment allowance received per month 1000

Entertainment allowance for the full fiscal year 12,000

Available withdrawal amount:

20% of salary (а) 24000

5000 rupees (b) 5000

The actual amount received (c) 12000

The amount allowed as a deduction (minimum a, b and c) is 5000

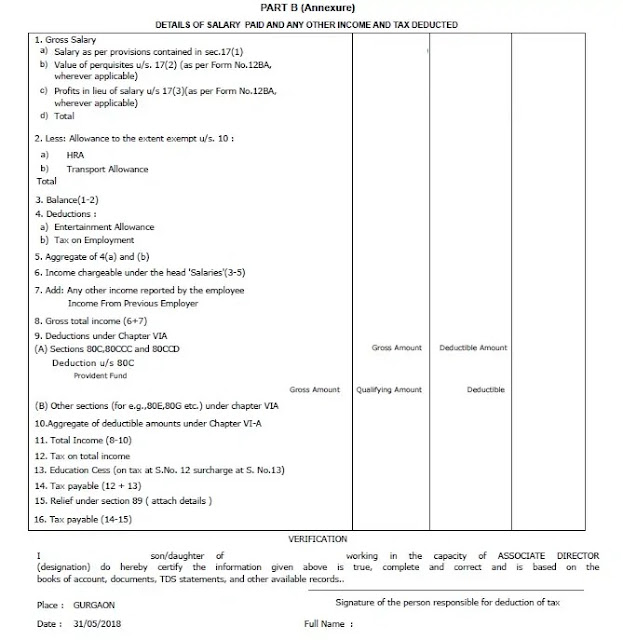

Download and Preparation at a time 100 Employees Form 16 Part B for the Financial Year 2021-22

Occupational or employment tax under Section 16(iii)

A deduction is allowed for payroll tax under section 16iii of the Income Tax Act. The amount paid by the taxpayer in respect of work tax or occupational tax is allowed as a deduction in accordance with section 16. Here, work tax is provided for in (2) of section 276 of the Constitution.

When calculating professional tax deductions, the following points should be considered:

The taxpayer must claim the deduction only in the fiscal year in which the professional tax is paid to the government.

Tax paid by an employer on behalf of an employee is also eligible for a deduction. Here, the amount paid by the employer as an occupational tax will be included in the first place as a mandatory condition in the total salary. Later, an equal amount will be allowed as a deduction under section 16.

Under section 16 of the Income Tax Law, there is no upper or lower deduction limit. However, no state government may charge more than 2500 rupees per year as professional tax. Only tax paid is deductible, not interest on late payment or fees for late or non-payment of professional tax.

Download and Preparation at a time 100 Employees Form 16 Part A&B for the Financial Year 2021-22

0 Comments