Income Tax Form 16 Download | In accordance with the Income Tax Act, each employer is required to withhold tax (or TDS - deductible at source) at the time of payment of the salary, which is calculated on the basis of the income tax rates in effect for that financial year.

Companies usually calculate the tax payable by an employee based on the expected profits and investment returns made by the employee at the beginning or during the year.

The TDS deducted in this way by the organization or employer is filed with the Income Tax Department and Form 16, in turn, is the same proof. Employers must issue Form 16 to their employees no later than May 31 of the fiscal year following the fiscal year in which the income was paid and taxes were deducted.

Form 16 components

Download and Prepare at a time 50 Employees Form 16 Part A&B for the F.Y.2021-22

One of the most important forms of income tax for employees is Form 16. It contains all the information regarding the salary received by the worker, as well as the tax that has been collected from the deductible salary.

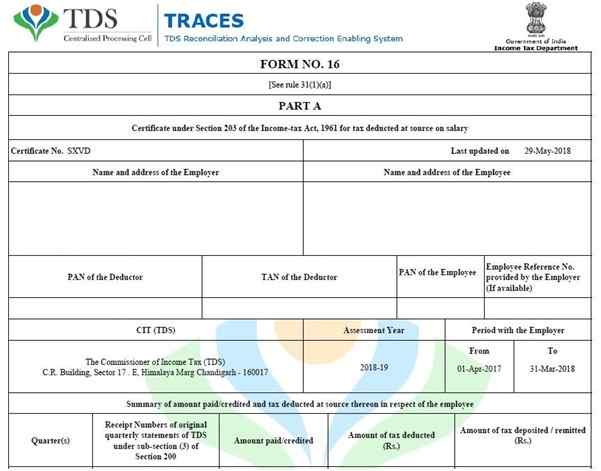

In essence, Part A is a summary of the taxes collected by an organization or employer on employment income on behalf of an employee and paid into the government account. This is a certificate duly signed by the employer who deducted the TDS from the employee's salary and handed it over to the income tax department.

Contains the following details:

Personal data of the employer and employees. Details such as person and employer name, address data, PAN data of both employer TAN data. (TAN refers to the number assigned to the account in charge of deducting and collecting the tax). These details help the IT department monitor the movement of money from employee and employer accounts. (It should be noted that if an organization does not have a TAN, they are not entitled to a TDS deduction. So, in this situation will not provide form 16

Download and Prepare at a time 50 Employees Form 16 Part B for the F.Y.2021-22

The length of time an individual worked for an employer in the relevant tax year.

Summary of wages paid

Payroll tax date

The date the tax was credited to the government account

Summary of taxes deducted and filed quarterly with the Income Tax Department

TDS payment confirmation number

This part is created and uploaded via the Department's Income Tax Track Portal. It also provides details such as the BSR code of the bank through which payments are made, challan numbers, etc. for future reference. All pages of Part A must be digitally or manually signed by the detractor.

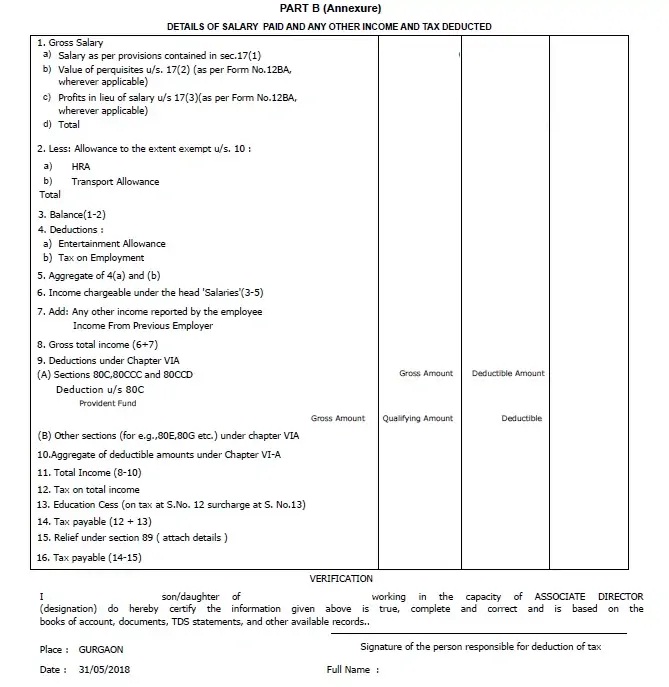

Part B is a summary statement that provides details of the compensation paid, any other income declared by the employee in their organization, the taxes paid and the taxes due, if any. It presents complete and orderly information about an employee's income earned and the benefits and deductions that apply to them, in a prescribed format. The information relating to the employee, such as name and personal number, is also cited in art

This chapter includes the following information:

Total Salary Received: The salary structure is further broken down into various components such as home rental allowance, vacation allowance, vacation collection, tips and more.

Download and Prepare at a time 100 Employees Form 16 Part A&B for the F.Y.2021-22

Permitted Exceptions: In section (10) of the Income Tax Act of 1961, such as allowances granted to employees for travel, housing rental (HRA), expenses for education and accommodation for children, services doctors, etc., are also mentioned in the form of.

Gross income: is the sum of wage income received by the employer and any other income claimed by the employee, such as income from home/property, etc. The details of the other income must be provided by the employee to the employer at the time of the stage of providing proof of investment.

Wage Deductions: Section 80 C / 80 CCC / 80 CCD includes contributions made to instruments or schemes such as the State Reserve Fund, Life Insurance Policies, Tax Savings Mutual Funds, Pensions, Sukanya Samriddhi and others. The maximum limit for the same is Rs. 1.50.000.

Download and Prepare at a time 100 Employees Form 16 Part B for the F.Y.2021-22

There are deductions for other sections such as 80D (premium paid to health insurance or Mediclaim), 80E (payment of interest on school loan), 80G (donations), disability deductions and other applicable sections. Details for all these deductions must be presented by the employee, along with the required supporting documents, to the employer.

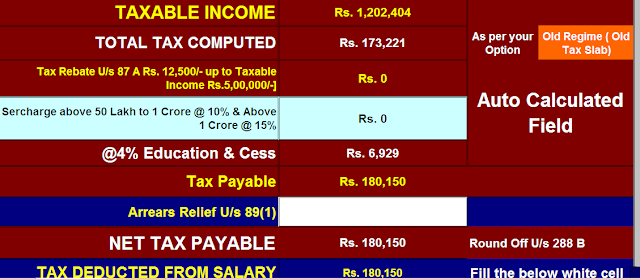

Net taxable salary: the general deductions are added according to "Chapter IV-A" and deducted from the gross income to calculate the taxable income. Your tax liability is calculated on this amount.

Download and Prepare One by One Form 16 Part B for the F.Y.2021-22

Education Cess and any co-payments

Section 87 Refund, if applicable

Assistance under section 89, if any

The total amount of income tax payable

Tax deduction and applicable payable or refundable residual tax

How important is form 16 for an employee?

For an employee, Form 16 is of paramount importance in terms of income tax. The information provided on this form is required to file the tax return.

With this certificate, a taxpayer can easily prepare their Indian tax return on their own without the need for a chartered accountant or financial planner. This is more applicable to individuals whose only source of income is the wages they receive from their organization.

Form 16 can be used to verify that taxes have been properly paid to the government. Accounts by comparing the amounts with form 26AS.

Download and Prepare One by One Form 16 Part B for the F.Y.2021-22

0 Comments