Income tax exemptions for salaried employees F.Y. 2022-23 | The Income Tax Act of 1961 provides

certain income tax benefits/exemptions for salaried employees. Therefore, these exceptions can help

salaried people save a significant portion of their income.

Here is a list of some basic income tax benefits as per Section 10 of the Act.

Advantage HRA (HRA)

If you rent a house then you can get the benefit of HRA. You can request the following minimum as an exception to HRA:

Total HRA received:

40% of income for non-metropolitan residents (Basic + DA) 50% for those living in metro

Actual Monthly Rent minus 10% of salary (Aadhaar + DA)

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

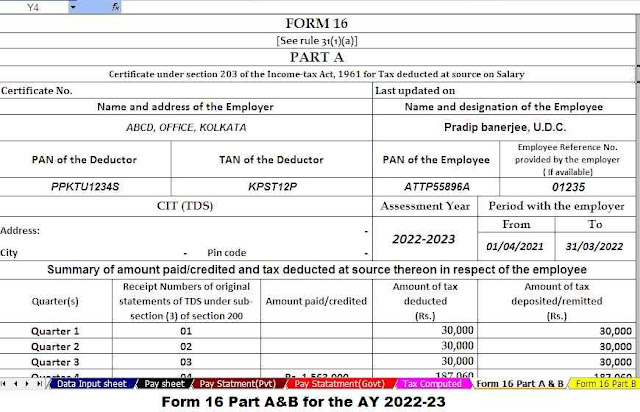

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

Leave travel allowances (LTA)

The Income Tax Act exempts salaried employees from the cost of domestic travel by train, plane or other public transport. However, this does not include the cost of food, shopping, leisure or other entertainment.

You can use the LTA version twice in four years.

From the Union Budget 2019, salaried individuals can apply for a standard deduction equal to Rs. 50,000. It replaces transport-related medical compensation.

Children’s education allowance

If your employer provides you with a child allowance, you can pay a maximum of Rs. 100 monthly tax breaks. This exception applies to children under the age of two.

Relocation allowance

If you have to leave for work/business reasons, your employer will bear the costs. These include accommodation, packing charges, and transportation costs by car, train/plane tickets, etc. Expenses that are reimbursed or paid for by your employer are directly exempt from tax.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

Mobile compensation

You can request reimbursement of mobile expenses at your place of residence. This fee can be the amount shown on the payroll or the actual account amount, which is less.

Personal Income Tax Deduction 2021-22 for Employees

Section 80 of the Income Tax Act allows various tax deductions for salaried employees. Let's take a look at some of these tax deductions:

Section 80C

Only natural persons and HUF can avail maximum tax deduction of Rs. 1.5 lakh per annum from their total income. Some of the tax-saving investment instruments under Section 80C include:

Employees Pension Fund (EPF)

Life insurance premium

Shares Savings Scheme

Capital Payment on Home Loan

Sukanya Samriddhi Yojana

Savings Program for Senior Citizens (SCSS)

National Savings Certificate (NSC)

Annuities / Pension Schemes

Fixed Tax Saving Deposit

Infrastructure bond

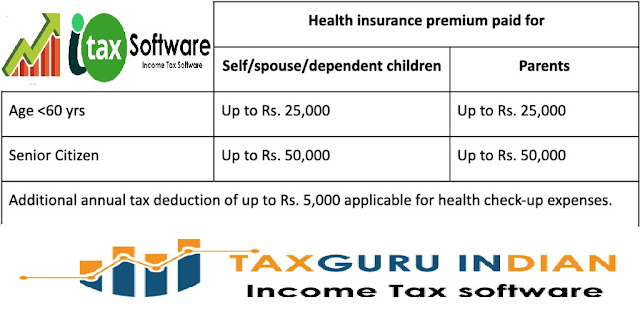

Section 80D

Section 80D deals with the tax deduction that can be claimed on medical bills for you, your family and your parents.

Section 80E

If you have taken a college loan, interest on it may be required for tax deduction under Section 80E. However, the claim is valid for only eight years. You can start applying for the next seven years from the year of commencement of loan repayment or till full repayment, whichever is earlier.

Section 80EE

If you have taken a home loan, you can apply for a tax deduction of up to Rs. 50,000 on his interest. The loan amount can not exceed Rs. 35 lakhs. Also, the value of the property should be Rs. 50 lakhs or less.

Section 80G

If you are contributing to charitable organizations or relief funds, you can apply for tax deduction under section 80G. However, you can claim this deduction only if you have donated the prescribed amount.

Also, any cash donation of more than Rs. 2,000 is not required for deduction under section 80G.

Section 80 TTA

Under Section 80TTA, you can request a tax deduction of up to Rs. 10,000 on the income earned by way of interest. Only natural persons and HUFs can make use of this claim on interest income on savings accounts. Interest amount in excess of Rs. 10,000 will be taxable.

In this section, senior individuals can apply for a tax deduction of up to Rs. 50,000 These deductions is applicable to their total gross income in a financial year.

Section 80U

People suffering from at least 40% disability can apply for the tax deduction, provided such disability is certified by a medical authority. Tax deduction up to Rs. 75,000 and Rs. 1.25 lakh are applicable for severe disabilities and handicapped respectively.

Non-payable deductions and exemptions in the new tax regime

The new tax regime does not provide for 70 deductions and exemptions, some of which are listed below:

House rent allowance

Leave travel allowance

Education allowance for children

Section 80C. invest under

Income for Senior Citizens under Section 80TTB

Interest Income u/s 80TTA

Section 80G. donate under

Education loan interest

Home loan interest payment

Auto Medical Bills or Costs Payable

Before you start preparing for your annual ITR declaration, make sure you have a thorough understanding of the various tax-saving tools. Whether it is allowances/exemptions or deductions on various expenses; You have many opportunities to save tax money. While the new tax regime offers lower tax rates, it eliminates many of the exemptions and deductions that the existing one provides.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for W.B. Government Employee’s Salary Structure.

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

7) Individual Salary Sheet

0 Comments