New Form-16 generator with automatic tax calculator and salary declaration|The Income Tax Department has notified a new format for Form 16.The Income Tax Department has made many new changes to the format of Form 16: the TDS Salary Certificate, which requires a detailed salary breakdown, the tax-exempt benefits paid to the employee, and also all the breakdowns of deductions required by the employee.

In addition, concurrent changes were made to the format of the TDS (24Q) declaration submitted by the employer to the tax office and Form-16. This will allow the taxman to cross-check the ITR, Form 16 and TDS of the employee's employer.

Due to the latest change made by the income tax department in the form-16 format. w.e.f 12/05/2022, from AY 2021-22 each employer must deliver form 16 part B to their employee in a new format.

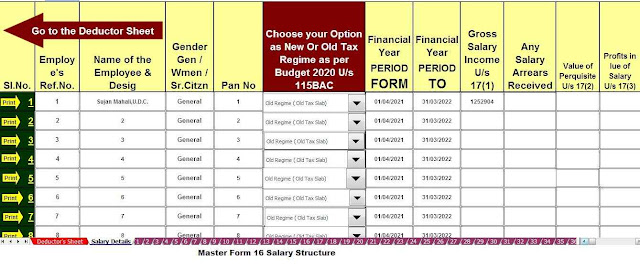

It is noted that, the Form-16 generator in a new format with automatic tax calculator and salary declaration at your disposal in excel format.

Now with less time, you can easily generate and print the Form 16.

Download & Generate 50 Employees Master of Form 16 Part B for the Financial Year 2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part B as per Section 115 BAC]

0 Comments