Income Tax Section 80GG is a exemption under Chapter VI-A of the Income-tax Act, 1961. It is intended to provide relief to those who do not receive a house rent allowance but are paying rent to stay. Thus, a person can claim a deduction for the rent paid even if he does not receive a house rent allowance.

An individual must be self-employed or salaried to claim deduction under this section. 80GG allows individuals to claim a deduction in the case of a rented house. This type of house will be rented for his own stay.

Exemption under section 80GG

To claim a deduction under this section, the following conditions must be met:

The person should not be in the habit of receiving any house rent allowance from his employer.

The person has mandatory to submitted a declaration in Form No. 10BA

• The other family member, should not own any residential home property where he normally resides or holds office or has business or occupation reasons.

• The appraiser should not own any other place of residence in his / her profession, the value of which must be determined in accordance with Sec 23 (2) (a) or Sec 23 (4) (a).

Simply put, if Mr. A, in his income tax return, claims a deduction in the case of self-acquired property and pays rent for a place where he normally resides but not his own, he cannot claim deduction under section 80GG

The amount of cuts must be at least one of the following:

Subtract 10 percent of the total income paid for actual rent.

• 5,000 / - per month.

25 25% of the total adjusted income.

Exceptions under section 80GG:

No person can claim a deduction on house rent if the location of the house is where he is employed or conducts business.

A person cannot claim a deduction on house rent if he or she claims the benefit of a proprietary home as self-acquired property elsewhere. If the person lives in one city and has a house in another place or town, it will be considered as rent.

If a person lives in their home with their parents, they can claim the benefit of rent deduction under section 80GG. He has to make a rental agreement with his parents to pay the rent. However, the parents who own the house have to show the rent as income in their tax return. If the house is jointly owned by the son / daughter, they will not be able to claim rent deduction on their taxable income.

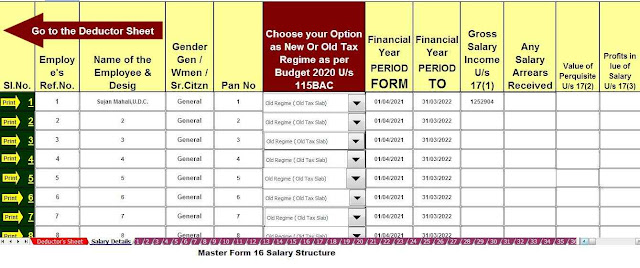

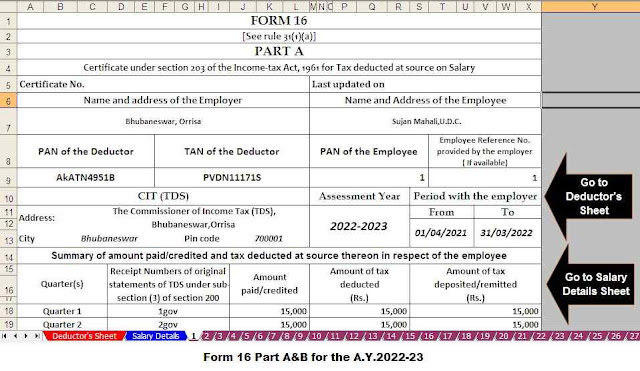

Download Automatic Income Tax Revised Form 16 Part A & B for the Financial Year 2021-22[This excel Utility can prepare at a time 50 Employees Form 16]

0 Comments