Don't get rent a house? But you can claim a house rent discount from Income Tax U / s 80 GG. Renting a house can be a real burden, mainly in cosmic cities where renting a house is difficult to arrange.

The amount of rent is also increasing day by day as the demand for rental houses is relatively high. Generally, people create a tax saving checklist every financial year to understand how and where they can get tax benefits. People who have to rent a house but do not maintain HRA (House Rent Allowance) can affect their monthly income.

As per the Income Tax Act, 1961, section 80GG entitled you to claim a deduction on the price of the rent you pay each year.

What is Section 80GG of Income Tax Act?

80GG is a section which can be found in Chapter VI-A of the Income-tax Act of India, following which a person can claim deduction on rent paid for a furnished or unusual house.

The house should be used for its residential purpose. Deductions indicate that expenses you can deduct from your total annual income to determine the net taxable income on which income tax will be levied.

You may also, like- Automated Income Tax Preparation Excel Based Software for the West Bengal State Govt.Employees for the F.Y.2021-22

Who is eligible to claim tax deduction under section 80GG?

As mentioned earlier, one must meet certain requirements in order to get a tax cut under this strange section of the ITA. Here are some of the factors that must satisfy an individual to claim a Section 80GG discount.

Only individuals and Hindu Undivided Families (HUFs) are eligible to claim this tax deduction. Businesses or other companies may not receive a uniform tax deduction in return for paying rent in a paid year.

B. Those who are salaried professionals or self-employed persons can also benefit from this provision. If there is no income in one's speech, they are excluded from the Section 80GG income tax benefit effort, even if they pay rent.

C. Those who want to avail the benefit of this tax deduction must submit a properly filled Form 10BA to the Government. This form is a declaration that the person submitting it does not claim privileges from self-acquired property anywhere.

D Section 80GG of the Income Tax Act is designed for those who do not receive house rent allowance from their employers. If a person's salary constitutes an HRA amount, they are ineligible to claim income tax deductions related to housing rent.

E If the annual rental expenditure exceeds Rs. 1 lakh, the taxpayer is required to present a copy of the landlord's PAN card for tax benefit supported by Section 80GG of the Income-tax Act.

You may also, like- Automated Income Tax Preparation Excel Based Software for the Non- Govt. Employees forthe F.Y.2021-22

F No person should claim HRA for the financial year for which they are claiming tax benefits under section 80GG. This is an important time for those who have changed employers in the previous year.

Even when a person has not collected HRA for a significant portion of the year, the same receipt for only one month makes them ineligible to claim this annual relief.

How to file Form 10BA?

As mentioned above, Form 10BA is required for persons seeking tax benefits under section 80GG. It is an announcement that you have rented a house within the relevant period and also you do not have any other accommodation. Here are some details that a person must fill out Form 10BA before submitting:

A complete address with postal code

b. Determinant name and PAN number

C. Payment method

Living period within d months

e Rental costs

F Name and address of the owner of the property

You may also, like- Automated Income Tax Preparation Excel Based Software for the Assam State Govt. Employees for the F.Y.2021-22

Where can one get Form 10BA?

These forms are readily available from a variety of sources, including the human resources department of any reputable organization. One can also get the form by going to the tax office. However, the most convenient place to make a spot is online. People can search and download it from various official websites.

Exceptions to Section 80GG

Let's look at some exceptions under the 80GG section:

A. You should not own any property (residential) in the area where you normally live or operate.

B. You will not receive a discount if you have previously claimed deductions on residential property maintained elsewhere. If you live in a city and own a property or home in another city, you cannot claim an HRA discount.

Amount eligible for discount

You can claim a minus amount from at least one of the following:

1. 25% of your adjusted total income *

2. 5000 per month / Rs. 60,000 per year

3. Total rent is paid after deducting 10% of the adjusted total income

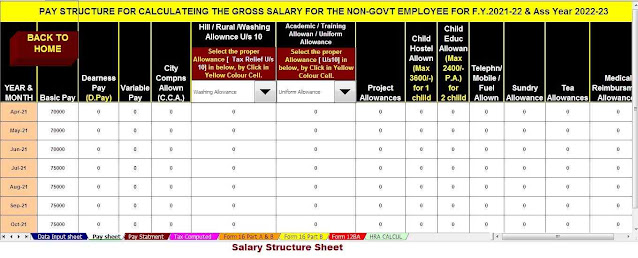

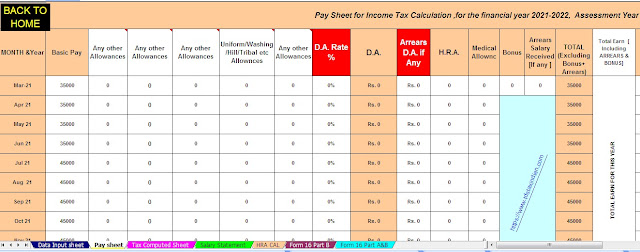

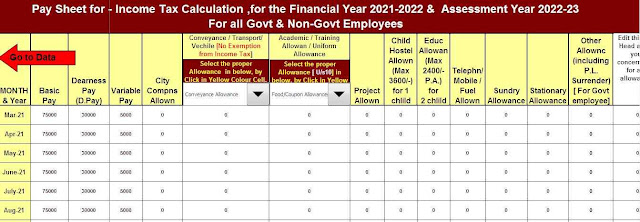

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2020

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount in to the in-words without any Excel Formula

0 Comments