NPS Tax Benefit F.Y 2020-21. Effective from F.Y 2020-21, a separate tax assessor will have the option to take a new tax slab rate excluding existing income tax deductions and exemptions, such as HRA, Section 80C, home loan tax benefits, etc.

So, to get the benefit of the new tax system below, which are optional, taxpayers have to pay income tax exemption.

Does this create confusion as to whether income tax benefits will accrue to popular investment options such as NPS (National Pension System)?

The Central Government has introduced the National Pension Scheme (NPS) for all citizens of

You may also, like- Auto-fill Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees [This Excel Utility can prepare at a time your tax computed sheet as per New & Old Tax Regime + Automated H.R.A. Exemption Calculation U/s 10(13A) + Unique Salary Structure as per Jharkhand State employees Salary Pattern + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

Most of the readers of my blog have chosen NPS for two main reasons - i) for tax saving purposes and ii) for most of the government employees no option other than investing in NPS has been made mandatory.

If you are investing in an NPS scheme or planning to invest in NPS, you need to be aware of all the latest NPS income tax benefits currently available under the old tax regime and the new tax regime (Budget 2021-22).

In this post, let’s discuss- What are the NPS income tax benefits for FPS 2020-21 or AY 2021-22? Can you claim income tax exemption on NPS investment under the new tax system? Under which section of the Information Technology Act can NPS investment be claimed as a tax deduction? What is the proof of investment to get tax benefits under NPS?

Latest NPS income tax benefits for the financial year 2020-21 / AY 2021-22 under the old and new tax system

Below are the various income tax categories under which an NPS investor can claim an income tax deduction for the financial year 2019-20 / A.Y 2019-21.

Section 80CCD (1)

Section 80CCD (2)

Picture of NPS

NPS Tax Benefit F.Y 2021-22. Income tax benefit under NPS Tier-1 account for AY 2021-22

Tax deduction under 80CCD (1) on NPS investment of salaried person (excluding Central Government servant):

An employee can contribute to government advertised pension schemes (such as the National Pension Scheme - NPS). Contributions can be up to 10% of salary (salaried person).

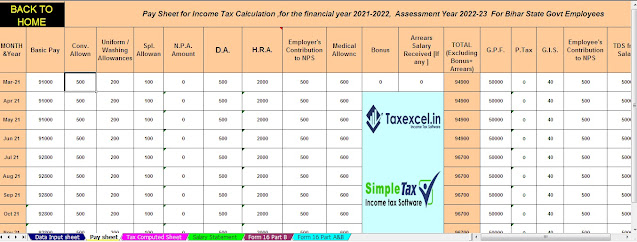

You may also, like- Auto-fill Income Tax Preparation Excel Based Software All in One for the Bihar State Employees [This Excel Utility can prepare at a time your tax computed sheet as per New & Old Tax Regime + Automated H.R.A. Exemption Calculation U/s 10(13A) + Unique Salary Structure as per Bihar State employees Salary Pattern + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

The maximum amount that can be claimed as a tax deduction U/s 80CCD (1) Rs.1.5 Lakh

Old tax system: If you are opting for the old tax system, you can claim the income tax exemption listed in the above two points.

Tax reduction under 80CCD (1) on NPS investments by self-employed persons:

Self-employed (persons other than salaried class) can contribute up to 20% of their total income and it can be deducted from the taxable income under section 80CCD (1) of the Income-tax Act, 1961.

The maximum amount that can be claimed as a tax deduction U/s 80CCD (1) is Rs. 1.5 Lakh.

Under the old tax system: If you choose the old tax system, you can claim the income tax exemption listed in the above two points.

Income tax deduction under 80CCD (2) on NPS investment for non-central government employees:

The amount of contribution made by the employer may be claimed as tax deduction under 80CCD (2), subject to the lower minimum limit; Amount paid by an employer

10% of basic salary + DA (or)

Total income

You may also, like- Auto-fill Income Tax Preparation Excel Based Software All in One for the Andhra Pradesh State Employees [This Excel Utility can prepare at a time your tax computed sheet as per New & Old Tax Regime + Automated H.R.A. Exemption Calculation U/s 10(13A) + Unique Salary Structure as per Andhra Pradesh State employees Salary Pattern + Automated Income Tax Form 16 Part A&B and Form 16 Part B]

This is an additional deduction that will not be part of the Sec.80C range.

Self-employed persons are not eligible to claim NPS tax deduction under 80CCD (2).

Income tax deduction under 80CCD (2) on NPS investments for Central Government employees:

The amount of contribution made by the employer (Central Government in this case) may be claimed as tax deduction under 80CCD (2), subject to the lower minimum limit; Amount paid by an employer

14% of basic salary + DA (or)

Total income

The centre will now contribute 14% of the basic salary to the pension corpus of government employees, up from 10%. This is from April 2019.

This is an additional cut that will not be part of the Sec.80C range.

NPS Additional Tax Deduction U/s 80CCD (1B)

Salary or self-employed persons can claim additional tax benefit of Rs. 50,000 under 80CCD (1B).

Please note that the total reduction under sections 80C, 80CCC and 80CCD (1) may not exceed Rs.1,50,000 for the financial year 2020-21. Additional tax deduction of 50,000 U/ s 80CCD (1B) has exceeded the limit of Rs 1.5 lakh.

Under the old tax system: If you opt for the old tax system, you can claim an income tax deduction of 80CCD (1B) 50,000/-

0 Comments