What is tax rebate U/s 87 A as per Income Tax Act 1961? The government of a country imposes income tax on its citizens. The tax system for this purpose varies from country to country. In India, the system is progressive, which means your income tax liability increases according to your annual income. The higher a person's income, the higher his share of income tax, and vice versa.

Under this tax system, the government also provides ways to exempt people at the lower end of the income spectrum. Thus, the tax system ensures that these individuals are not overburdened by taxes and can end up with limited financial means.

These processes of tax relief are known as tax exemptions and one of the most common tax exemptions provided by the Income Tax Act is U/s 87A.

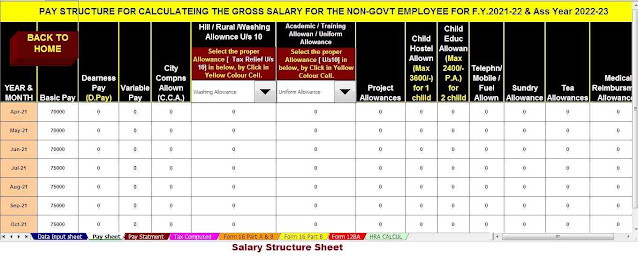

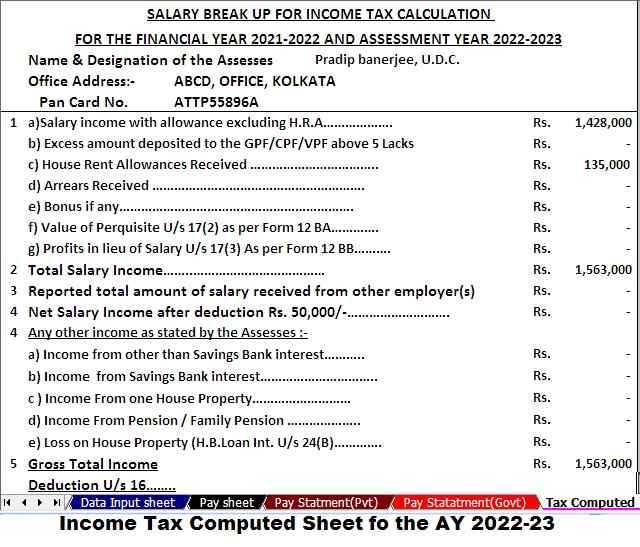

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Non-Govt Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Income Tax Computed Sheet as per new and old tax regime U/s 115 BAC + Individual Salary Structure as per the All Non-Govt Employees Salary Pattern + Automated Income Tax Form 12 BA + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B]

Tax exemption under section 87A

This proposal under section 87A was first introduced in 2013 and has been in effect for several years, it has recently been updated as 2019. Millions are eligible for income tax exemption of Rs12,500.

Who's Taxable Income less than 5 Lakhs they can entitle to these benefits(Rebates U/s 87A)as per the Income TaxAct.

.

Claim exemption under Section 87A of the Income-tax Act, 1961

You may also, like- Automated Income Tax Arrears Relief Calculator U/s 89(1) for the F.Y.2021-22

How is the income tax rebate calculated?

To calculate discounts:

1) Calculate total income - Add income from all sources like salary, capital gain, house rent and income from other sources.

2) Find Net Taxable Income - Apply deductions under section 80 for your total income as applicable.

3) For taxable income equal to or less than Rs 5 lakh, you can claim an exemption under section 87A.

Subject to note about Section 87A

However, here are a few points of note that a taxpayer must keep in mind before considering income tax protection in India under section 87A:

This tax exemption under Section 87A cannot be enjoyed by non-resident Indians, who are NRIs.

You may also, like- Automated Income Tax Preparation Excel Based Software All in One for the Jharkhand State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Income Tax Computed Sheet as per new and old tax regime U/s 115 BAC + Individual Salary Structure as per the All Jharkhand State Employees Salary Pattern + Automated Income +Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B]

Tax These tax exemptions cannot be availed by corporations, firms or HUFs.

Sen Although seniors (60 to 80 years old) can get this tax exemption, super seniors (80 years or older) cannot.

To provide relief and reduce the burden on small taxpayers, the government announced tax exemption plans through the introduction of Section 87A in the Income Tax Act.

Criteria for exemption under section 87A

Under the existing provisions, any Indian resident whose income is less than Rs. 500,000 is eligible to claim tax exemption under this section Maximum Rs. 12,500/-.

You may also, like- Automated Income TaxPreparation Excel Based Software All in One for the Andhra Pradesh State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Income Tax Computed Sheet as per new and old tax regime U/s 115 BAC + Individual Salary Structure as per the Andhra Pradesh State Employees Salary Pattern + Automated Income + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B]

Section 87A - Eligibility

To claim an exemption under section 87A:

- Be a resident personal taxpayer in India

- Under Section 80, hold the total income after deducting the eligible discount below the total discount limit i.e., below Rs.5,00,000.

Note:

Discounts will be given

- The calculated amount of tax will be available before adding any education or related cess.

- Available to one person only and not to any firm/company / HUF.

- Stay available for senior citizens above 60 years of age for the old tax system

- Not available for super senior citizens over 80 years of age and opting for the old tax system.

- Available under the old tax regime and the new tax system.

You may also, like- Automated Income TaxPreparation Excel Based Software All in One for the Bihar State Employees for the F.Y.2021-22 [This Excel Utility can prepare at a time your Income Tax Computed Sheet as per new and old tax regime U/s 115 BAC + Individual Salary Structure as per the All Non-Govt Employees Salary Pattern + Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B]

Adjustment of tax liability as opposed to rebate

This exemption can be claimed against tax liability in case of long-term capital gains under section 112 of the Income-tax Act,

levying tax at slab rate. (Section 112 applies to long-term capital gains for the sale of capital assets other than equity-based schemes of mutual funds in addition to listed equity shares.) This exemption is also available against short-term capital gains tax on listed equities. Shares as well as equity-based schemes of mutual funds under Section 111A of the Act, on which tax is payable at an equivalent rate of 15%.

Main Feature of this Excel Utility:-

#This Excel Utility can prepare at a time your Income Tax Computed Sheet as per new and old tax regime U/s 115 BAC

# Individual Salary Structure as per the All Non-Govt & Govt Employees Salary Pattern

# Automated Income Arrears Relief Calculator U/s 89(1) with For 10E For the F.Y.2021-22

# Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A)

#Automated Income Tax Form 16 Part A&B and Part B]

# Automated Income Tax H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Form 16 Part A&B and Part B]

0 Comments