How to save income tax for F.Y.2021-22 as per budget 2021. Income tax is a term that always hits

taxpayers.

However, these amounts are always reduced with the help of income tax saving strategies. Do you know these strategies? If not, no worries! Let's understand everything little by little.

Income tax-saving tips

The Government of India provides certain ways to reduce the income tax of the taxpayers. The Income Tax Act,1961 includes some tax savers including mutual funds, insurance premiums, NPS, medical insurance, home loans and more.

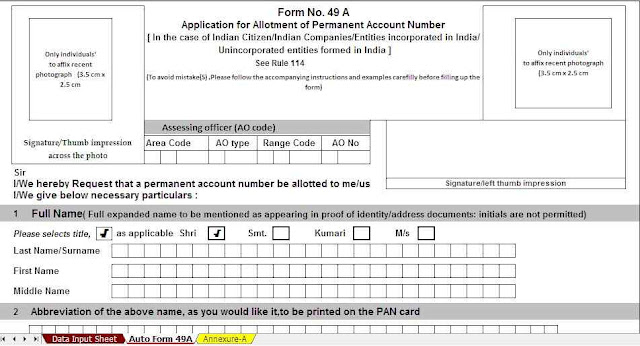

You may also, like- Automated Pan Card Application 49 A in the new format in Excel

There are some departments that act as a relief for the taxpayers because under these main departments they can save taxes.

They can certainly be helpful for many taxpayers, especially the income tax of salaried employees. Income tax exemptions and allowances are a priority in the financial planning of any person or entity.

Department investment discount limit

Investments in PPF, PF, Insurance, NPS, ELSS etc. 150,000

80CCD NPS investment 50,000

80D Medical insurance investment for own or parent 25,000 / 50,000

80EE interest on home loan 50,000

80EEA interest on home loan 1,50,000

80EEB electric car loan interest 1,50,000

80E full amount of interest on education loan

24 home loan 200,000 interest payments

10 (13A) house rent allowance (HRA) according to the salary structure

You may also, like- Income Tax Challan ITNS 280 in Excel

Therefore, the list below shows the categories and discount limits for each.

How to save income tax under section 80C?

Under Section 80C, there are various investment and expenditure options through which you can get Rs. 1.5 lakh in a financial year. These options are as follows:

National Savings Certificate (NSC)

Natation Savings Certificate (NSC) is an extra tax exemption strategy that comes with a 5-year term. The National Savings Certificate provides a fixed interest rate, which is currently 6.8% per annum.

You may also, like- Automated all in one Value of Perquisites Calculator U/s 17(2)

The interest earned from this income tax savings account is a decent tax-saving option and under Section 87 A, up to 10 Thousand can be taken as a rebate whose Taxable Income is less than 5 Lakh.

Public Provident Fund (PPF)

PPF is one of the income tax protection strategies in

The PPF rate changes quarterly, which is currently 7.1%. The funny thing about PPF is that the interest on PPF is tax-free.

Employees Provident Fund (EPF)

12% of the salaries of employees under the Employees Provident Fund are tax-free. It is, therefore, a beneficial income tax savings scheme for service line individuals.

Salary

As the name implies this income tax protection strategy is for people who finance the education of parents and their children. Again dedication of Rs. 1.5 lakh can be claimed under this income tax-saving strategy.

You may also, like- Automated House Rent Exemption Calculator U/s 10 (13A) in Excel

Tax deductions do not depend on the child's class or level of education. This income tax savings scheme is for divorced, unmarried parents, or all types of parents who have adopted children.

Home loan repayment

In order not to impede income tax on the process of buying your own home, Section 80C introduces a scheme where people who are already paying EMI for their home loan are exempted from paying income tax on their interest.

You may also, like- Automated Pan Card Application 49 A in the new format in Excel

What are the other income taxes saving options?

Apart from Section 80C, there are other sections (mentioned earlier) that provide income tax exemption. Here are some of the income tax protection options:

The pen has tax deductions for contributions to the National Pension System (NPS). The discount limit is 1.5 lakh.

Insurance There are income tax deductions for medical insurance premiums U/s 80D. Max Rs 25,000 below 60 Years of age, and Rs. 50,000 for senior citizens above 80 years.

There is also a tax deduction on home loan interest; You can claim discounts up to money. 50,000 under Section 80EE.

Feature of this Excel Utility:-

1) This Excel utility prepares and calculates your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

3) This Excel Utility has a unique Salary Structure for Government and Non-Government Employee’s Salary Structure.

4) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2021-22 (Update Version)

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

0 Comments