Assessment arranging is an imperative piece of a money-related arrangement. Regardless of whether you are a salaried individual, an expert or an agent, you can spare duties to a certain degree through legitimate expense arranging.

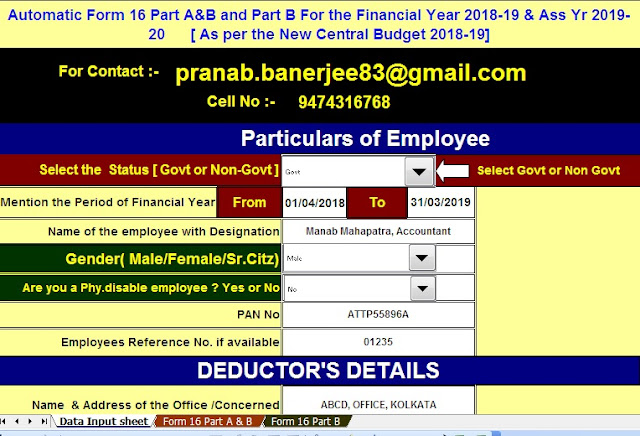

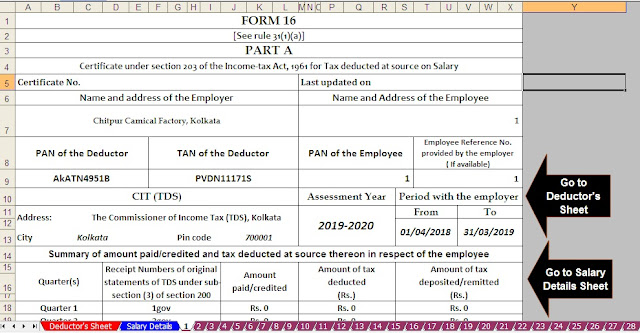

Download Automated Income Tax Form 16 Part B for the Financial Year 2018-19 [ This excel Utility Can Prepare at a time 50 Employees Form 18 Part B for A.Y. 2019-20]

The Indian Income Tax act takes into account certain Tax Deductions/Tax Exemptions which can be professed to spare expense. You can subtract charge derivations from your Gross Income and your assessable pay gets diminished to that degree.

In this post, let us experience the Income Tax Deductions List FY 2019-20, most ideal approaches to spare duties and best expense sparing choices for FY 219-20/AY 2020-21.

Pay Tax Deductions List FY 2019-20/AY 2020-21 (Chapter VI-A conclusions list)

Under Section 80C

The most extreme expense exception limit under Section 80C has been held as Rs 1.5 Lakh as it were. The different venture roads or costs that can be guaranteed as expense conclusions under area 80c are as underneath;

• PPF (Public Provident Fund)

• EPF (Employees' Provident Fund)

• Five year Bank or Post office Tax sparing Deposits

• NSC (National Savings Certificates)

• ELSS Mutual Funds (Equity Linked Saving Schemes)

• Kid's Tuition Fees

• SCSS (Post office Senior Citizen Savings Scheme)

• Principal reimbursement of Home Loan

• NPS (National Pension System)

• Income Tax benefits are right now accessible on Tier-1 stores just (FY 2018-19). The commitments by the administration representatives (just) under Tier-II of NPS will likewise be secured under Section 80C for finding up to Rs 1.5 lakh with the end goal of pay charge, with a three-year lock-in period. This is w.e.f April 2019.

• Life Insurance Premium

• Sukanya Samriddhi Account Deposit Scheme

Download Automated Income Tax Form 16 Part B which can prepare at a time 100 Employees Form 16 Part B for F.Y. 2018-19

Under Section 80CCC

Commitment to annuity plan of LIC (Life Insurance Corporation of India) or some other Life Insurance Company for getting benefits from the store is considered for a tax cut. The greatest permissible Tax derivation under this segment is Rs 1.5 Lakh.

Under Section 80CCD

The representative can add to Government informed Pension Schemes (like National Pension Scheme – NPS). The commitments can be up to 10% of the compensation (salaried people) and Rs 50,000 extra tax reduction u/s 80CCD (1b) was proposed in Budget 2015.

According to the Budget 2017-18, the independently employed (individual other than the salaried class) can contribute up to 20% of their gross pay and the equivalent can be deducted from the assessable salary under Section 80CCD (1) of the Income Tax Act, 1961.

To guarantee this derivation, the worker needs to add to Govt perceived Pension plans like NPS. The 10% of the pay limit is pertinent for salaried people just and Gross pay is relevant for non-salaried. The meaning of Salary is just 'Dearness Allowance.' If your manager likewise adds to the Pension Scheme, the entire commitment sum (10% of pay) can be guaranteed as expense conclusion under Section 80CCD (2).

Download Automated Income Tax Form 16 Part B for F.Y. 2018-19 [ This Excel Utility can prepare One by One preparation Form 16 Part B for F.Y. 2018-19]

The Center will currently contribute 14% of fundamental compensation to Govt workers' annuity corpus, up from 10%. This is w.e.f April 2019.

Mercifully note that the Total Deduction under segment 80C, 80CCC and 80CCD(1) together can't surpass Rs 1,50,000 for the budgetary year 2019-20. The extra assessment derivation of Rs 50,000 u/s 80CCD (1b) is far beyond this Rs 1.5 Lakh limit.

Commitments to 'Atal Pension Yojana' are qualified for Tax Deduction under segment 80CCD.

Under Section 80D

In the association spending plan 2018, the administration of India has proposed the beneath changes as for derivations accessible on Health Insurance as well as towards Medical treatment. Similar arrangements are relevant for FY 2019-20 also;

Free Download Automated Income Tax Form 16 Part B for F.Y. 2018-19 [ This Excel Utility Prepare One by One Form 16 Part A&B and Part B ]

• Health Insurance and Senior Citizens: In Budget 2018, it has been proposed to raise the most extreme duty finding limit for senior residents under Section 80D of the Indian Income Tax Act 1961. The utmost of duty derivation took into consideration FY 2017-18 for senior residents was Rs. 30,000 which was expanded to Rs 50,000, from FY 2018-19 (AY 2019-20) onwards.

• Under Section 80D an assessee, being an individual or a Hindu unified family, can guarantee a finding in regard of installments towards yearly premium on health care coverage strategy, preventive wellbeing registration or medicinal consumption in regard of senior native (over 60 years old).

• As of FY 2017-18, truth be told, Very Senior Citizens (who are over 80 years old), can guarantee a conclusion of up to Rs 30,000 brought about towards restorative use, on the off chance that they don't have medical coverage. The Budget 2018 has expanded this to Rs 50,000 and furthermore enabled similar adaptability to senior nationals. Indeed, even people who pay premiums for their reliant senior resident's guardians can guarantee the extra conclusion on health care coverage premium (or) restorative use.

Free Download Income Tax Form 16 Part A&B for F.Y. 2018-19 [ This Excel Based Software Prepare at a time 100 Employees Form 16 Part A&B ]

• Single premium Health Insurance arrangement

/Multi-year Mediclaim approach :

• In the instance of single premium medical coverage approaches having a front of over one year, it is suggested that the conclusion will be permitted on the proportionate reason for the quantity of years for which medical coverage spread is given, subject to the predefined money related point of confinement.

Preventive wellbeing checkup (Medical checkups) costs to the degree of Rs 5,000/ - per family can be guaranteed as expense conclusions. Keep in mind, this isn't well beyond as far as possible as clarified previously. (Family incorporates: Self, companion, guardians and ward kids).

Under Section 80DD

You can guarantee up to Rs 75,000 for spending on medicinal medications of your wards (life partner, guardians, children or kin) who have 40% handicap. The assessment finding cutoff of up to Rs 1.25 lakh if there should be an occurrence of serious incapacity can be benefited. To guarantee this reasoning, you need to submit Form no 10-IA.

Under Section 80DDB

An individual (under 60 years old) can guarantee up to Rs 40,000 for the treatment of indicated basic infirmities. This can likewise be asserted in the interest of the wards. The assessment finding limit under this area for Senior Citizens and extremely Senior Citizens (over 80 years) has been reexamined to Rs 1,00,000 w.e.f FY 2018-19.

To guarantee Tax conclusions under Section 80DDB, it is compulsory for a person to acquire 'Specialist Certificate' or 'Remedy' from a master working in a Govt or Private medical clinic.

For the motivations behind area 80DDB, the accompanying will be the qualified illnesses or afflictions:

• Neurological Diseases where the handicap level has been affirmed to be of 40% or more;

(a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson's Disease

• Malignant Cancers

• Full Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

• Chronic Renal disappointment

• Hematological issue

1. Hemophilia

2. Thalassaemia

Under Section 80CCG

Tax breaks of Rajiv Gandhi Equity Savings Scheme (RGESS) under area 80CCG has been pulled back. In any case, if a speculator has put resources into the RGESS plot in FY 2016-17 (AY 2017-18), they can guarantee derivation under this Section until AY 2019-20.

Free Download Automated Income Tax House Rent Exemption Calculator U/s 10(13A)

Under Section 24 (B) (Loss under the head Income from House Property)

• From FY 2017-18, the Tax advantage on advance reimbursement of the second house is confined to Rs 2 lakh for every annum possibly (regardless of whether you have different houses the utmost is as yet going to be Rs 2 Lakh just and as far as possible isn't per house property).

• The unclaimed misfortune if any will be stolen forward to be set away against house property pay of resulting 8 years. In the vast majority of the cases, this can be treated as 'dead misfortune'.

• I trust this is a noteworthy hit to the financial specialists who have purchased various houses on a home loan(s) with a goal to spare duties alone.

• Until FY 2016-17, intrigue paid on your lodging credit is qualified for the accompanying tax reductions ;

• Municipal charges paid, 30% of the net yearly pay (standard derivation) and intrigue paid on the advance taken for that house are permitted as findings.

• After these findings, your rental salary can be NIL or NEGATIVE and is called 'misfortune from house property' in the last case.

• Such misfortune is right now permitted to be set off against different heads of pay like Income from Salary or Business and so forth which encourages you to bring down you charge obligation generously.

• Currently (FY 2018-19), salary charge on the notional lease is payable on the off chance that one has more than one self-involved house. No expense on notional lease on Second Self-involved house has been proposed. Thus, you would now be able to hold 2 Self-involved properties and don't need to demonstrate the rental pay from the second SoP as a notional lease. This is with successful from FY 2019-20.

Under Section 80E

In the event that you take any advance for higher examinations (in the wake of finishing Senior Secondary Exam), charge reasoning can be asserted under Section 80E for intrigue that you pay towards your Education Loan. This advance ought to have been taken for advanced education for you, your life partner or your kids or for an understudy for whom you are a legitimate gatekeeper. Chief Repayment on instructive advance can't be guaranteed as assessment conclusion.

There is no restriction on the measure of intrigue you can guarantee as conclusion under area 80E. The derivation is accessible for a limit of 8 years or till the intrigue is paid, whichever is prior.

Under Section 80EE

This was another proposition which had been made in Budget 2016-17. A similar will be proceeded in FY 2018-19/AY 2019-20 as well. First time Home Buyers can guarantee an extra Tax reasoning of up to Rs 50,000 on home credit intrigue installments u/s 80EE. The beneath criteria must be met for guaranteeing charge finding under segment 80EE.

• The home advance ought to have been authorized amid FY 2016-17.

• Loan sum ought to be not as much as Rs 35 Lakh.

• The estimation of the house ought not to be more than Rs 50 Lakh and

• The home purchaser ought not to have some other existing private house in his name.