If you are a salaried people, you have many ways to save tax. The allowances are one of the best ways to reduce the tax outgo. However, the tax saving from the allowances depends upon your employer. Because the only employer can decide to give you a particular allowance. If there is an allowance in your salary structure only then you can avail tax benefit.

Allowances are a fixed payment to the employee apart from the salary. This payment is given for some particular requirement of the employee. e. g Uniform Allowance, driver allowance etc. There are generally three types of allowances – taxable allowances fully exempted allowances and partially exempted allowances.

In this post, I have listed the most useful tax exempted allowances, fully or partially. I hope using these allowances; you would be able to save a good amount of tax.

Common Allowances

These allowances are available to private and government employees both. If your employer gives these allowances, you would not pay 100% tax on these.

House Rent Allowance

· This is the most common and useful allowances. This allowance alone If your employer gives you the house rent allowance (HRA)and you live in rent, you would be eligible for tax exemption on HRA.

· Even, you can pay rent to your parents to avail tax benefit of HRA. In this case, the house should be owned by your parents.

· If you are paying more than Rs.1 lakh rent for a year, you have to give PAN of your landlord.

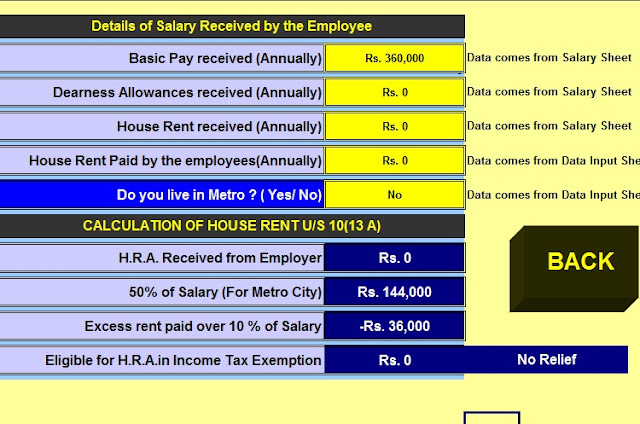

· You would not get the full exemption on HRA. The tax exemption is given to the least of the following amount.

1. Actual HRA Received

2. 40% of annual salary (For metro 50%)

3. Rent Paid – 10% of your salary (basic + DA)

Click here to download Automated H.R.A. Exemption Calculator U/s 10(13A)

Leave Travel Allowance (Abolished)

This allowance is related to your vacations. In the LTA, your employer gives this allowance for a holiday. The employer bears the burden of traveling through this allowance. The LTA is eligible for tax exemption. There is no maximum limit on LTA. It is the employer who gives LTA as per its wish. However, for tax exemption, you have to present the proof of travel. The tickets are required as the proof.

Note, the travel should be within India. The exemption is only for the travel. Food, and stay are not considered for exemption. You can take family members with you. The family means your spouse, children, and parents.

You can claim LTA twice in 4 years. The dates for this 4 years is prefixed. The current 4-year block is 2018-2021. During this tenure, you can avail LTA exemption twice any time.

Education Allowance

If your employer gives Allowance for children education, it is also exempted from tax. However, there is an upper limit of Rs.100 per month per child. Thus total exemption is available on an allowance of Rs. 2400 in a year.

Hostel Allowance

If your children are living in the hostel and your employer gives hostel allowance, this allowance is also exempted from tax. The maximum amount of exemption is Rs.200 per month per child.

Uniform Allowance

Often companies give uniform allowance to its employee. It is given to maintain proper uniform during the job. The Allowance given for this purpose is also exempt from tax. There is no upper limit for this allowance. There is no maximum limit for the exemption. However, the expense should be real.

Research or Academic Allowance

There are some jobs which require on job learning and research. Hence companies promote research and learning by giving allowance for this. Such allowance is also exempted from tax. There is no upper limit for this exemption.

Daily Allowance

Daily Allowance is given to an employee when he/she performs duty outside of his normal place. This allowance is given for food, lodging and other expenses of the employee. If your employer gives this allowance, this would be fully exempted from tax. There is no maximum limit for this.

Conveyance Allowance(Abolished)

Your employer can also give you the conveyance allowance. This allowance is given if you travel in course of your job. However, the exemption would be given on actual expense.

Transport Allowance(Abolished)

Sometimes people confuse conveyance allowance with transport allowance. Transport allowance is given for the commute between your place of work and home. There had been tax exemption on this allowance. The maximum limit of this allowance was Rs.1600/month.

However, this exemption was withdrawal from the Budget 2018. In place of this exemption, the government gives standard deduction.

Click here to Download Income Tax Calculator for Financial Year 2018-19 & Ass Year 2019-20 as per Finance Budget 2018

Medical Allowance

This allowance is given to meet the medical expense of employee and family. But now this allowance is not exempted from the tax. The government is giving Standard deduction in place of exemption on this allowance. There was an upper limit of Rs.15,000/year for the exemption.

Helper/Assistant Allowance

In a senior position, you may be entitled to the Helper/Assistant Allowance. It is also exempted from the tax.